“Even Moody’s in the End” — U.S. Dragged Down by Debt, Loses All 'Top' Credit Ratings

Input

Changed

Moody’s Downgrades U.S. Sovereign Credit Rating to Aa1 All Three Major Credit Rating Agencies Strip U.S. of Top Rating Will a Massive Selloff of U.S. Treasuries Follow?

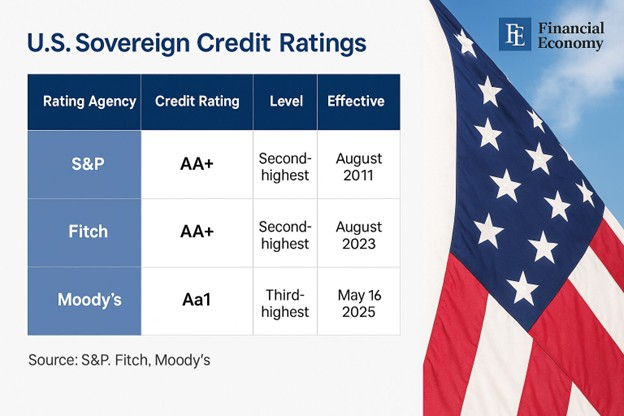

For decades, the United States has served as the anchor of global credit stability—its triple-A sovereign credit rating a symbol of unparalleled trust in its economic might and political institutions. But in a move loaded with historical and financial significance, Moody’s Investors Service has stripped the U.S. of its final ‘AAA’ rating, marking the end of an era. With this decision, all three major international credit rating agencies—Moody’s, Standard & Poor’s (S&P), and Fitch—have now downgraded the U.S. The consequences are poised to reverberate across markets, policy debates, and the fiscal direction of the Trump administration.

U.S. Sovereign Credit Rating Downgraded Again

In a press release issued on November 16, Moody’s downgraded the United States’ long-term sovereign credit rating from the highest possible level, Aaa, to Aa1, citing “large and growing fiscal deficits” and rising interest costs. This is the first time since 1917 that the U.S. has fallen below Aaa in Moody’s assessment—a gap of 108 years.

Moody’s pointed specifically to the rapid expansion of federal debt and rising interest payments as central reasons behind the downgrade. Over the last decade, the U.S. has accumulated debt at a pace far surpassing similarly rated countries. As of May 2025, total U.S. national debt reached $36.22 trillion, a surge of approximately $1.66 trillion from the same period the year before.

Even more alarming is the cost of servicing that debt. In 2023, the U.S. government spent over $1.13 trillion just on interest payments, crossing the trillion-dollar mark for the first time in history. The interest burden is becoming one of the largest categories of federal spending, threatening to crowd out critical investments in defense, infrastructure, and social programs.

Looking ahead, the fiscal picture appears increasingly bleak. Moody’s projects that debt accumulation will accelerate, driven by persistent budget deficits and rising interest rates. The agency noted that none of the current budget proposals being debated in Congress appear sufficient to correct the structural fiscal imbalance.

Instead of implementing tax reforms or revenue-enhancing policies to address the widening deficit, the Trump administration has doubled down on pushing for further tax cuts. President Trump recently called on Republicans to pass a new legislative package that would extend the 2017 Tax Cuts and Jobs Act—a flagship policy of his first term—and add additional reductions. Critics argue that this move could further erode the government’s revenue base at a time when fiscal discipline is urgently needed.

S&P and Fitch Also Say “U.S. Sovereign Debt Is on Shaky Ground”

Moody’s is not alone in its pessimism. The other two titans of credit analysis—Standard & Poor’s (S&P) and Fitch Ratings—have already pulled the plug on America’s AAA status.

S&P was the first to make such a move back in August 2011, when it downgraded the U.S. from AAA to AA+ during a fierce political battle over the debt ceiling. The downgrade, driven by what S&P called “political brinkmanship” in Congress, sent shockwaves through global markets and was a warning about growing dysfunction in Washington’s fiscal governance.

More recently, on August 1, 2023, Fitch followed suit, also slashing the U.S. rating from AAA to AA+. In its official statement, Fitch expressed concerns over the deteriorating fiscal outlook, the anticipated rise in debt-to-GDP ratio over the next three years, and a decline in what it described as "governance." This term refers to a country’s institutional capacity to manage public finances effectively and maintain political and administrative stability.

Crucially, Fitch explicitly cited the January 6, 2021, Capitol riot as part of its rationale. Richard Francis, co-head of Fitch’s sovereign ratings division, said in an interview that the storming of the Capitol by Trump supporters—angry over the 2020 election results—was partially factored into the downgrade. The violent event, which disrupted the certification of the election results and resulted in multiple deaths, underscored deep institutional vulnerabilities in the American political system. Former President Trump has since been indicted for his role in inciting the attack.

This broader political instability, combined with weak fiscal planning, paints a troubling picture for the United States’ financial reputation on the global stage.

Experts Warn of Market Fallout

The complete loss of the U.S.’s top-tier credit rating status has triggered widespread concern among market observers and economic analysts. A country’s credit rating serves as a barometer of its creditworthiness, affecting everything from the cost of government borrowing to the interest rates on home loans and business financing. When a sovereign rating drops, bond yields typically rise, leading to higher borrowing costs for both the government and ordinary consumers.

One of the most immediate concerns is the potential for a massive selloff in U.S. Treasury bonds. Andrew Brenner, head of international fixed income at NatAlliance Securities, warned of an impending attack by what he referred to as “bond vigilantes”—market participants who sell off government bonds in protest against fiscal mismanagement or inflationary policies. This phenomenon often forces governments to raise interest rates even further to maintain investor confidence.

Others believe that the downgrade could trigger a broader flight from U.S. financial assets. Max Gokhman, chief investment officer at Franklin Templeton, remarked that institutional investors are already shifting away from U.S. Treasuries in favor of other safe-haven assets. As a result, the cost of debt servicing will continue to climb, leading to a decline in long-term Treasury prices, mounting pressure on the U.S. dollar, and reduced investor appetite for American equities.

Yet, not all analysts foresee a financial crisis on the scale of 2011. Some argue that the risks posed by America’s fiscal imbalances are already well understood and have been priced into markets. The Wall Street Journal reported that few market participants expect Moody’s downgrade to spark the kind of turmoil seen after S&P’s 2011 action. Similarly, British investment bank Barclays emphasized that a one-notch downgrade is not significant enough to alter regulatory frameworks regarding the collateral value or risk weighting of U.S. Treasuries—meaning that financial institutions are unlikely to shift away from U.S. debt instruments in a meaningful way.

Still, the symbolism of the downgrade is powerful. It signals that confidence in the U.S. government’s ability to manage its finances is slipping, even among the most trusted credit watchdogs in the world. Whether the market reaction is limited or long-lasting, the underlying issues—rising debt, political dysfunction, and weakened governance—remain a growing source of concern both domestically and abroad.