SoftBank chief Son explores debt-heavy financing for $500 billion AI push

Input

Changed

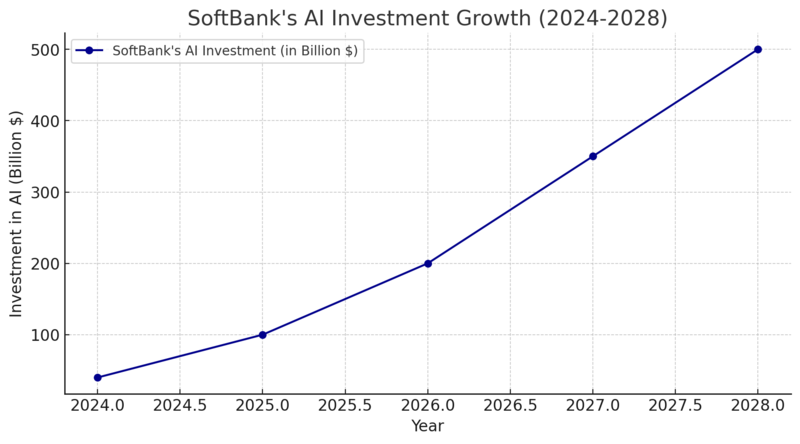

With multi-billion-dollar investments in artificial intelligence (AI), SoftBank Group CEO and billionaire founder Masayoshi Son is making a big splash in the global IT landscape. SoftBank was suffering enormous losses in the Vision Fund a few years ago as a result of botched investments in firms such as WeWork. With calculated AI investments, SoftBank Group is negotiating intricate financial plans to finance Stargate, a significant AI infrastructure initiative in collaboration with OpenAI, Oracle, and MGX of Abu Dhabi. The project, which might cost as much as $500 billion, intends to build data centers and artificial intelligence computer capacity on a never-before-seen scale. Son is looking at project funding for Stargate, which is probably going to involve 70% debt and 10% equity.

SoftBank must strike a balance between high-risk investments, growing competition, and changing AI environments as it investigates novel debt financing options.

The Financing Strategy of SoftBank

SoftBank is thinking about project financing, a mechanism frequently employed for major infrastructure projects like power plants and oil pipelines, with an immediate funding commitment of $100 billion. About 10% of the overall cost would be covered by stock contributions from SoftBank, OpenAI, Oracle, and MGX under this strategy, with the remainder funds coming from debt markets.

Mezzanine debt and preferred equity are a hybrid strategy that exposes investors to more risk but offers larger profits. The aggressive AI funding plans from the US and Europe align with SoftBank's push for AI investments as Ursula von der Leyen, president of the European Commission, announced the European Union's €200 billion AI Investment Plan, which includes €20 billion for AI gigafactories to train sophisticated AI models.

While French President Emmanuel Macron wants to establish France as a major hub for artificial intelligence through his €109 billion AI initiative. The US Project Stargate in which the Biden administration established 20 massive data centers as part of a $500 billion AI infrastructure program that included OpenAI, Oracle, and SoftBank. These conflicting initiatives reveal a worldwide struggle for supremacy in AI, in which SoftBank's Stargate project is a key player.

SoftBank confronts significant financial and competitive obstacles in spite of its lofty vision, it takes a significant amount of capital to build tens of gigawatts of computer capacity. AI factories present logistical issues due to their enormous energy usage more than 50 megawatts per site and complex cooling systems.

SoftBank is vulnerable to market volatility due to its highly leveraged financing approach.

Because AI infrastructure projects don't generate income right away, it can be challenging to get good credit terms. Because SoftBank's "bet-the-house" approach is reminiscent of previous Vision Fund losses, investors are afraid of it. DeepSeek, a Chinese AI startup, is upending the AI market with its open-source, inexpensive models. OpenAI's market share may be threatened by the entry of Meta, Google, and Alibaba into the open-source AI space.

The long-term viability of Stargate may be at risk if the cost of AI computing decreases.

For its most recent fiscal quarter, SoftBank is anticipated to record a loss of ¥155 billion ($1 billion). During the December quarter, the public portfolio of the Vision Fund saw a $700 million loss. Liquidation risks affect SoftBank's private holdings, including Indonesian startup eFishery and ByteDance, the parent company of TikTok.

