“Saving the Nation First” — Tariff-Induced Employment Shock Sets Stage for September Rate Cut, Prospects of a ‘Big Cut’ Reemerge

Input

Changed

‘25bp vs 50bp,’ U.S. August Employment Shock Mounting Pressure from Record U.S. Debt and Surging Interest Costs Intensifying Outlook for Inflation and Dollar Weakness After Rate Cut

Since President Donald Trump took office, the Federal Reserve had resisted lowering interest rates on grounds of tariff-driven policy uncertainty. That stance now appears poised to shift at this month’s Federal Open Market Committee (FOMC). Consecutive data releases showing deterioration in the U.S. labor market in the wake of reciprocal tariff measures, coupled with intensifying White House pressure on the Fed, have pushed the implied probability of a September rate cut to 100%. Some Wall Street investors are even pricing in the likelihood of a “big cut” — a half-point reduction. With the rate cut now effectively priced in, market focus has turned to post-cut inflation dynamics. Tariff-induced cost escalation and employment weakness are seen as powerful drivers of renewed inflationary pressures.

August Employment Falls Short by 54,000 Amid Tariff Shock

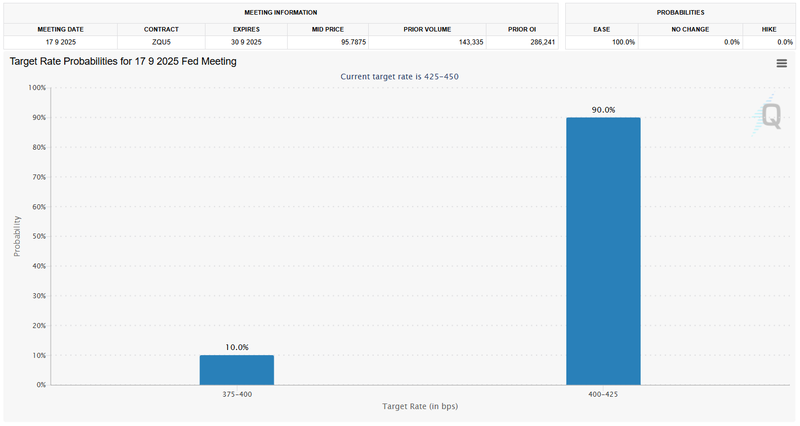

According to CME FedWatch data on September 7, futures markets assign a 90% probability to a 25-basis-point cut at the September 16–17 FOMC, and a 10% probability to a 50-basis-point move. Prior to the August employment report, the market had not considered a half-point cut plausible, but the jobs shock has brought the scenario into play. The report was widely viewed on Wall Street as the key determinant for the Fed’s September decision.

The Bureau of Labor Statistics (BLS) reported that nonfarm payrolls in August increased by just 22,000 — falling short of the Dow Jones consensus forecast of 75,000 by 53,000. Job gains for June and July were revised down by a combined 21,000. June payrolls were revised from a gain of 27,000 to a loss of 13,000, while July’s figure was adjusted from 73,000 to 79,000.

The unemployment rate rose from 4.2% in July to 4.3% in August, the highest since 2021. Jobless claims also surged. On September 4, the Labor Department reported that initial claims for the week of August 24–30 rose to 237,000, up from 229,000 the prior week and above Bloomberg’s estimate of 230,000 — the highest since June. On the same day, ADP reported just 54,000 private-sector payroll additions in August, down from 106,000 in July and well below economists’ forecast of 65,000. ADP’s survey, covering 26 million workers, is regarded as a key gauge of labor-market conditions.

The Labor Department’s JOLTS report on September 3 reinforced the picture. Job openings in July fell to 7.181 million, the lowest since September 2023. Openings have now declined for two consecutive months, after 7.712 million in May and 7.357 million in June. “Hiring surged early this year but momentum has not been sustained due to heightened economic uncertainty,” said Nela Richardson, ADP’s chief economist. Companies facing rising input costs under Trump’s tariff regime appear increasingly reluctant to add workers. Reflecting the trend, Treasury yields dropped sharply: the 2-year fell 7.9bp to 3.511%, while the 10-year dropped 8.7bp to 4.076%.

U.S. Debt Raises Risk of ‘Economic Cardiac Arrest’

Labor data aside, Trump’s intensifying pressure on the Fed is reinforcing expectations of a cut. The president has argued that his tariff strategy can only succeed if accompanied by monetary easing. Lower rates would depress the dollar, boosting U.S. export competitiveness while undermining that of foreign rivals.

Surging government debt has added another layer of urgency. Treasury data show U.S. debt surpassed $37 trillion in August — a historic first. Net interest outlays, which accounted for just 9% of revenue a decade ago, soared to 19% ($950 billion) in FY2024. The average interest rate on Treasury securities, at 3.352% in July, is the highest in 15 years. Analysts warn that debt has become America’s Achilles’ heel.

As debt mounts, repayment burdens outstrip income growth, compressing fiscal space and risking what some call an “economic cardiac arrest.” Rising debt-service costs can trigger investor flight from both new and outstanding Treasuries, pushing yields higher. In turn, the Fed may respond by expanding liquidity, but monetizing debt erodes the dollar’s value, undermining its role as a store of wealth.

Dollar weakness amplifies systemic risks. As the world’s primary reserve and transaction currency, dollar instability threatens global trade and capital markets. Weakness also complicates U.S. fiscal financing. With trillions in new spending planned over the next decade, any erosion in investor demand for Treasuries could sharply raise borrowing costs.

Inflation Emerges as Post-Cut Wildcard

The pivotal concern following a rate cut is inflation. Rising unemployment due to tariffs is structurally inflationary, constraining the Fed’s ability to mitigate job losses through easing. Instead, looser policy risks amplifying tariff-driven price pressures.

Contrary to President Trump’s assertions that tariffs are non-inflationary, Wall Street’s consensus is that higher tariffs inevitably fuel price increases. JPMorgan chief economist Michael Feroli warned that tariffs could shave up to 1% off GDP and raise inflation by 1–1.5%. “The scale of tariff hikes under Trump ranks among the largest in U.S. postwar history, and the uncertainty over their consumer price impact is significant,” he said. UBS chief economist Brian Rose added: “Tariffs have already halted the decline in core inflation as companies pass rising costs to consumers, leading to a gradual upward trajectory.”

With inflationary pressures rising, the dollar faces heightened downside risk. A Fed rate cut would exacerbate the trend, as lower rates expand liquidity and erode relative currency value. While a strong economy could offset depreciation, most analysts see such an outcome as unlikely. Morgan Stanley projects the dollar could fall another 9% by mid-2026. Surveys by Goldman Sachs and Bloomberg similarly show consensus that dollar weakness will persist. Such depreciation would accelerate global investor flight from Treasuries and dollar-denominated assets, likely triggering higher long-term yields and heightened financial-market volatility. Experts warn that the feedback loop could further destabilize an economy already strained by unprecedented debt.

Comment