Samsung Life, Fire sell $280 million in Samsung Electronics shares to comply with law

Input

Changed

The sale of $280 million worth of Samsung Electronics shares by Samsung Life Insurance and Samsung Fire & Marine Insurance was primarily motivated by regulatory compliance rather than performance or market sentiment. The Financial Holding Company Act of South Korea, which prohibits financial institutions from owning more than 10% of a non-financial company, must be followed, so this action is crucial.

By February 17, ₩3 trillion ($2.25 billion) worth of shares will be burned as part of Samsung Electronics' ₩10 trillion ($7.5 billion) stock buyback. This action will automatically increase the shareholding of current shareholders, such as Samsung Life and Samsung Fire & Marine Insurance, by lowering the total number of outstanding shares.

Their aggregate position would surpass 10% if they didn't sell shares, which would be against financial regulations.

If a financial institution owns more than 10% of a non-financial affiliate, they are required by South Korean law to either decrease their holdings or secure special regulatory approval.

Samsung Life is selling 4.25 million shares and Samsung Fire is selling 743,104 shares in order to avoid legal problems in advance.

The sales will take place through a block deal, which enables big transactions to be carried out without significantly affecting market prices, prior to the market opening on February 12.

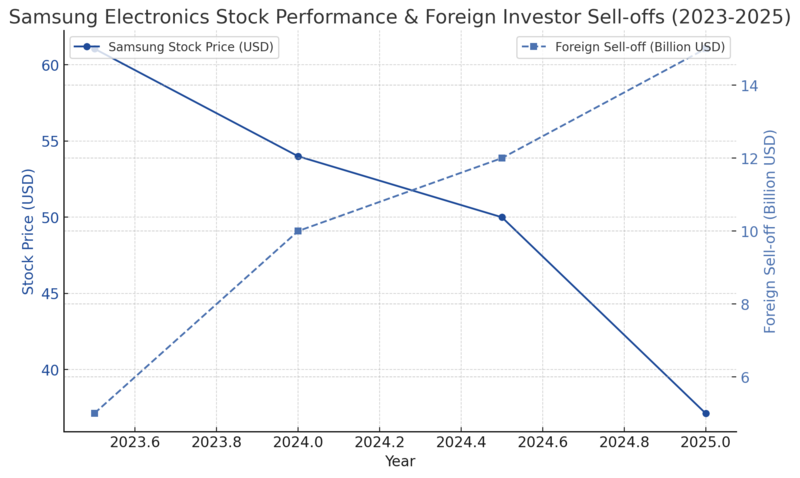

The sale price will be close to the market price if institutional demand is high; if not, a discount may be applied. Over the last six months, $15 billion (₩22 trillion) worth of Samsung Electronics shares have been aggressively sold by foreign investors. Consequently, for the first time since January 2023, foreign ownership has dropped below 50%. This sell-off is mostly due to decreased semiconductor demand and disappointing performance in key areas like AI chips and foundry services.

Samsung Electronics has been falling behind rivals: SK Hynix is the global leader in high-bandwidth memory (HBM), particularly in circuits related to artificial intelligence. Samsung's lack of faith in its semiconductor division is seen in the upcoming Galaxy S25, which will use Qualcomm's Snapdragon 8 Elite rather than Samsung's own Exynos. Deepseek, a Chinese AI company, is launching more affordable AI models, which could lower demand for Samsung's memory processors.

Samsung Electronics' stock has declined from a peak of ₩88,800 ($61.06) in July 2024 to ₩54,000 ($37.13). The U.S. CHIPS Act offered a short-term boost, but the stock is on a declining trajectory. Analysts are cutting target prices, citing weak profits and uncertainty in the semiconductor sector.

Fourth-quarter operational earnings are predicted to fall by 30.8% to ₩9.38 trillion ($7 billion). U.S.-China tensions could lead to more tariffs that may negatively harm Samsung’s HBM business.

Analysts believe Samsung could come back if it improves its technological competitiveness and enhances shareholder returns. A projected bottoming-out of semiconductor pricing could give a recovery chance later in 2025.

In conclusion The selling of Samsung Electronics shares by Samsung Life and Samsung Fire is required by law, not because they don't trust the business. However, the rebound of Samsung Electronics' stock price is hampered by broader market factors, such as sell-offs by foreign investors, difficulties with semiconductors, and poor earnings. If the company can regain its competitiveness in AI and chipmaking, analysts are still cautiously hopeful and are counting on a long-term recovery.

