Unexpected Decline in U.S. August Wholesale Prices Expands Case for Fed Rate Cuts

Input

Changed

Leading inflation gauge PPI down 0.1% in August Sharp reversal after last month’s surge Expectations rise for Fed rate cut next week

The U.S. Producer Price Index (PPI) for August fell 0.1% from the previous month. Analysts attribute the decline to lower oil prices driven by oversupply following increased output from major producers. The weaker PPI reading has strengthened expectations of an imminent Federal Reserve rate cut this month. Because PPI reflects fluctuations in raw materials and intermediate goods, a decline in the index is seen as easing corporate cost burdens and reinforcing disinflationary momentum, thereby bolstering prospects for monetary easing.

August producer prices well below forecasts

According to Bloomberg and other outlets on the 10th (local time), the Labor Department reported that PPI fell 0.1% in August. This marked the first monthly decline in three months, after gains of 0.7% in July and 0.1% in June. The result was well below the 0.3% increase projected by economists surveyed by Dow Jones. On a year-over-year basis, PPI rose 2.6%, also below expectations of 3.3%.

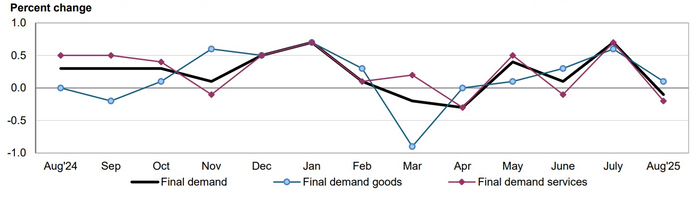

The decline was led by a 0.2% drop in final demand services, with trade services—measuring margins received by wholesalers and retailers—falling 1.7%, the sharpest drop since April (-0.3%). Wholesale and retail trade margins exerted the most downward pressure, with wholesale machinery and motor vehicles margins plunging 3.9%. Additional declines were recorded in wholesale prices for professional and commercial equipment, chemicals, furniture retail, food and alcohol retail, and data processing services.

Conversely, portfolio management fees rose 2.0%, while freight transportation and apparel wholesale margins also edged higher. In goods, PPI rose 0.1%, extending its fourth straight monthly increase. Excluding food and energy, the core PPI advanced 0.3%, in line with forecasts, and climbed 2.8% year-on-year. Because producer prices typically feed into consumer prices with a lag, the PPI is viewed as a leading indicator for CPI.

OPEC+ output surge weighs on oil prices

Energy price declines also dragged the overall PPI lower. August energy costs fell 0.4%, reflecting a pullback in global crude prices. As of 3:30 p.m. on the 10th, West Texas Intermediate (WTI) crude traded at $63.79 a barrel on the New York Mercantile Exchange, down about 8% from $69.26 a month earlier.

Oversupply remains the key factor pressing oil prices lower. Since the start of the year, eight members of OPEC+—the grouping of OPEC and non-member producers including Russia—have increased output by a combined 2.5 million barrels per day, equivalent to roughly 2.4% of global demand. Having long adhered to production cuts to support prices, the group shifted to expansion amid concerns about the impact of electric vehicle adoption and waning Chinese demand, compounded by persistent U.S. pressure to reduce oil costs. The volumes restored since April effectively offset the 2.2 million barrels per day cut implemented in 2023.

Despite higher production, oil prices have fallen just 12% year-to-date compared to a year earlier, cushioned by Western sanctions on Russia and Iran and strong summer travel demand. The Wall Street Journal noted that OPEC+’s continued supply expansion “signals confidence that prices will not collapse.” Still, industry forecasts warn of significant downward pressure on crude in the fourth quarter, with OPEC+ set to raise output by another 140,000 barrels per day beginning next month. Analysts interpret the move as a strategy to gain market share even if prices soften.

Rate cut expectations gain traction

Following weaker-than-expected August jobs data, the surprise PPI decline further heightens the likelihood of Fed easing. Most of Wall Street now anticipates a 25-basis-point cut at the September Federal Open Market Committee (FOMC) meeting, with further reductions expected thereafter. Goldman Sachs, which previously forecast two cuts this year in September and December, revised its outlook to anticipate three cuts in September, October, and December, projecting additional cuts in 2026 that would bring the terminal rate down to 3–3.325%.

Bank of America, long skeptical of 2025 rate cuts, reversed its stance after the August data, now expecting two reductions in September and December. Morgan Stanley also adjusted its forecast, projecting two 25bp cuts over the same months. While maintaining the two-cut baseline, the bank noted risks are skewed toward additional easing, leaving the door open to consecutive rate cuts.

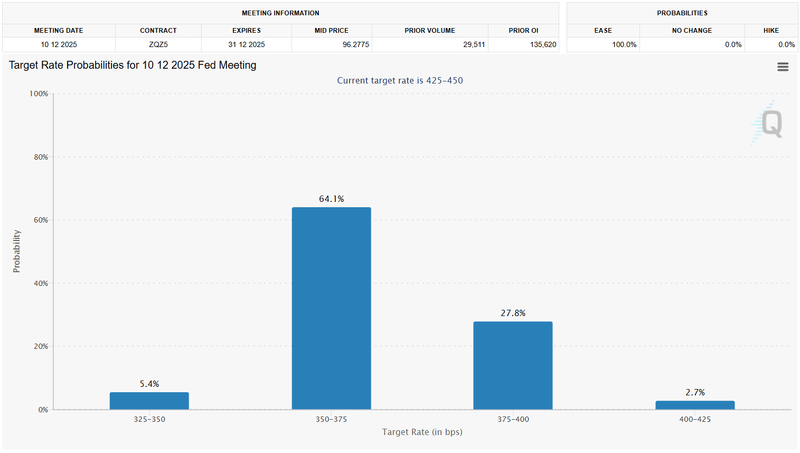

In futures markets, expectations are nearly unanimous. According to CME FedWatch on the 10th, traders priced in a 100% probability of a September cut, with a 92% chance of a 25bp move and an 8% probability of a 50bp cut. Markets also assign a 64.1% probability that the policy rate will fall by 75bp to the 3–3.5% range by December 2026, up from 43.1% just a week earlier.

Comment