CXMT’s Advances in 16nm DRAM Production and Push for 15nm Development

Input

Changed

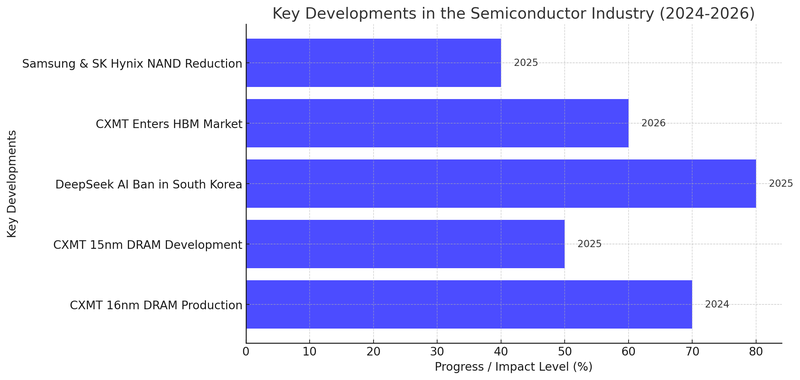

ChangXin Memory Technologies (CXMT), a leading Chinese DRAM manufacturer, has made significant strides in memory technology, particularly in advancing its production processes. Recently, CXMT transitioned from a 17nm to a 16nm process for its initial DDR5 products. This development represents a crucial step in narrowing the technological gap between CXMT and established global competitors such as Samsung Electronics, SK Hynix, and Micron. The move to 16nm DRAM is part of a broader push toward more efficient and powerful memory solutions, allowing CXMT to better compete in both domestic and international markets.

CXMT's continued attempts to produce 15nm DRAM, with research and development anticipated to be completed by 2025 and mass production scheduled for late 2026, have further solidified the company's technical leap. Analysis of the company's DDR5 chips has shown that it has already made notable advancements in bit density and DRAM cell size. This development demonstrates CXMT's goal of becoming a significant force in the DRAM industry, which has historically been controlled by American and South Korean companies. However, major geopolitical and trade conflicts, especially U.S. sanctions that restrict China's access to cutting-edge semiconductor manufacturing equipment, such as extreme ultraviolet (EUV) lithography, are causing CXMT to develop quickly. Notwithstanding these limitations, CXMT intends to create its 15nm DRAM using already-existing equipment, a tactic Micron used with its 13nm DRAM technology. The company's ongoing development indicates that Chinese companies are progressively catching up to their American and South Korean counterparts in terms of technology, which is escalating rivalry in the global semiconductor market.

South Korean Government Bans the Use of DeepSeek AI

In a separate development reflecting broader technological and security tensions between China and South Korea, several South Korean government ministries, including the Ministry of National Defense, the Ministry of Foreign Affairs, and the Ministry of Trade, Industry and Energy, have prohibited the use of the Chinese-developed artificial intelligence (AI) tool DeepSeek within their operations. The ban is driven by growing concerns over national security and data privacy, as South Korean authorities fear that sensitive government information could be compromised through DeepSeek’s data collection practices.

In contrast to Western AI models like ChatGPT, DeepSeek is said to collect a vast amount of user data, including IP addresses, cookies, text, photos, audio files, device information, and keyboard input patterns. In light of these worries, the South Korean government has limited its use on official devices in a cautious move. While the Ministry of National Defense has completely barred access to DeepSeek on military computers, the Ministry of Industry has released instructions cautioning against entering any private or sensitive corporate data into the AI tool. Other nations, such as the US, Japan, Australia, Italy, and Taiwan, have similarly limited or outright prohibited the use of DeepSeek due to security concerns; this decision is consistent with their policies.

Beyond the government sector, private corporations in South Korea, such as Kakao and LG U+, have also prohibited the use of DeepSeek for internal business purposes. These widespread restrictions indicate a broader shift in South Korea’s stance toward Chinese technology, particularly in sectors where data security is a primary concern. The ban on DeepSeek underscores the deepening technological and geopolitical divide between China and South Korea, further complicating economic and trade relations between the two nations.

