Eroding Confidence in Japanese Sovereign Debt, 30-Year Yield Surges to Record High Amid Fiscal Strains

Input

Changed

Japanese long-term bond yields hit record highs Fiscal deficit fears following tax-cut proposals trigger market convulsions Global upswing in long-duration yields amid fiscal uncertainty

Amid weakness in long-term bonds across the United States and Europe, Japan’s sovereign debt also faced a wave of sell-offs, shattering the long-held perception of Japanese government bonds (JGBs) as a safe-haven asset. A toxic combination of political uncertainty, fiscal instability, and reduced central bank purchases has driven the turmoil.

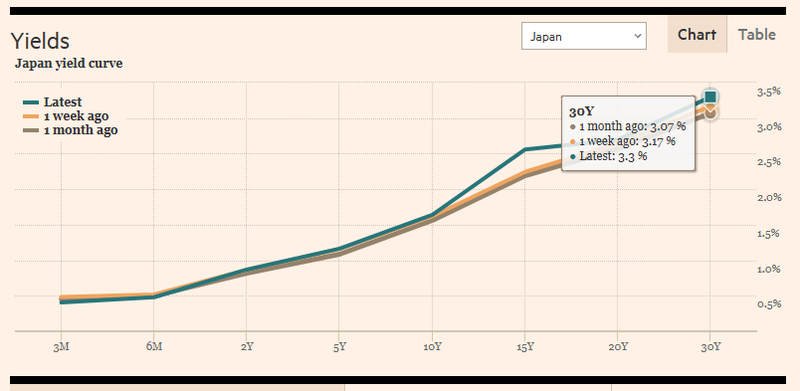

30-Year Yield at 3.285%, All-Time High Since Listing

According to CNBC on the 3rd (local time), the yield on Japan’s 30-year government bond surged 8.5 basis points (bp, 0.01%) to 3.285%, the highest level since its listing. The yield has risen more than one percentage point so far this year. Bond yields move inversely to prices. The 20-year yield climbed to 2.695%, the highest since 1999, with an 8bp increase this year, while the 10-year benchmark yield traded at 1.633%, its highest since 2008, up more than 5bp since January. The 40-year yield also gained about 9bp this year to reach 3.506%.

Mounting inflationary pressures, normalization of monetary policy, and heightened fiscal uncertainty are seen as the main drivers behind the spike in ultra-long yields. Political uncertainty intensified after one of Prime Minister Shigeru Ishiba’s key allies announced his resignation as LDP secretary-general with Ishiba’s consent. Meanwhile, a surge in corporate bond sales also weighed on demand for JGBs. On the previous day, following sharp increases in U.S. and European yields, global issuers offloaded at least $90 billion of investment-grade bonds.

Concerns over surging JGB yields were already raised in July, when the 10-year yield climbed to its highest in 17 years since October 2008. Yields on the 20- and 30-year tenors also jumped, with the 20-year reaching 2.650%—its highest since November 1999—and the 30-year briefly hitting a record 3.200%.

Capital Flight Risks as JGB Yields Spike

Analysts warn that if Japanese yields continue to rise, market confidence in yen-denominated sovereign debt—long regarded as a safe-haven—could erode. According to the IMF, Japan’s debt-to-GDP ratio stood at 236.7% last year. The government must issue some $191 billion in deficit-financing bonds this year alone.

Despite this, Tokyo is considering tax cuts, including reducing the consumption tax on food from 8% to as low as 0%. Such a move would slash annual tax revenues by an estimated $47 billion. With consumption tax accounting for more than 30% of state revenues, the shortfall would have to be plugged through additional bond issuance.

In a budget committee session, Prime Minister Ishiba remarked, “Japan’s fiscal situation is very dire—worse than Greece.” Indeed, Japan’s debt-to-GDP ratio is near 250%, far exceeding Greece’s 127% at the height of its 2009 debt crisis, and more than double the U.S. ratio of 120.8%, which led Moody’s to downgrade its rating earlier this year.

The Bank of Japan, the single largest player in the JGB market, has been tapering purchases since last year, raising net supply. This has also pressured the unwinding of yen carry trades. A major investment bank noted, “If JGB yields rise further, Japanese funds—particularly life insurers—could be repatriated, undermining overseas bond markets. Rising JGB yields diminish the appeal of U.S. and other foreign bonds while raising hedging costs.”

Surge in long-term government bond yields in major countries, including the US, UK, and France

The surge in long-duration yields is not unique to Japan. In France, political instability has driven a sharp increase in borrowing costs. On the 2nd, France’s 10-year yield rose to 4.5%, while the 30-year surpassed 4.5% for the first time since 2011. Fiscal risks loom large as Prime Minister François Bayrou pursues a sweeping austerity package with over $71 billion in spending cuts for 2026. Facing fierce resistance, he has convened a special parliamentary session for a confidence vote on the 8th. Should Bayrou lose, France’s constitution requires the resignation of the prime minister and cabinet.

Opposition parties are rallying for Bayrou’s ouster, while far-right factions argue that President Emmanuel Macron must also step down if the government collapses. Against this backdrop, with the deficit expected to hit 5.4% of GDP this year, fiscal risk has fueled a surge in long-term yields.

In the United Kingdom, concerns over rising deficits are likewise driving gilt yields higher. Britain’s debt-to-GDP ratio exceeds 96%, forcing the government to consider spending cuts and tax hikes, while shuffling senior advisers. Persistent inflation limits the Bank of England’s ability to cut rates, and political instability combined with heavy new issuance has rattled the gilt market.

In the U.S., the 30-year Treasury yield has climbed to 4.972%, near the 5% threshold, with the 10-year at 4.279%. The upward trajectory accelerated after the D.C. Circuit Court ruled President Donald Trump’s reciprocal tariffs legally unfounded. Though Trump has vowed to appeal to the Supreme Court, markets are preparing for a possible affirmation of the ruling, which would slash tariff revenues, widen deficits, and reignite fiscal risks—particularly since the administration pushed through a sweeping tax cut (OBBBA) predicated on tariff collections.

Comment