CXMT Accelerates Push into HBM3 Production Amid China’s Race for Semiconductor Self-Sufficiency

Input

Modified

Facility Investments Resume to Speed HBM Entry

Experience Gained from DDR5 Pursuit

Quality and Yield to Test Global Competitiveness

Changxin Memory Technologies (CXMT), China’s largest memory chipmaker, is ramping up its entry into the high-bandwidth memory (HBM) market with large-scale facility investments and workforce expansion. The company aims to leverage the expertise it has built while growing its share of the DRAM market to enhance the prospects for mass production of next-generation HBM. Industry experts note, however, that to translate this momentum into global competitiveness, CXMT will first need to secure consistent quality and yield while managing the pricing risks of potential oversupply.

Accelerating Technological Catch-Up with Experience as a Base

According to industry sources on the 14th, CXMT has recently resumed new equipment orders to break into the HBM market. Its production hub in Hefei, Anhui Province, will install a large number of tools for HBM3 development and mass production, reviving previously stalled investment schedules. Earlier in the year, delays in equipment procurement were triggered by the suspension of certain models and U.S. export controls, but the shortage of HBM chips has constrained China’s artificial intelligence strategy, accelerating the timeline.

Alongside these capacity boosts, CXMT is recruiting specialized global talent to enhance the sophistication of its processes. As a latecomer, the company intends to accelerate its technology catch-up. It is also pushing to secure market readiness by supplying HBM3 samples early to customers such as Huawei, expediting the certification and evaluation process. Mass production could begin as early as next year. This strategy aims to fill the gap left by foreign-sourced HBM under sanctions with domestic production, build close ties with China’s AI accelerator ecosystem, and secure early revenue from the domestic market.

However, turning this blueprint into reality in the near term will be challenging. Industry analysts estimate that CXMT’s DRAM process and design capabilities lag those of industry leaders Samsung Electronics and SK hynix by two to three years—a gap that directly impacts the complex demands of HBM3 and beyond, including packaging precision, thermal control, and power management. As a result, many in the industry believe CXMT’s moves will have only limited near-term impact on the global HBM market.

Rising Output Fuels Oversupply Concerns

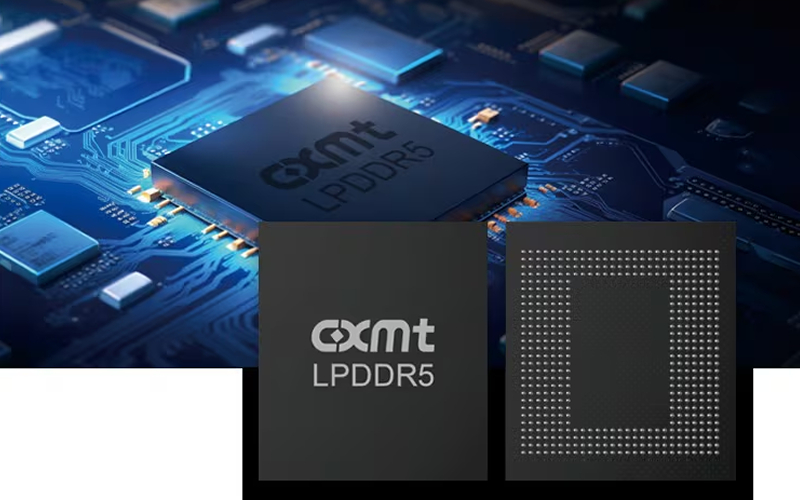

Still, there is no shortage of counterarguments pointing to CXMT’s accelerating progress. Analysts note the company’s rapid growth in the DRAM sector and its push to transition quickly to advanced products such as DDR5 and LPDDR5. In a June report, market research firm Counterpoint projected CXMT’s share of DRAM shipments would rise from 6% in the first quarter to 8% by year-end, indicating a measurable narrowing of the technology gap with leading competitors.

This trend suggests CXMT’s production and shipping systems are stabilizing quickly. Such progress is possible only when certain traditional hurdles—such as process miniaturization, test and burn-in optimization, and reducing quality lot variability—are met with tangible results, implying the company’s fundamentals have solidified faster than expected. These capabilities and growth patterns are directly transferable assets for HBM development.

The challenge is that such momentum also raises industry concerns about oversupply. If CXMT’s DDR5 output expansion becomes visible, downward pricing pressure could intensify in the short term, potentially hastening the onset of another inventory correction phase. Paradoxically, this supply risk could drive a faster pivot toward HBM. By leveraging the same front-end infrastructure while bolstering back-end capabilities such as packaging and testing, CXMT could increase its share of high-margin products, offsetting unit price declines and protecting profitability. In other words, capacity expansion and yield stabilization in DDR5 could simultaneously create the motivation and foundation for CXMT to move upmarket into HBM.

Three-Stage Global Strategy

At this juncture, the market is focusing on the potential expansion of CXMT’s HBM packaging capabilities, though the gap between potential and commercialization remains substantial. HBM production involves a host of intertwined challenges—through-silicon via (TSV) stacking, thermal and power management, bumping and bonding, underfill and molding, and ensuring high-speed I/O reliability. As stack height increases, defect probability rises exponentially; failure to control thermal resistance and power integrity can derail mass production plans. While DDR5 achievements are a necessary foundation, they are not sufficient—proving back-end excellence remains a critical step.

Even so, China’s position as the world’s largest semiconductor consumption market offers favorable conditions. Once a certain yield level is achieved with legacy models, companies can generate steady revenue. Reports indicate that beyond CXMT, other Chinese firms, such as Tongfu Microelectronics, have already entered mass production or pilot production of HBM2 as part of the nation’s broader strategy for AI chip self-sufficiency.

These initial efforts are largely aimed at meeting domestic demand, but over the long term, they are seen as a prelude to global expansion. Securing global competitiveness, however, is another matter entirely. In high-value markets such as AI and servers, brand trust cannot be built on pricing alone. For Chinese companies to shed the “low-cost memory supplier” image, they will need to deliver indisputable results in quality and reliability.

In the final analysis, the HBM strategies of CXMT and its Chinese peers can be summed up in a three-stage roadmap: stabilize domestic revenue, upgrade packaging capabilities, and secure global certification and market entry. Even if early domestic sales ensure financial stability, meaningful positioning in the global market will hinge on achieving high yields and long-term reliability for HBM3/3E-grade products. The next two to three years, therefore, are likely to be a period of quality verification as China’s memory manufacturers work to close the technological gap between domestic and global markets.