Fractional Investment Ignored by Government and Market — Innovation or Mere Experiment?

Input

Modified

Demand base for fractional art investment remains weak. It is increasingly seen as an "illiquid asset." Authorities focus more on regulation than market development.

The fractional art investment market has effectively come to a halt amid repeated subscription shortfalls and institutional limitations. As major platforms’ ambitious public offerings all record poor results, and the government’s token securities (STO) institutionalization faces delays, uncertainty continues to grow. Structural issues such as investment limits for general investors, lack of tax benefits, and low liquidity are emerging one after another, causing trust in the market itself to collapse.

Market reaction lukewarm despite investors’ enthusiasm

According to the investment industry on the 4th, all fractional art investment offerings conducted in Korea this year have failed to attract sufficient subscriptions, resulting in subscription shortfalls. A representative example is the ‘Pumpkin’ offered by Yeolmae Company. The investment contract securities (ICS) for Yeolmae Company 4-1, based on the artwork of the same name by globally renowned Japanese installation artist Yayoi Kusama, faced a shortfall of 3,328 shares out of a total offering of 7,400 shares. Considering that 10% of shares are preferentially allocated to joint business operators, the actual subscription rate falls below 50%.

Yes24’s subsidiary Artipio, which recently entered the fractional art investment market, also experienced failure in its first offering. Artipio held a subscription for its first ICS in February, based on David Hockney’s 2021 iPad drawing artwork, ‘30th May 2021, From the Studio.’ Out of a total issue amount of USD 530,054.85 (72,000 shares) were subject to subscription, but the subscription rate was only 39.34%. As a result of the subscription shortfall, Artipio absorbed 64.59% of the total offering, equivalent to USD 370,913.00 (50,380 shares).

Multiple causes have contributed to the sluggish subscription rates. From an investor’s perspective, art is fundamentally a difficult asset to realize returns from. Unlike securities, prices do not reflect changes quickly, and as a physical asset, liquidity is low. Moreover, the timing of capital recovery is unclear, and there is significant uncertainty in valuing the artworks. Especially in an environment where investors cannot see the actual works and only acquire partial ownership, the investment model is viewed as unattractive.

Institutional deficiencies and regulations hinder progress

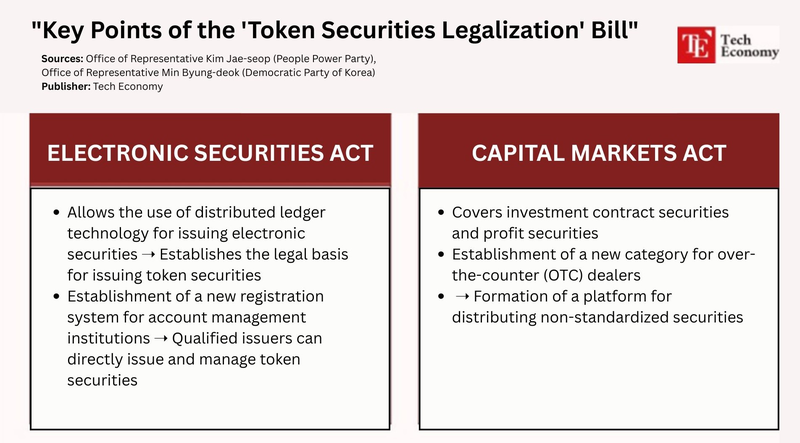

The absence of a solid institutional framework and the government’s passive stance are also cited as obstacles to activating the fractional art investment market. Notably, the core framework of fractional investment, token securities (STO), still lacks a clear roadmap. Although the Financial Services Commission (FSC) has mentioned STO activation for years, concrete strategies and infrastructure development remain insufficient. Consequently, fractional investment platforms operate amid legal uncertainty, leaving investors uneasy about committing funds.

Current regulatory conditions further dampen investor willingness. The subscription limit for general investors in fractional investment products is capped at USD 22,079.77 per person, and investors cannot receive securities exceeding this amount. This leads to a market dominated by professional investors rather than the general public. Restrictions introduced to protect investors from risk ironically act as barriers to market growth.

Experts agree that these regulations prevent the creation of a market where digitized real assets such as art or real estate can be freely traded. The essence of fractional investment products lies in tradability and liquidity. However, with secondary markets and liquidity channels failing to function properly, investors face a ‘lock-in’ scenario where they can enter but find it difficult to exit. The fractional investment model, once hailed as a new industry, has been left stranded without institutionalization, resulting in lost opportunities for investor protection, business support, and market growth.

Securities firms struggle with regulatory barriers

Some securities firms have attempted to tap the fractional investment market as a new revenue source. For example, ‘Project Pulse,’ launched in March last year by Shinhan Investment Corp, SK Securities, and blockchain developer Blockchain Global, aims to provide STO issuance, distribution infrastructure, and consulting by running a blockchain financial infrastructure pilot project for fractional investment and innovative financial service operators.

Around the same time, Kyobo Securities signed a business agreement with LucentBlock, operator of the real estate fractional investment platform ‘Soyu.’ Hana Securities also partnered with Print Bakery, LucentBlock, Pinnacle, and Oasis Business on fractional investment services. Korea Investment & Securities signed agreements with art platform operator Abitus Associates (‘Artu’) and stockkeeper StockKeeper, which runs the Hanwoo fractional investment platform ‘Bangcow.’

Securities firms’ interest in STO stems from viewing token securities’ distribution as a new business opportunity, including transaction fee revenue. According to Hana Financial Management Research Institute, Korea’s STO market is expected to grow from USD 25 billion this year to USD 270 billion by 2030. Fractional art investment, distinct from traditional financial assets, has gained attention as a premium alternative investment and a means to attract younger investors and enhance brand image.

However, repeated subscription shortfalls and structural challenges have prevented these positive prospects from translating into market expansion. Seoul Auction Blue’s fractional art investment service ‘Sotu,’ partnered with four securities firms including KB Securities, Mirae Asset Securities, SK Securities, and Shinhan Investment Securities, conducted its 8th offering last year based on Andy Warhol’s ‘Dollar Sign.’ The subscription rate was 86.9%, but investors pulled out en masse just before payment, resulting in a dismal outcome.

This too is seen as a consequence of regulatory barriers. Fractional investment is essentially based on tokenized physical assets, but without legal and technical infrastructure to support it, the product’s credibility inevitably suffers. Financial authorities consider fractional investment platforms as securities asset exchanges but have not established separate approval and management systems, leaving both operators and investors in an ambiguous state, market participants consistently say.