Dual Strategy of BYD, the World's No. 1 Electric Vehicle Maker: The Hidden Crisis Behind the Price Cuts

Input

Modified

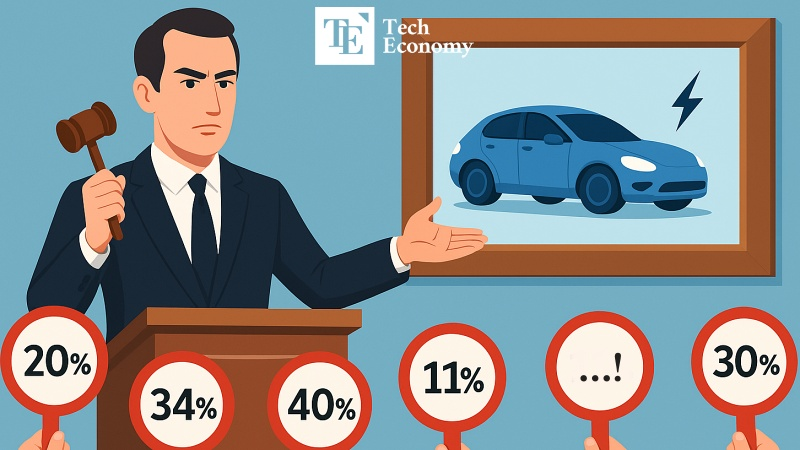

BYD’s ‘Bombshell Sale’ Intensifies Price Competition Potential Reshaping of Competitive Landscape with Tesla Accounting Transparency and Hidden Debt Issues Come to Light

As the world accelerates toward a future dominated by electric vehicles, China's BYD—now the global EV leader—is not just participating in the race but rewriting the rules. Known for its rapid ascent and formidable domestic presence, BYD is intensifying a two-pronged strategy aimed at reshaping both the Chinese and global electric vehicle markets. By launching a wave of aggressive price cuts across its lineup, the company seeks to eliminate smaller rivals at home and corner major players like Tesla on the world stage. But while the surface narrative showcases dominance and innovation, a closer look reveals mounting financial risks, opaque accounting practices, and a low-margin business model that could jeopardize its long-term ambitions.

The EV “Chicken Game” Heats Up in China

In a bold move announced at the end of May, BYD revealed plans to slash prices by up to 34% on 22 of its vehicle models through the end of June. Among the most dramatic cuts was the compact Seagull (SEAGULL), whose price dropped nearly 20%, from approximately USD 9,600 to USD 7,600. Meanwhile, the mid-to-large Seal (SEAL) sedan was reduced by a full 34%, now retailing for USD 14,300. The scale and scope of these reductions were seen as unprecedented, signaling a new phase in China’s EV war.

The motivation behind these aggressive discounts, according to industry analysts, lies in a ballooning inventory problem. Since the beginning of the year, BYD’s unsold vehicle stock has increased by roughly 150,000 units—nearly half of its average monthly sales volume of 350,000 vehicles. After selling 4.27 million vehicles in 2023, BYD raised its 2024 target to a staggering 5.5 million. With such lofty goals, the company is under enormous pressure to clear inventory to maintain sales momentum.

But BYD’s pricing bombshell didn’t go unnoticed. It ignited a ripple effect across the industry, pushing competitors into a corner. Leapmotor responded by slashing prices by around 30%, and Geely cut up to 18% on seven of its models. Even Changan Automobile—a player known for focusing on high-end models—was forced to offer a 10.5% discount on its flagship Deepal S07, bringing its price down to about USD 23,700.

Industry observers believe BYD’s tactics signal more than a push to boost short-term sales—they point to a larger strategy of forced consolidation. By triggering an industry-wide price war, BYD appears intent on weeding out weaker firms, restructuring the market around a few major players. As of March 2024, BYD’s domestic market share stood at 29.7%, down from 37.5% a year prior. While still in the lead, the 7.8 percentage point drop suggests the company is under pressure to defend its dominant position. Its price war, then, is not just tactical—it’s existential.

