Japan Didn’t Turn Right; It Turned Away—from Austerity Without a Mandate

Input

Changed

This article was independently developed by The Economy editorial team and draws on original analysis published by East Asia Forum. The content has been substantially rewritten, expanded, and reframed for broader context and relevance. All views expressed are solely those of the author and do not represent the official position of East Asia Forum or its contributors.

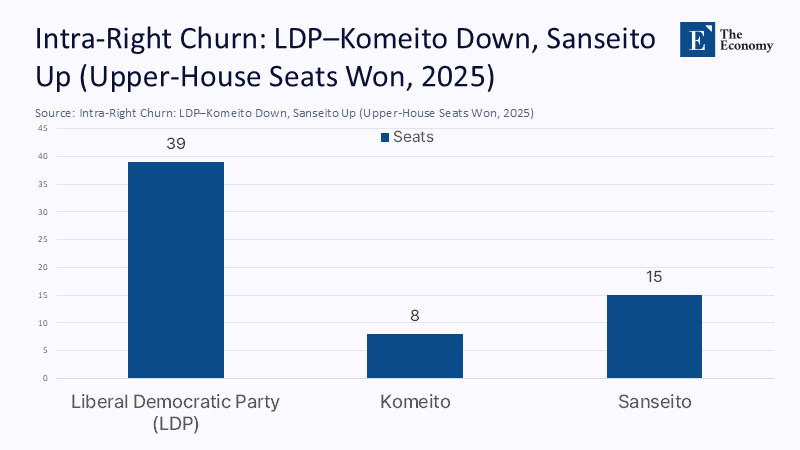

Start with the arithmetic that matters. In Japan’s July 2025 upper‑house contest, the ruling coalition slumped to 47 of the 125 seats up for grabs, a humiliating setback for Prime Minister Shigeru Ishiba. Yet the headline “far‑right surge” dissolves when we tally the broader bloc: the Liberal Democratic Party (LDP) and Komeito combined for roughly 47, while Sanseito, a hard‑right party founded in 2020, leapt to 14–15. Add the established conservative micro‑parties and the right‑of‑center share of the contested slate still clusters around the low 60s, essentially flat versus the last cycle. Voters did not shift ideology; they churned within the right, punishing leadership they no longer trusted on taxes and prices. The political gravity of Japan looks steady. What moved was credibility—especially the premier’s insistence that public finances are “worse than Greece’s,” a warning most households heard as pain without a plan.

Reframing the Story: From Ideology to Competence

The central misreading of this election is that Japan “swung right.” The seat math points to a reallocation inside the right, not a migration to a new ideology. Sanseito siphoned disgruntled conservatives with nationalist rhetoric and pocketbook promises, while the coalition’s offering—cash handouts packaged with grim lectures about debt—satisfied neither markets nor voters. That is not a cultural realignment; it is a referendum on managerial competence in an inflationary environment. When politics becomes a choice between unfunded relief and unpopular discipline, electorates punish messengers and keep shopping inside the same aisle. The ruling side lost its majority; the broader ideological ledger barely budged. The frame that fits the facts is performance, not polarization.

Timing amplifies the stakes. Tokyo core CPI sits near 2.9%, national inflation remains above target, and 10-year JGB yields recently touched a 16-year high near 1.6%, with super-long yields pushing higher as investors price political turnover and policy drift. The yen hovers around ¥148–149 per dollar—off last year’s extremes, but still pressuring import prices. In that environment, a “Greece” metaphor absent a sequenced plan reads as scolding without relief; unfunded tax cuts read as expedient without guardrails. Both are punished: by voters on election night and by markets via volatility premia. The country needs neither hair-shirt austerity nor free-lunch populism; it needs credibility: a staged fiscal path that eases near-term pain and codifies medium-term consolidation.