Amid Samsung Electronics' buyback, Samsung Life and Samsung Fire sell shares to comply with financial law. Before the stock market opened on February 12, 2025, the top life and non-life insurers in South Korea, Samsung Life Insurance Co. and Samsung Fire & Marine Insurance Co., sold 280 billion won ($193 million) worth of Samsung Electronics shares in a block sale.

Samsung Electronics' ongoing share purchase and cancellation plan, which would have raised the insurers' ownership shares above the legal cap set by South Korean financial regulations, served as the impetus for this action.

Legal Restrictions and Regulatory Compliance

The Act on the Structural Improvement of the Financial Industry (ASIFI), which forbids financial institutions from owning more than 10% of the shares of non-financial companies, is what the share sales are intended to prevent.

Prior to the sale 8.51% of Samsung Electronics was owned by Samsung Life Insurance, 1.49% was owned by Samsung Fire & Marine Insurance, in which the total combined is 10% (the highest amount allowed by law). In the absence of sales, the insurers' interests would have grown to: Samsung Electronics' cancellation of 3 trillion won worth of treasury shares as part of a 10 trillion won repurchase plan.

For 236.4 billion won, Samsung Life Insurance sold 4,252,305 shares (0.071%). For 41.3 billion won, Samsung Fire & Marine Insurance sold 743,104 shares (0.013%). As a result, their combined holdings remained below 10%, with their interests falling to 8.44% and 1.48%, respectively.

In November 2024, Samsung Electronics announced a 10 trillion won stock buyback as part of a plan to increase shareholder value. By February 17, 2025, the business promised to repurchase 3 trillion won worth of shares, with the remaining 7 trillion won to be completed by November 2025.

The initial stage of the buyback is intended to help Samsung's stock price, which has been falling because of low demand for semiconductors, loss of high-bandwidth memory (HBM) competitive advantage, samsung shares being sold by foreign investors for $15 billion in six months. The number of outstanding shares falls as treasury shares are retired, increasing the percentage ownership of current shareholders and necessitating regulatory compliance.

Samsung Life and Samsung Fire might have to further cut their ownership if Samsung Electronics moves on with the second phase of the repurchase, which involves canceling an additional 7 trillion won in treasury shares.

According to Jung Jun-seop of NH Investment & Securities, if Samsung Electronics cancels the entire 10 trillion won worth of stock, Samsung Life will have to sell an extra 760 billion won ($524 million) worth of shares in order to keep its 8.51% stake.

A similar action was taken in 2018 when Samsung Life sold shares after Samsung Electronics had already canceled and repurchased them. The market's supply may rise as a result of the divestment, according to some analysts, which might negatively impact Samsung Electronics' stock performance. This coincides with Samsung's efforts to increase its valuation by repurchasing shares.

Samsung Life and Samsung Fire could increase shareholder returns with the 280 billion won revenues from the sale of their shares. These shares are within the category of financial assets assessed at fair value through other comprehensive income (FVOCI) under IFRS 9 accounting standards. This means that the sale does not produce accounting profits, but it may be used to pay dividends or repurchase shares. For the first time since January 2023, foreign investors have reduced their stake of Samsung shares below 50% after selling $15 billion worth of shares. In the market for high-bandwidth memory (HBM), which is essential for AI applications, Samsung trails SK Hynix. The Galaxy S25 will use Qualcomm's Snapdragon 8 Elite chip rather than Samsung's Exynos chip, indicating internal semiconductor competition challenges.

Possible Trade and Regulatory Risks

Samsung's semiconductor business in China may be impacted by geopolitical risks, such as US tariffs on China. Earnings may suffer if global memory demand recovers more slowly.

Even though Q4 2024 earnings would be lower, some analysts are still hopeful that Samsung might experience a recovery if it maintains its shareholder-friendly policies and boosts its technological competitiveness.

The block sale of Samsung Electronics shares by Samsung Life and Samsung Fire is not a result of a lack of trust in the company, but rather of a regulatory need brought on by South Korean financial legislation. However, Samsung Electronics still has to deal with more general market issues like regulatory uncertainty, semiconductor difficulties, and sell-offs by foreign investors.

Future stake sales by Samsung Electronics' financial affiliates might be necessary if the company proceeds with additional treasury share cancellations. In the meanwhile, Samsung Life and Samsung Fire stockholders may get dividends or buybacks from the sale's proceeds.