BYD’s Bold Push for Global Dominance

Beyond its domestic turf, BYD’s ambitions stretch across continents. Its dramatic price reductions are not merely a reaction to local competition but part of a larger strategy to alter the global EV hierarchy. Nowhere is this more evident than in the shifting status of Tesla, BYD’s chief international rival. As Tesla grapples with dual pressure from BYD and local disruptor Xiaomi in China, its once-prized position in the world's largest EV market is weakening. Tesla’s continued emphasis on high-end models appears increasingly out of sync with consumer demand, especially in a market where affordability and technological novelty drive sales.

BYD, in contrast, has a structural advantage. With a vertically integrated business model that includes in-house battery manufacturing, the company enjoys a level of price flexibility that Tesla cannot easily match. This nimbleness allows BYD to deploy aggressive pricing strategies without immediately jeopardizing its supply chain or production efficiency. In effect, it can weaponize price while maintaining scale.

Meanwhile, Xiaomi is carving out space in the premium EV segment, effectively flanking Tesla from the opposite side. The release of Xiaomi’s debut electric car, the SU7, generated a media frenzy when it racked up 50,000 pre-orders in just eight minutes. With Xiaomi appealing to consumers seeking style and novelty, and BYD dominating the value market, Tesla finds itself squeezed between two aggressive and fast-moving Chinese competitors. This dynamic marks a clear shift in consumer preference toward vehicles that are either significantly cheaper or notably more innovative than Tesla's offerings.

This domestic battle has clear international echoes. BYD is accelerating its expansion into Europe and Southeast Asia, markets where Tesla had previously enjoyed considerable dominance. In several emerging markets, BYD’s affordability and solid performance are winning over consumers and governments alike. Its growing presence in economies experiencing financial instability only strengthens its value proposition—where price and durability matter more than brand prestige.

Industry consensus is coalescing around a sobering conclusion: Tesla must revise its strategy if it hopes to retain relevance in this rapidly shifting landscape. BYD, by launching an assault on both domestic and foreign fronts, is no longer just a competitor—it’s the primary architect of a new EV world order.

Aggressive Pricing Strategy Could Amplify BYD’s Debt Risk

But behind BYD’s relentless drive lies a less glamorous reality. The company’s financial foundation is riddled with uncertainties that could ultimately undermine its rapid ascent. In early 2024, Bloomberg cited data from Hong Kong accounting firm GMT Research estimating BYD’s net debt at an eye-popping USD 44 billion. More troubling, the report suggested BYD may be obscuring its real debt load by underreporting or delaying the recording of accounts payable—particularly commercial notes issued to suppliers.

The average maturity period for BYD’s supplier-issued notes was found to be around nine months—more than four times the industry standard of two months. This longer delay in settling payments raises red flags about the company’s cash flow management and long-term liquidity. In an environment of rising costs, intense competition, and global expansion, even a minor disruption in funding could snowball into a full-blown liquidity crisis.

These financial maneuvers paint a troubling picture: a company pursuing breakneck growth while straining its financial resilience. And it’s not just about cash flow. A significant portion of BYD’s business model relies on government subsidies and foreign investment. As one analyst warned, "Any change in policy could directly impact performance." In other words, BYD’s strategy is as exposed to political winds as it is to market forces.

This precarious balance has sparked deep division among investors and analysts. On the one hand, BYD’s pricing strategy could yield a surge in market share and global brand recognition. On the other, it risks becoming a “race to the bottom,” where rising fixed costs and plummeting margins crush long-term profitability. In such a capital-intensive industry, the combination of shrinking gross profit and mounting debt could create a financial trap from which even the most innovative firms might not escape.

Thus, what appears on the surface to be a triumph of strategy may also be a cautionary tale in the making. BYD’s aggressive push for dominance, both at home and abroad, is clearly reshaping the global EV sector. But whether it emerges as a lasting powerhouse or stumbles under the weight of its own ambition will depend on how well it can manage its expanding risk profile while maintaining its technological and pricing edge.