Samsung Partners with Nvidia on HBM3E, Sets Sights on HBM4 Breakthrough

Input

Modified

Signs Contract to Supply Up to 50,000 Units

Samsung Reaffirms “No Overheating Issues”

HBM4 Poised to Put Quality Concerns to Rest

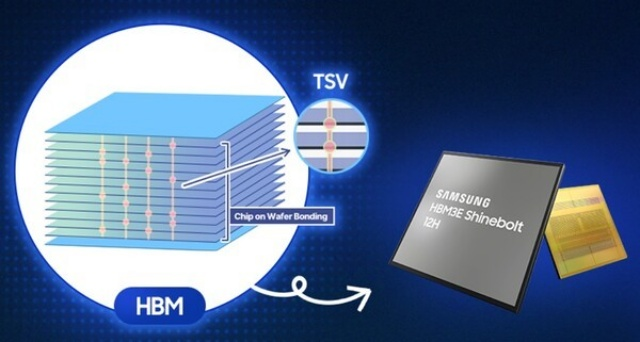

Samsung Electronics has entered into a supply agreement with Nvidia for its 12-high (12-Hi) high bandwidth memory (HBM) modules, moving into large-scale delivery. The deal marks Samsung’s successful navigation of Nvidia’s rigorous qualification tests, proving its technological prowess. However, the fact that the chips are designated for use exclusively in water-cooled servers suggests the company has yet to fully overcome heat management challenges. Having long dismissed overheating concerns while stressing its distinctive design and manufacturing processes, Samsung now appears intent on accelerating HBM4 development to definitively silence lingering doubts.

Successfully navigated the qualification tests after many twists and turns

Samsung recently signed a contract to supply Nvidia with up to 50,000 units of its HBM3E 12-Hi modules. These will be used in Nvidia’s next-generation AI GPU, the Blackwell Ultra, and in water-cooled AI servers. To pass Nvidia’s qualification tests, Samsung redesigned the DRAM used in the modules and worked to enhance back-end manufacturing productivity, among other efforts.

The agreement reflects a convergence of Nvidia’s strategy to diversify its memory supply chain amid surging AI semiconductor demand and Samsung’s ambition to expand its share of the high-value memory market. In AI training and inference, maximizing GPU performance requires both high bandwidth and low latency—criteria Samsung’s HBM3E met, according to analysts. The industry expects this supply deal to reaffirm Samsung’s technology and production capabilities in the global market.

Still, some observers noted that much of the shipment will go into water-cooled servers. While liquid cooling is an effective and sensible choice for managing heat and ensuring stable operation, this has been read by some as an indication that thermal control limitations remain unresolved. Given Nvidia’s protracted supply shortages, it is also possible the company accepted certain performance trade-offs.

“Increasing Metal Content and Adjusting Joint Thickness for Thermal Control”

Samsung, however, has consistently dismissed industry doubts about overheating. In early April, at the 2025 annual conference of the Korea Microelectronics and Packaging Society, Samsung senior researcher Kim Jae-choon told reporters, “Our clients point out exact defects and request solutions. This has nothing to do with the overheating issues some have speculated about.”

His remarks came amid delays in Samsung’s integration into Nvidia’s supply chain. Anticipation for passing the qualification tests began in earnest in the second quarter of last year. During a conference call in the third quarter, Samsung Memory Business Vice President Kim Jae-joon said, “We’ve achieved meaningful progress by completing key stages in the HBM3E qualification tests, and we expect to expand sales in the fourth quarter.” However, with no major announcements through the first half of this year, the prevailing industry view was that overheating, power efficiency, and yield issues were holding Samsung back.

Kim explained, “We determined that joint thickness is the key factor related to HBM heat. In our thermal compression non-conductive film (NCF) process, joint thickness is much thinner than in molded reflow-underfill (MR-MUF) processes.” He added, “Elements contributing to HBM thermal resistance include the bonding layer and the bare layer; from a packaging perspective, the bonding layer matters most. From a design standpoint, a higher metal ratio is better, and Samsung’s metal content is among the highest in the industry.”

Full Throttle Toward HBM4 to Regain Trust

At the same time, Samsung is pressing ahead with HBM4 development, signaling differentiated technology from its competitors. Unlike SK Hynix, which is producing HBM4 on fifth-generation (1b) DRAM, Samsung plans to leapfrog directly to sixth-generation (1c) DRAM to win over customers. In DRAM manufacturing, 10-nanometer-class nodes advance in the sequence 1x (first generation) – 1y (second) – 1z (third) – 1a (fourth) – 1b (fifth) – 1c (sixth). Each new process generation narrows line widths, greatly increasing manufacturing complexity while boosting capacity and performance.

Samsung’s direction for HBM4 is closely tied to its goal of ending the long-running quality controversy. The company plans to incorporate the performance data and customer feedback gathered during HBM3E production into the design of its next-generation product, aiming for across-the-board improvements in heat management, stability, and compatibility. The ultimate goal is to restore market confidence and secure a stable share.

Industry sources say Samsung has improved 1c DRAM wafer yields for HBM4 to about 40% in cold tests and 50–60% in hot tests during the second quarter. Analysts attribute the gains to bold design changes and process optimization. If the company achieves its goal of reaching about 60% yield in cold tests by year-end, HBM4 customer deliveries could soon follow.

The key question is whether Samsung can begin HBM4 mass production and shipments on schedule. Goldman Sachs recently forecast that starting in 2026, the average selling price of HBM will fall by more than 10%, with HBM4 commanding only about a 45% premium over its predecessor. This means even a one- or two-month delay in HBM4 supply could dull the financial impact of Samsung’s high-stakes bet.