The Seat Math: Transparent Estimates Show No Rightward Turn

Because some counts were reported while late precincts were still closing, we present a transparent range rather than false precision. On widely reported tallies, the LDP won ~39 of the 125 seats at stake, Komeito around 8, and Sanseito 14–15. Adding a small conservative newcomer pushes the right‑of‑center sum to roughly 63 ± 1. We classify the bloc as LDP + Komeito + Sanseito + micro‑conservative entrants—mirroring actual coalition practice and the way Japanese media grouped parties on election night. Whether Sanseito ends at 14 or 15 does not change the analytical point: the right’s aggregate footprint in this tranche is little changed. The shock is intra‑right churn, not a swing of the societal pendulum.

That conclusion aligns with independent election syntheses. Policy institutes and wire services converged on three facts: the coalition lost control of the upper house; Ishiba’s position weakened; and Sanseito captured disillusioned conservatives with “Japanese First” branding and tax‑cut promises. None of those alter the ideological ledger; all point to competence as the new binding constraint on winning a governing majority. A successor who mistakes this outcome for a mandate to double down on austerity—or to distribute unfunded largesse—will replay the coalition’s defeat. Only a sequenced program can reconcile the electorate’s demand for relief with investors’ demand for coherence.

Economics, Not Culture, Drove the Revolt

The household math is unforgiving. Real wages fell for a third straight year in 2024 and were still soft into mid‑2025, even after the largest “shuntō” settlements in decades. Food‑price stickiness and pass‑through from a weaker yen sustained consumer fatigue. These conditions made ideological appeals secondary to purchasing power. Voters gravitated toward parties that promised immediate relief—most notably temporary consumption‑tax cuts focused on essentials—while balking at cash‑handout schemes that looked both expensive and mis‑targeted. The premier’s “worse than Greece” invocation offered no bridge between the two realities—the result: a sanction on leadership rather than a turn in ideology.

Markets told a parallel story. Into the vote and after, long‑end JGB yields rose as investors gamed two scenarios: drift toward unfunded giveaways or whiplash toward front‑loaded tightening. The BOJ has cautiously normalized policy and signaled conditional openness to further hikes later this year if wage and price dynamics persist. Still, political noise raises the risk premium on duration. For foreign capital, the calculus is blunt: rising yields help value screens, but policy uncertainty and currency volatility deter multi‑year commitments. Japan’s net external asset position and domestic bond ownership structure reduce acute crisis risk, yet they cannot substitute for a readable fiscal map. Elections without a plan are volatility machines.

What Voters Heard: Tax Cuts vs. Greece

Surveys in April–June 2025 captured a durable preference: majorities favored a temporary consumption‑tax reduction—especially on food—provided offsets are specified. Business elites were more skeptical of cutting the headline rate, but even there, the split was about design and funding, not denial of households’ pain. Against that backdrop, the ruling side’s cash‑handout pitch looked improvisational, while the premier’s Greece comparison sounded punitive. Scholarly commentary stressed a different route: serious tax reform supported by an independent fiscal institution that can score proposals and publish long‑run debt dynamics. The politics punished rhetoric that lacked that architecture.

The Greek analogy also misfired on substance. Japan’s gross debt ratio is enormous—but the structure diverges from the euro‑periphery template: debts are mostly yen‑denominated, mainly held at home, and backed by a towering net international investment position that reached ¥533 trillion at end‑2024. Those features do not excuse drift, but they do change the crisis channel: from sudden stops to interest‑cost creep as rates normalize. The better message is sequencing, not fear. Recognize price pain; deliver narrow, sunsetted relief; show the offsets; and bind the path to a transparent rules‑based council. It is the absence of that structure—not the absence of warnings—that voters punished.

Methodology: How We Read the Seats, Prices, Wages, Yields, and Yen

Where counts varied in the first 48 hours, we used ranges anchored in reputable reporting: LDP ~39, Komeito ~8, Sanseito 14–15, with one minor conservative entrant at ~2. We then defined the right‑of‑center bloc as the coalition partners (LDP + Komeito) plus Sanseito and the conservative micro‑party, mirroring coalition patterns. That yields a right‑of‑center sum near 63, ±1. Such classification choices are transparent: including or excluding micro‑parties shifts the total by at most a couple of seats and leaves the inference intact—no ideological swing, just intra‑right churn. We present this as an estimate because late‑count noise in multi‑member districts can adjust one or two seats without changing the policy story.