CXMT’s Entry into the High Bandwidth Memory (HBM) Market

Along with its DRAM developments, CXMT is getting ready to join the High Bandwidth Memory (HBM) market, which has historically been controlled by South Korean firms like SK Hynix and Samsung Electronics. HBM is a profitable and strategically important market since it is essential to data center applications, artificial intelligence, and high-performance computing. CXMT is anticipated to start mass producing HBM goods by 2026 and has been aggressively seeking HBM development specialists.

CXMT’s entry into the HBM market is particularly noteworthy because it poses a direct challenge to South Korean memory giants, which currently hold the majority share in this sector. SK Hynix, for example, is the leading supplier of HBM3, the latest generation of high-bandwidth memory used in AI accelerators and high-performance computing. Samsung and SK Hynix’s dominance in the HBM sector has been largely due to their early investments and expertise in stacking DRAM layers to achieve higher data throughput and lower power consumption. However, CXMT’s expansion into this space could disrupt the status quo, especially if the company manages to secure Chinese government support and domestic AI firms as major customers.

The drive for semiconductor self-sufficiency in China has increased the potential for CXMT to challenge Samsung and SK Hynix in the HBM market. CXMT's HBM products may experience robust demand in the domestic market as a result of China's emphasis on reducing its dependence on foreign memory suppliers and the growing demand for AI computation. The competitive dynamics of the global memory industry could be significantly altered if CXMT successfully enters the HBM segment, necessitating South Korean manufacturers to further innovate and modify their pricing strategies in order to preserve their leadership.

Samsung and SK Hynix’s NAND Flash Production Cuts and Market Erosion by China

Meanwhile, Samsung Electronics and SK Hynix have reportedly decided to reduce their NAND flash production by over 10% in the first quarter of 2025. This move is part of a strategic transition, known as "Tech Migration," in which older NAND production lines are being upgraded to newer processes. However, the reductions in output reflect deeper issues within the NAND market, which has been experiencing prolonged price declines and eroded profit margins due to oversupply and weak demand.

South Korean manufacturers have encountered significant obstacles in the NAND flash market due to the increased prevalence of Chinese competitors. Companies like Yangtze Memory Technologies Corp. (YMTC) have aggressively expanded their NAND production capabilities, utilizing government subsidies to provide competitive pricing. Samsung and SK Hynix have been compelled to reconsider their production strategies as a result of the increasing competition. The objective of the transition from 128-layer NAND to more sophisticated 176-layer, 238-layer, and 286-layer models is to enhance cost efficiency and preserve competitiveness with Chinese competitors.

Despite these technological advancements, the global NAND market remains volatile, with persistent concerns about demand fluctuations and potential trade restrictions. The production cuts by Samsung and SK Hynix suggest that South Korean firms are bracing for further instability in the NAND sector. The increasing presence of Chinese firms in the semiconductor industry, coupled with strategic moves like CXMT’s expansion into HBM and DRAM, signals a shift in the balance of power. The long-standing dominance of South Korean memory firms is being challenged by Chinese companies that are rapidly advancing in technological capabilities, posing significant challenges to traditional market leaders.

In conclusion, the expanding ambitions of China in the semiconductor industry are underscored by CXMT's advancements in DRAM and HBM development, which are exerting increased pressure on established South Korean memory firms. In the interim, South Korea has implemented restrictions on Chinese AI technologies such as DeepSeek due to geopolitical concerns, which further underscores the fractured relationship between the two countries. The broader challenges that South Korean firms are confronting as they navigate an increasingly competitive and uncertain global memory market are underscored by the recent production adjustments in the NAND sector by Samsung and SK Hynix. The semiconductor industry is undergoing a transformation as a result of the ongoing ascent of Chinese firms, which presents both opportunities and challenges for the future.