France’s Bond Yields Flip Above Corporates: The Cost of Welfare Populism

Input

Modified

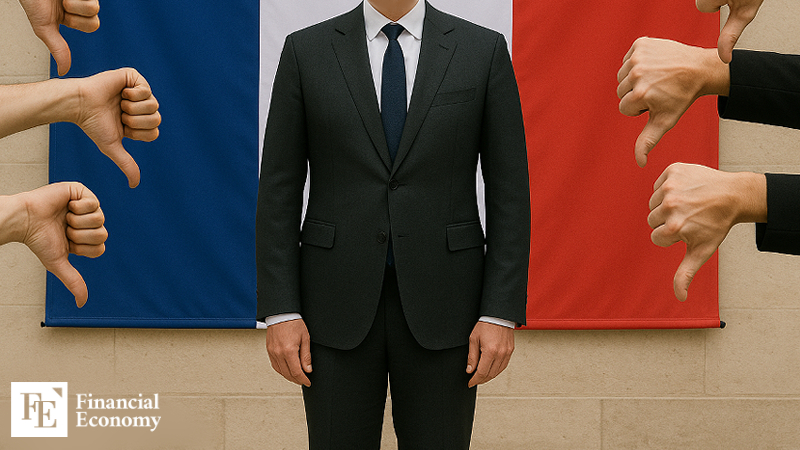

French Bond Yields Surpass Corporate Debt in France and Eurozone Soaring Debt From Heavy Welfare Spending Topples Austerity-Minded PMs Global Credit Agencies Like Fitch and S&P Grow Increasingly Critical

French government bond yields have begun to climb above those of corporate bonds issued by French private companies. The shift reflects growing concern that Paris’s populist spending policies are pushing the state into a fiscal crisis, leading investors to view corporate debt as a safer bet than French sovereign bonds. Despite the worsening market backdrop, the government has been unable to implement meaningful austerity measures, facing resistance in parliament and beyond.

Dark Clouds Over the French Economy

On the 13th, the Financial Times cited Goldman Sachs data showing that the yields on bonds issued by ten major French companies—including L’Oréal, Airbus, and Axa—have fallen below those of French government bonds with similar maturities. This marks the largest such gap since 2006. Across the eurozone as a whole, more than 80 companies are now trading at yields lower than French sovereign debt, an unusual inversion for one of the bloc’s traditionally wealthiest economies.

The spike in French bond yields stems from mounting fiscal stress. According to the IMF, France’s national debt stood at €3.3 trillion ($3.55 trillion) in 2023, or 113% of GDP—the third-highest in the eurozone after Greece and Italy. In effect, even if all of France’s 68 million citizens devoted their entire annual income to debt repayment, the burden could not be cleared. The fiscal deficit has also surged to 5.8% of GDP, nearly double the EU average of 3%.

At the root of this deterioration lies the country’s heavy welfare spending. Public expenditure accounted for 57% of GDP in 2023, far above the OECD average of 42.6%. Social protection programs such as pensions, health insurance, and unemployment benefits made up 23.4% of GDP—the third-highest share among OECD countries, behind only Finland (25.7%) and Sweden (25.0%). This vast outlay has entrenched structural deficits, and rising interest payments have further locked France into an upward debt spiral.

Austerity Proves Futile

As France’s fiscal outlook continued to deteriorate, the EU last July recommended the launch of an Excessive Deficit Procedure (EDP), a mechanism to monitor and correct member states’ budget shortfalls and public debt. In January, Brussels went further, urging Paris to reduce its fiscal deficit to 3% of GDP by 2029.

In response, then–Prime Minister Michel Barnier’s cabinet drafted an austerity budget late last year. But France’s opposition-controlled parliament wielded anti-austerity sentiment as a political weapon and blocked the reforms. Barnier attempted to push the measures through regardless but failed, ultimately resigning before completing his term.

His successor, François Bayrou, also pressed for fiscal restraint, unveiling a 2025 budget plan that would cut €44 billion in spending through measures such as reducing two public holidays, freezing pensions, and scaling back healthcare funding. The opposition again revolted: the left denounced the plan as “forcing sacrifice on ordinary citizens without taxing the wealthy or large corporations,” while the far right warned of higher electricity bills and healthcare costs that would squeeze low-income families and the elderly. On January 8, parliament held a confidence vote over the austerity plan, and after losing, Bayrou was forced out of office as well.

Experts say the turmoil illustrates the perils of what they call “fiscal addiction.” One market analyst noted, “Once public spending increases, it is extremely difficult to roll it back. If an economy relies on government funds instead of private-sector innovation to drive growth, national finances inevitably become precarious.” The analyst added that France’s plight should serve as a cautionary tale not only for China but also for countries like South Korea that pursue economic populism.

Credit Ratings Under Threat

Global credit rating agencies are taking an increasingly dim view of France’s fiscal position. On the 12th, Fitch Ratings downgraded France’s sovereign credit rating from AA– to A+, less than a year after placing the country on negative outlook following the release of its 2025 budget plan. An A+ rating puts France one notch below the U.K. and South Korea, and on par with Belgium.

In its report, Fitch said the government’s defeat in a parliamentary confidence vote reflected deepening political division and polarization, undermining the political system’s capacity to restore fiscal discipline. The agency also forecast that France’s deficit would remain above 5% of GDP through 2026–2027, while national debt would rise to 121% of GDP by 2027.

S&P Global Ratings has also warned that unless Paris brings its deficit under control, it may cut France’s rating again in its November review. S&P had already lowered the country’s rating to AA– early last year and has yet to shift away from its negative stance. Market observers caution that if S&P follows Fitch with another downgrade, France could face higher borrowing costs, driving its finances deeper into a vicious cycle of debt and deficit.

Comment