For the macro context, we triangulated across official statistics and real‑time market data. For prices, we emphasized Tokyo core CPI (a timely leading indicator), cross‑checked against national metrics. For wages, we relied on Kyodo’s summary of labor ministry data showing real‑wage declines in 2024. For yields, we used Nippon.com tracking of the 10‑year JGB climbing to ~1.6%, supplemented by market coverage around the BOJ’s July meeting. For the yen, we cited Reuters spot pages and day‑of reporting showing ¥148–149 per dollar. For external balance and debt structure, we drew on MOF international investment position releases and IMF Article IV materials. None of these series is perfect on its own; together they capture the lived experience pressuring households and the valuation screens guiding capital.

Implications for Educators, Administrators, and Policymakers

The near‑term budget environment will feel unsettled rather than immediately austere. A leadership wobble reduces the probability of sweeping tax hikes in 2025; parties that promised relief will seek a visible, narrow win—most likely a temporary cut on food or targeted energy subsidies. That mix does not slash education outlays overnight, but it complicates planning. Universities and school districts should hedge procurement and energy costs, assume elevated import prices while the yen remains weak, and prepare for wage‑driven payroll pressures as settlements filter through. Finance offices should model scenarios with higher long‑end discount rates for pensions and capital planning as the JGB curve resets. Administrators who align capital approvals with BOJ decision windows and maintain contingency lines will be better placed to navigate volatility.

International education will see asymmetric flows. A softer yen boosts Japan’s attractiveness to inbound students and research partners, while squeezing outbound mobility for Japanese families whose real incomes lag. Institutions should offer micro‑scholarships and work‑study to cushion domestic students, while scaling capacity for inbound demand from Asia and Europe. For research consortia and campus infrastructure, super‑long JGB moves raise the lifecycle cost of debt‑like commitments; delaying or phasing capital projects until fiscal signals clarify can save basis points that compound over decades. Policymakers should resist episodic tuition credits in favor of predictable, means‑tested aid that can be folded into a medium‑term fiscal plan—the macro credibility needed to calm bond desks is the same necessary credibility to reassure parents and school boards.

A Credible Path Forward—And How to Sell It

The policy architecture consistent with both voter preferences and market discipline has four legs. First, deliver targeted, time‑limited relief where price pain bites hardest—zero‑rate essential foods for one year with an explicit sunset. Second, pair that relief with a legislated offset—for example, closing low‑efficiency exemptions and stepping up anti‑avoidance enforcement worth a comparable amount; publish the math. Third, create an independent fiscal council with a statutory mandate to score proposals and publish long‑run debt dynamics, much as scholars have urged. Fourth, move toward base‑broadening rather than headline‑rate hikes—clean the tax code, simplify investment incentives, and sequence any consumption‑tax changes after real‑wage growth has turned. This is not anti‑austerity; it is sequenced consolidation that burns less political capital and reduces risk premia.

Communication is as important as design. Replace the Greece frame with a structure frame: Japan’s debt is enormous, but it is yen‑denominated and primarily domestically held; the crisis channel is not a sudden stop but a steady rise in interest costs as normalization proceeds. Voters can grasp this while accepting that delay is costly. The message discipline is straightforward: acknowledge pain; provide narrow relief with a sunset; show the offset and the calendar; and commit to an external referee for the numbers. For markets, that sequence de‑risks the long end and stabilizes the yen by anchoring expectations. For educators and municipal leaders, it signals predictability in transfers and a glide path for capital grants. It is what the election result asked for: competence over grandstanding.

Anticipating the Pushback

“Debt is unsustainable—tighten now.” Japan’s debt metrics are indeed extreme, but the risk channel differs from the euro crisis: domestic holdings, yen denomination, and a giant net external asset cushion reduce run risk. That does not mean do nothing; it means sequence action to avoid kneecapping real wages just as they begin to rise. A council‑scored plan that broadens efficient bases and locks in a path to primary balance addresses sustainability without triggering a growth shock. Evidence from the bond market suggests investors react most to uncertainty, not to targeted relief that is transparently financed.

