Fed Holds Rates Steady for Fifth Consecutive Meeting Despite Trump Pressure: “Closely Monitoring Market Volatility”

Input

Modified

Fed Governors Bowman and Waller Dissent in Favor of Rate Cuts Powell “Inflation Remains High Even Without Tariff Effects” Wait-and-See Mode Until September Meeting “More Learning Needed”

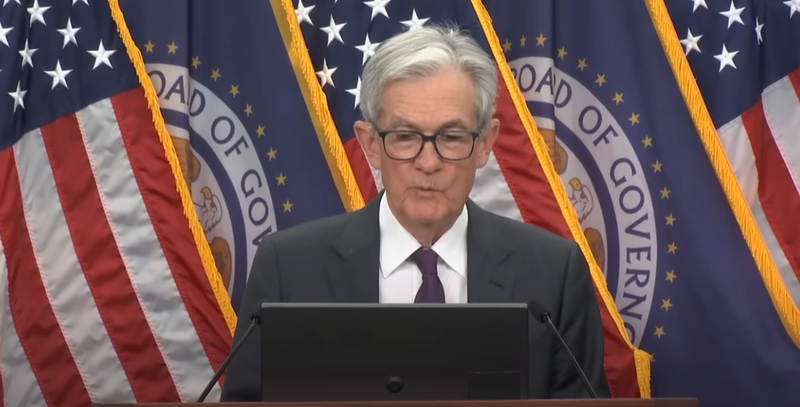

Federal Reserve Chair Jerome Powell held a press conference in Washington, D.C., on the 30th (local time) following the Federal Open Market Committee (FOMC) meeting. Despite growing political and internal pressure, the Fed opted to hold its benchmark interest rate steady, maintaining a cautious stance on rate cuts amid persistent inflation and looming economic uncertainty. Two Fed governors voted against the decision, but the majority agreed that holding the current rate was appropriate. Powell signaled the Fed would remain in a wait-and-see mode through the next meeting in September, emphasizing the need to assess upcoming employment and inflation reports and to evaluate the full impact of tariffs on consumer prices.

Fed Keeps Benchmark Rate at 4.25–4.5%

On the 30th, the FOMC held its regular policy meeting and decided to keep the federal funds rate unchanged at 4.25–4.5%. Of the 11 committee members present, nine voted in favor of the hold, while two—Michelle Bowman and Christopher Waller, both of whom have advocated for rate cuts—dissented. This marks the first time since 1993 that two Fed governors have opposed a rate decision.

In its post-meeting statement, the Fed acknowledged that “economic activity growth slowed in the first half of the year,” adding that “market conditions remain robust and inflation is somewhat elevated,” while also noting that “uncertainty about the economic outlook remains high.” This represents a shift from the more optimistic tone in June, when the Fed stated that “the economy continues to grow at a solid pace.” CNBC noted that while economic slowdowns typically prompt stronger calls for rate cuts, the FOMC did not endorse such a move this time.

During the press conference, Powell stated, “No decision has been made regarding the September meeting,” and emphasized that the Fed would base its judgment on a range of indicators, including inflation data. “We are closely watching the impact of tariffs on inflation,” Powell said, “and managing long-term inflation expectations remains our responsibility to prevent temporary price increases from becoming persistent inflation.” While not ruling out the possibility of rate cuts, Powell highlighted the ongoing uncertainties surrounding inflation and tariffs as reasons for policy continuity.

3% GDP Growth in Q2, Labor Market Remains Strong

Powell noted that while the U.S. economy grew at a slower 1.2% rate in the first half—down from 2.5% last year—the labor market has not weakened. However, he warned of “clear downside risks to the labor market,” explaining that while labor supply and demand are declining in tandem, the trend signals underlying fragility.

This decision reflects several factors, including a significant moderation in inflation from its 2021–2023 peaks, a stronger-than-expected 3% quarter-on-quarter annualized GDP growth in Q2, and signs of waning demand from both businesses and consumers. It also considers potential inflationary pressures from a renewed tariff war instigated by former President Trump.

Why Trump Is Pushing Hard for Rate Cuts

The Fed has now held rates steady for five consecutive meetings in 2025, following three rate cuts that began in September 2024, marking a pivot away from monetary tightening. Trump’s calls for rate cuts have intensified, particularly as he seeks to reduce government interest expenses and stimulate the economy. Ahead of the July meeting, he even raised questions about Powell’s future at the Fed in an attempt to increase pressure.

In a rare move, Trump visited the Fed’s headquarters in Washington on July 24, inspecting a controversial and costly renovation project—interpreted as a symbolic maneuver to pressure Powell. Just before the FOMC decision was announced, Trump posted on Truth Social, citing the stronger-than-expected Q2 GDP figure to demand an immediate rate cut.

The Trump administration’s aggressive focus on lowering Treasury yields stems from America’s ballooning federal debt. As of the first half of 2025, the U.S. national debt has reached $36.2 trillion—double what it was 15 years ago—largely due to pandemic-era stimulus spending.

This surge in debt has driven interest rates higher, fueling inflation and causing federal interest payments to skyrocket. The average yield on outstanding government bonds has climbed to 3.28%, twice the 1.61% rate in 2021. Annual interest payments now stand at $1.158 trillion, surpassing last year’s defense budget of $886 billion. Trump has stressed the need to “balance the federal budget and fix what’s broken,” underscoring the urgency of the situation. The yield on the 10-year Treasury note, which had dropped to 4.1% after peaking at 4.8% earlier this year, now hovers around 4.3%.

Another issue looming over the administration is the expiration of Trump’s 2017 tax cuts at the end of this year. Extending them will require securing additional revenue—posing a fresh challenge for a second Trump term. Analysts say the administration’s aggressive push to raise tariffs on major trading partners reflects a desperate attempt to boost fiscal revenue—a form of “debt detox.”