SoftBank may use low borrowing prices and government help to expand Stargate to Japan.

Collaborations on AI infrastructure with major chip companies (Arm, Nvidia) may aid in attracting more investment. In order to draw in institutional investors, SoftBank may change its financing approach and increase its exposure to preferred shares and mezzanine debt. SoftBank is putting itself in a strong position to dominate the global AI infrastructure race, even in the face of short-term financial threats. It is yet unclear, though, if this risky investment would produce long-term gains.

Masayoshi Son's Audacious AI Bet with Stargate and Worldwide AI Growth with SoftBank and OpenAI.

U.S. President Donald Trump unveiled the Stargate program on January 22, 2025, with the goal of building state-of-the-art AI data centers throughout the country. Son will lead one of the biggest expansions of AI infrastructure in history, with SoftBank serving as the project's chair. Additionally, it has been reported that SoftBank, which values OpenAI at $260 billion, is nearing completion of a $40 billion investment in the company.

Son and SoftBank have undergone a dramatic change, indicating a renewed focus on AI, chip research, and computing infrastructure. SoftBank has made investments in software, infrastructure, and AI models as part of its multidimensional AI drive, such as the $500 billion AI infrastructure plan for the Stargate project. This is a collaboration between MGX of Abu Dhabi, SoftBank, OpenAI, and Oracle, which intends to create energy-efficient supercomputers and data centers with an AI focus.

SoftBank's $40 billion OpenAI investment

SoftBank is on the verge of completing one of the biggest private technology transactions ever, a $40 billion investment in OpenAI. With this investment, SoftBank would acquire a sizeable portion of OpenAI as it grows into enterprise solutions and AI services. In order to provide AI services to business clients, Sam Altman and Son have decided to establish SB OpenAI Japan, a joint venture established in Japan. To license OpenAI's technology for use across its businesses, SoftBank will pay $3 billion a year. This supports SoftBank's initiatives to integrate AI into the robotics, logistics, and telecoms industries.

With SoftBank's "Super AI Chip" vision, it is investigating the creation of a next-generation AI processor by utilizing its majority ownership in Arm. This attempts to challenge Nvidia's hegemony in AI hardware. According to reports, SoftBank is negotiating with Samsung and TSMC to produce chips with an AI focus. Risk factors and financial challenges faced by SoftBank. Despite its significant AI bet, SoftBank continues to confront financial challenges including challenges for the Vision Fund. In Q4 2024, SoftBank's Vision Fund reported a quarterly loss of $2.4 billion. SoftBank's earnings were negatively impacted by a ¥309.9 billion ($2.1 billion) drop in public interests such as Coupang and Didi Global. Due to its heavy reliance on loan markets, SoftBank's financing approach is vulnerable to delays in AI returns.

Chinese DeepSeek AI's Competitive Threats

The business model of OpenAI is being directly challenged by the low-cost AI models being developed by the Chinese AI company DeepSeek. SoftBank's investment returns and OpenAI's profitability may be impacted if open-source AI models become more popular.

Son thinks that during the next ten years, AGI will become a reality. His investments are concentrated in chip design, infrastructure, and AI processing power. The ultimate objective of SoftBank is to provide the groundwork for economies powered by AI.

Stargate as a Revolutionary

According to Son, AI infrastructure is the "new oil," and Stargate may serve as the foundation for the global spread of AI. The initiative is anticipated to speed up the development of AGI and lower the costs associated with AI computation.

The domination of AI by SoftBank and OpenAI will be crucial during the next five years. With plans to expand to Japan and the EU, there will be more than ten data centers in the United States. SoftBank and Oracle will spearhead the infrastructure expansion. SoftBank's investment might pave the way for a future initial public offering (IPO) of OpenAI. OpenAI may be able to raise billions more if it goes public.

Financial concerns still exist, though, and SoftBank needs to demonstrate that AI infrastructure can generate sustained profitability. Son might establish himself as one of the most significant tech investors of the AI era if he is successful, but SoftBank might experience yet another severe financial meltdown if he is unsuccessful.