“This proves a far‑right turn.” Sanseito’s rise is real and merits scrutiny, but the bloc arithmetic shows ideological continuity: the right‑of‑center share of contested seats remains in the low 60s. Voters replaced one right‑wing messenger with another because they disliked the offer, not because society lurched into a new camp. That matters for policy: competence, sequencing, and clarity can win back conservatives who defected on performance grounds. The corrective is policy craft, not culture-war one-upmanship or punitive fiscal hair-shirts.

From Seat Counts to Statecraft

Return to the number that launched this column: about sixty‑three. Not the 47 that humbled the ruling bloc, but the approximate right‑of‑center tally across contested seats—the figure that tells us Japan did not pivot right so much as it rearranged the right. That choice was an indictment of a leadership style that warned of Greece while offering neither targeted relief nor a credible medium‑term plan. The remedy is not ideological whiplash; it is statecraft: temporary, sunsetted food‑tax relief; a statutory fiscal referee; and base‑broadening consolidation that protects growth. Such a package speaks to households paying more for groceries, to bond desks eyeing the long end, and to schools and universities budgeting through an uncertain year. The electorate has issued a narrow but usable mandate: stop moralizing about debt, start sequencing reform, and show your work. Get that right, and the next seat count will take care of itself.

The original article was authored by Purnendra Jain, an Emeritus Professor in the Department of Asian Studies at the University of Adelaide, Australia. The English version, titled "LDP’s Historic Electoral Defeat upends Japan’s Politics," was published by East Asia Forum.

References

Asahi Shimbun. “Poll shows 59% support reducing consumption tax temporarily.” April 21, 2025.

Asahi Shimbun. “Survey: 72% back sales tax cut if new revenue sources clarified.” May 20, 2025.

Asahi Shimbun. “Sanseito, DPP sharply increase their presence in Upper House.” July 21, 2025.

Bank of Japan. “International Investment Position of Japan (Calendar Year Data).” May 27, 2025.

East Asia Forum. “Japan needs to get serious about tax reform.” July 7, 2025.

East Asia Forum. “LDP’s historic electoral defeat upends Japan’s politics.” July 27, 2025.

CSIS Japan Chair. “Japan’s Upper House Election: Prolonged Instability.” July 2025.

Fortune. “Japan faces a fiscal crisis ‘worse than Greece,’ says Ishiba.” May 19, 2025.

IMF. Japan: 2025 Article IV Consultation—Press Release; Staff Report. April 2025.

Japan Ministry of Finance. “International Investment Position of Japan (End of 2024).” May 27, 2025.

Japan Times. “Ishiba’s Greece debt comparison risks deeper crisis.” May 22, 2025.

Japan Times. “Upper House election could further hamper BOJ’s drive to raise rates.” July 14, 2025.

JETRO. Invest Japan Report 2024. December 2024.

Kyodo News. “Japan’s real wages drop for third straight year in 2024.” February 5, 2025.

Mainichi (Kyodo). “Japan PM touts cash handouts as opposition pushes tax cuts in poll.” July 3, 2025.

Mainichi. “Japan Cabinet support rate stagnates at 24%, 66% against cash handouts.” June 30, 2025.

Mainichi. “Editorial: LDP’s cash handouts closer to pork‑barreling than policy.” June 19, 2025.

Nippon.com (via Jiji). “Key 10‑Year JGB Yield Hits Over‑16‑Year High of 1.6%.” July 23, 2025.

Reuters. “Core inflation in Japan’s capital stays above BOJ target in July.” July 24, 2025.

Reuters. “Dollar falls against yen as markets weigh new trade deal, Japanese politics.” July 23, 2025.

Reuters. “Japan’s shaky government loses upper house control.” July 21, 2025.

Reuters. “PM Ishiba vows to stay on after bruising election defeat.” July 21, 2025.

Reuters (Market Data). “US Dollar / Japanese Yen (USDJPY=X).” Accessed July 29, 2025.

Reuters. “What’s at stake for Japan’s fragile bond market this week.” July 29, 2025.

Reuters. “Enough apologies: How Japan is shaking its price‑hike phobia.” July 29, 2025.

Comment