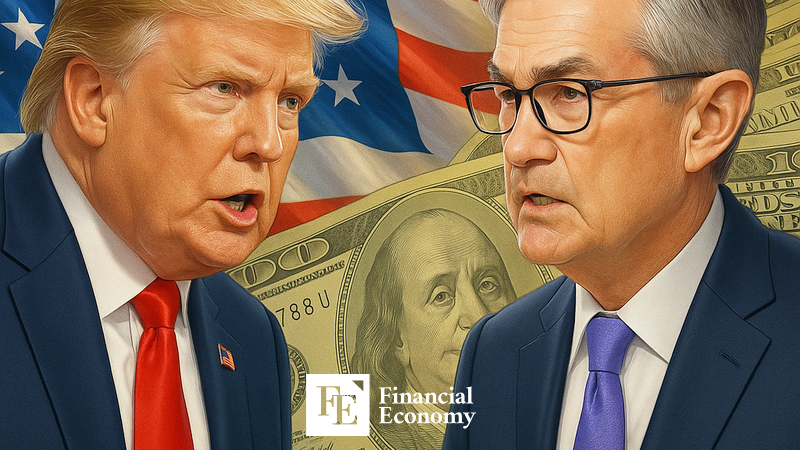

Fed Rate Cut under Trump Administration, Signals Two Additional Eases within the Year

Input

Modified

Concerns over slowing economy prompt first cut in nine months by 0.25 percentage points Newly appointed Trump nominee votes for “big cut” Divergent views among policymakers heighten policy uncertainty

The U.S. Federal Reserve (Fed) has lowered its benchmark interest rate for the first time in nine months. Having withstood persistent pressure from President Donald Trump to ease policy, the Fed ultimately cut rates on the basis of worsening conditions in employment and the broader economy. With speculation mounting over the possibility of two additional cuts this year, divisions among policymakers over the scale of reductions are deepening uncertainty around monetary policy.

Fed Reflects “Easing Momentum in Economic Activity in First Half”

On September 17 (local time), the Fed announced at the conclusion of its two-day Federal Open Market Committee (FOMC) meeting that it had lowered the target range for the federal funds rate from 4.25–4.50% to 4.00–4.25%. This marks the first reduction since Trump’s second administration took office and the first in nine months. The Fed had resumed rate cuts in September last year after a four-and-a-half-year pause, continuing through December, before holding rates steady throughout this year until now.

In its FOMC statement, the Fed noted that “job gains have slowed recently and the unemployment rate has edged higher but remains at a stable level,” adding that “inflation has risen and remains somewhat elevated.” It further explained that “recent indicators suggest growth in economic activity moderated in the first half of the year” and that “with uncertainty about the outlook still high, downside risks to employment have increased,” outlining the rationale for the rate reduction.

Nine of 19 Policymakers Project Two More Cuts This Year

Once again, committee members split over the magnitude of the cut. As in July, unanimity was absent. On the eve of the FOMC meeting, newly appointed Fed Governor Stephen Myron, nominated by President Trump, voted for a 0.5 percentage point reduction, while the other members opted for 0.25. The “big cut” repeatedly pressed by Trump—defined as a cut of 0.5 points or more—failed to gain majority support.

This divergence was reflected in the Fed’s Summary of Economic Projections (SEP) dot plot. According to the report, of 19 officials, seven projected the policy rate to remain at or above current levels by year-end, two anticipated one additional 0.25-point cut, and nine forecast two such reductions. One policymaker, presumed to be Myron, projected the year-end rate at 2.75–3.00%, implying a cumulative cut of 1.25 points from current levels.

Reuters observed that “the U.S. central bank is deeply divided over the outlook for the rate path.” CNN noted that “as Trump pushes for structural reforms of the Fed and deregulation, political pressure and internal strains are intensifying,” adding that “divergent views on rate cuts further compound uncertainty.” Bloomberg similarly reported that “the appointment of Myron and changes at the Fed’s top ranks are also contributing to policy ambiguity.”

Concerns Over Unusual Equilibrium of Weak Hiring and Firing

Despite the discord, most analysts expect two more cuts by year-end. According to the newly released dot plot, the median projection for the year-end policy rate stands at 3.6%, down 0.3 points from 3.9% in June. Assuming the Fed continues with quarter-point moves rather than a “big cut,” the projection effectively embeds two more reductions this year. The FOMC still has two meetings left, scheduled for October 28–29 and December 9–10.

Close attention will be needed on labor market dynamics. At the Jackson Hole symposium on August 22, Chair Jerome Powell warned, “The recent labor market reflects an unusual equilibrium of both supply and demand slowing significantly,” diagnosing that “this equilibrium could evolve into an atypical situation with heightened risk of deterioration.” He cautioned, “If such risks materialize, layoffs and unemployment could rise very rapidly.”

According to the Labor Department, the U.S. hiring rate in June was just 3.3%, below the pre-pandemic level of 3.9% in February 2020 and well under the 4.6% recorded in November 2021 during the labor market rebound. The Wall Street Journal (WSJ) wrote, “Companies are not aggressively laying off workers, but they also show little interest in hiring new staff, exposing vulnerabilities in the labor market,” diagnosing the phenomenon as “labor hoarding in uncertain times.”

Comment