Trump Says His ‘Big’ Tariffs Are Coming Today: What To Know About Reciprocal Tariffs—And Inflation Impact

Input

Changed

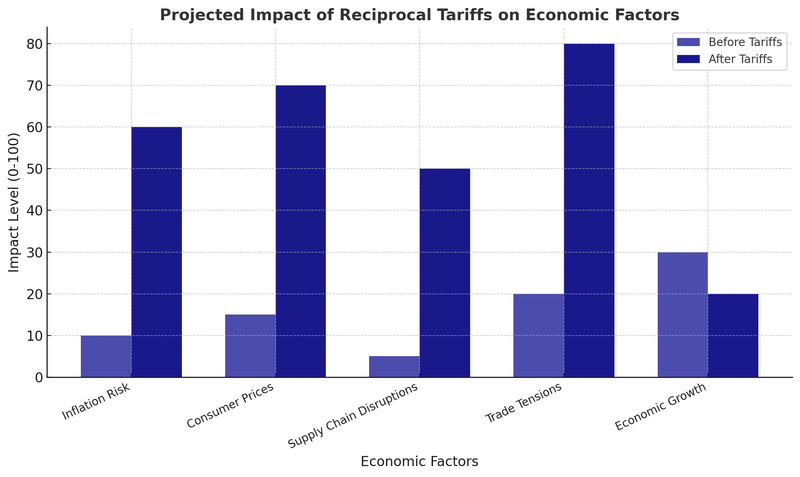

In a highly anticipated move, President Donald Trump is set to announce a major shift in U.S. trade policy on Thursday, revealing his plans for “reciprocal tariffs.” This announcement is stirring both excitement and concern across the business world, as well as among policymakers and global leaders. These tariffs, designed to punish countries that impose high tariffs on U.S. goods, could have sweeping economic consequences, both in the U.S. and internationally. In particular, concerns are mounting over their potential to cause inflationary pressures on goods and services, disrupt supply chains, and escalate trade tensions worldwide.

Understanding Reciprocal Tariffs

Reciprocal tariffs are a key component of Trump's trade policy, aimed at ensuring that tariffs imposed by the U.S. on imports mirror the duties other countries place on American goods. In essence, this approach dictates that if a foreign government imposes a tariff on U.S. exports, the U.S. will impose an equal or higher tariff on imports from that country.

The rationale behind reciprocal tariffs is to level the playing field in global trade, particularly in industries where the U.S. faces high tariffs on its exports while allowing low-cost imports to flood its domestic market. Trump’s administration argues that these tariffs will incentivize foreign governments to negotiate fairer trade terms with the U.S., preventing what the president describes as "decades of unfair trade practices."

While some analysts view this as a strategic move to bolster American manufacturing and domestic industry, others caution that reciprocal tariffs could have unintended economic consequences. Historically, tariffs have often led to price increases, strained trade relationships, and, in some cases, full-scale trade wars. The new policy raises questions about whether the U.S. can maintain its global trade standing without causing major disruptions to international supply chains.

Economic and Political Reactions

The proposal has generated mixed reactions. Supporters argue that reciprocal tariffs will strengthen the U.S. economy by encouraging fair competition. However, many economists caution that tariffs could create economic inefficiencies and trigger a cycle of retaliation among trading partners.

Historically, tariff policies have led to tit-for-tat responses, where affected countries impose their own tariffs on American goods in response to U.S. trade restrictions.

For example, if the U.S. imposes higher tariffs on European automotive imports, the European Union (EU) may respond by raising duties on American agricultural products or technology exports. China, one of the U.S.'s largest trading partners, has already signaled that it may introduce countermeasures if the new tariffs affect Chinese goods.

In past trade disputes, retaliatory tariffs have negatively impacted American farmers, manufacturers, and exporters who depend on foreign markets. A trade war could lead to job losses in industries reliant on international commerce and further strain diplomatic relations between the U.S. and its allies.

In addition, businesses that have established overseas supply chains may struggle with higher operating costs and logistical challenges. Global financial markets are also likely to react to increased trade tensions, potentially leading to stock market volatility and economic uncertainty.

Inflationary Risks and Consumer Impact

Many industries in the U.S. rely on imported raw materials and components, and imposing tariffs could drive up production costs, which would then be passed down to consumers.

For instance, sectors like electronics, automobiles, and consumer goods depend on international supply chains to maintain competitive pricing. If reciprocal tariffs are placed on key imports such as steel, aluminum, and semiconductors, businesses will face higher costs, leading to price hikes on everyday items. This could directly impact American consumers by increasing the prices of household goods, cars, and technology products.

According to economic experts, tariffs often function as a hidden tax on consumers. When import prices rise, domestic producers may also raise their prices, reducing competition and limiting choices for buyers. With inflation already a major concern for the U.S. economy, additional tariffs could exacerbate financial pressures on middle- and low-income households.

Moreover, businesses that rely on global supply chains could face profit squeezes and reduced competitiveness in international markets. Higher costs for raw materials could make American-made products less attractive abroad, potentially harming U.S. exports rather than strengthening them.

The Federal Reserve’s Role

Amid concerns over the economic impact of the tariffs, Trump has also pushed for the Federal Reserve to lower interest rates. By reducing borrowing costs, he hopes to stimulate economic activity and counteract any negative effects from tariffs.

While lower interest rates can encourage investment and consumer spending, some economists caution that such a move could further fuel inflation if supply chain disruptions and higher import costs persist. The Federal Reserve faces a delicate balancing act—supporting economic growth while keeping inflation in check.

Global Trade Implications

The long-term effects of reciprocal tariffs remain uncertain, but history provides some insight into potential outcomes. The implementation of tariffs during past trade disputes, such as the Smoot-Hawley Tariff Act of the 1930s, contributed to reduced global trade and economic downturns.

While Trump's administration argues that tariffs will lead to stronger domestic production and job creation, critics warn that the approach may discourage foreign investment and disrupt economic growth. Many multinational corporations rely on stable trade policies to make long-term investment decisions. If trade relations between the U.S. and its partners become too unpredictable, businesses may hesitate to expand operations or relocate production facilities.

Additionally, major corporations that export to foreign markets could suffer revenue losses if other countries impose counter-tariffs on U.S. goods. Companies that depend on global distribution networks may find themselves at a disadvantage compared to competitors in countries that maintain more open trade policies.

Looking Ahead

As the world awaits Trump’s official announcement, the debate over reciprocal tariffs continues to intensify. While the policy aims to establish fairer trade practices and boost domestic production, the potential risks—rising inflation, supply chain disruptions, and trade conflicts—cannot be ignored.

Whether reciprocal tariffs will ultimately benefit or harm the U.S. economy remains to be seen. If successful, the strategy could reshape global trade dynamics in America’s favor. If miscalculated, it could trigger an economic downturn, undermining the very industries it aims to protect.

For now, businesses, investors, and policymakers will closely watch how these tariffs unfold and whether they lead to the desired outcomes or unintended economic challenges. The global trade landscape is shifting, and the effects of Trump’s reciprocal tariffs could be felt for years to come.