Dongfeng, Changan hint at merger that could create world's 5th largest auto group

Input

Changed

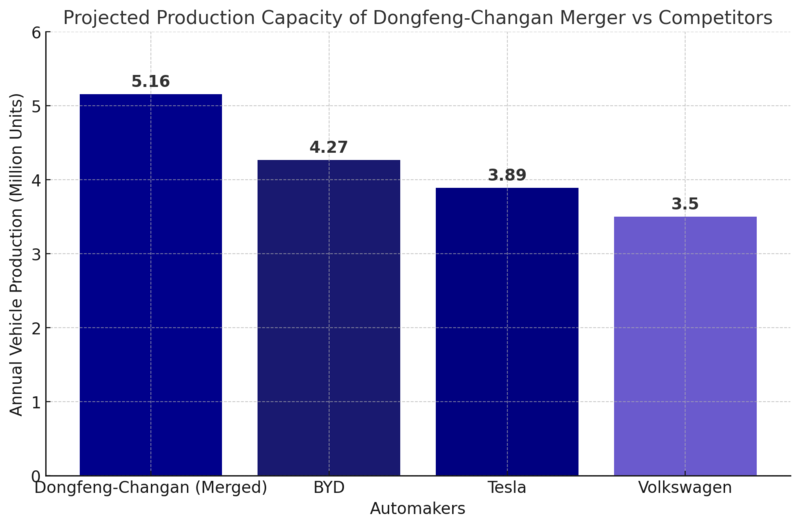

Due to reports of a merger between state-owned automakers Dongfeng Motor and Changan Automobile, China's automobile industry is witnessing a significant upheaval. The potential merger of Dongfeng and Changan is one of the most significant developments in China's automobile industry in recent years. With the revelation of reorganization plans by two of its state-owned automotive titans, Dongfeng Motor and Changan Automobile, China's car sector is set to undergo a substantial shift. The merging of Dongfeng and Changan symbolizes a fundamental revolution in the Chinese auto industry. Despite the fact that neither company has formally declared a merger, industry speculation suggests that it could lead to the formation of the world's fifth-largest auto group. A merger between Dongfeng and Changan would increase competition in the industry and maybe produce a state-backed competitor that could challenge BYD's hegemony.

Dongfeng's Dominance in the New Entity

According to reports, Dongfeng will be in charge of the combined business, and Yang Qing, its current chairman, will serve as the group's leader. Dongfeng is now in a position of power, and Zhu Huarong, the chairman of Changan, is conspicuously missing from the leadership structure—possibly because he will be retiring in 2025.

This new auto group's main goal will be supply chain integration, which will enable both businesses to reduce expenses and streamline procurement. This is a crucial tactic, particularly as Chinese automakers continue to use aggressive pricing tactics and government subsidies to undercut international rivals. The merger would generate a larger innovation pool for electric vehicle (EV) and autonomous driving technology, enabling the combined organization to better compete with Tesla, BYD, and other global competitors.

The possible merger is in line with a larger trend in the global automotive sector, where businesses are banding together to maintain their competitiveness. Traditional automakers are under increased pressure to dominate the electric vehicle (EV) market, and consolidation offers a means of pooling resources, cutting expenses, and gaining market share.

With local brands now controlling 70% of the domestic market, the competitive landscape in China is changing quickly. This is in sharp contrast to just five years ago. Both Chinese and foreign automakers are finding it difficult to stay profitable as a result of the fierce price war in the EV market, which is being driven by the government's aggressive support for domestic brands.

China’s State-Owned Automakers and the NEV Transition

China’s State-owned Assets Supervision and Administration Commission (SASAC) has hinted at policy changes to accelerate NEV production, citing concerns that state-owned carmakers have been too slow in their transition to electrification. The restructuring of Dongfeng and Changan could be part of a broader effort by Beijing to push its state-controlled automakers to compete with private firms like BYD and foreign EV leaders like Tesla.

The rumored Dongfeng-Changan merger is not happening in isolation. Similar moves are being discussed globally. For instance, Honda and Nissan recently explored a merger to strengthen their position in the EV race but ultimately called off the deal due to disagreements over control.

This reflects a broader global auto industry trend, where companies are being forced to consolidate, form alliances, or risk falling behind in the technological and economic race.

While the Chinese EV industry has rapidly grown, its export strategy is now under threat. Countries like the U.S., EU, and India are raising trade barriers to prevent China from dominating their local auto markets. With tariffs on Chinese EVs increasing, many Chinese automakers are setting up overseas manufacturing plants to bypass trade restrictions. However, even this strategy is facing obstacles, as seen in Brazil halting BYD’s factory project due to poor labor conditions.

Given these challenges, Chinese carmakers are focusing more on their domestic market, making mergers like Dongfeng-Changan a strategic necessity rather than a mere corporate maneuver.

If the Dongfeng-Changan merger materializes, it will not only create a dominant force in the Chinese auto market but also pose a serious challenge to international automakers. The new entity will be better positioned to compete with global players, particularly in EV and autonomous driving technologies.

However, the success of the merger will depend on execution. Integrating two massive companies comes with organizational and operational challenges, and the ability to effectively streamline production, supply chains, and R&D efforts will determine whether this new giant can truly reshape the global auto landscape.

As China’s auto industry faces an existential battle for survival and global dominance, mergers like Dongfeng-Changan represent a pragmatic response to the increasing pressure from competition, policy shifts, and trade restrictions. The next few months will be crucial in determining whether this potential auto giant becomes a market powerhouse or struggles under the weight of its own ambitions.

In Dongfeng-Changan’s potential merger, this would reshape China’s automotive hierarchy given that the combined annual vehicle sales of Dongfeng and Changan in 2024 were 5.16 million units, compared to BYD’s 4.27 million. A merger would create China’s largest car manufacturer, overtaking BYD in both market share and production capacity. The potential merger is a strategic move aimed at tackling overcapacity, enhancing competitiveness, and responding to shifting industry trends, particularly in the EV sector. Below, we explore the key implications of this merger and how it might reshape China’s automotive landscape.

This is significant because BYD, backed by strong government subsidies and aggressive pricing strategies, has dominated the EV market in China.

One of the key benefits of consolidation is the capacity to distribute resources more effectively. Morgan Stanley’s research indicates that a merged Dongfeng-Changan group could prioritize investment in its most competitive brands and technologies, improving overall efficiency.

In the era of electrification, state-owned automakers maintain their competitiveness. However, overcoming managerial, operational, and market obstacles will be necessary to carry out the merger successfully. If executed well, this might serve as a model for upcoming SOE consolidations in China, significantly altering the automobile industry's worldwide landscape. A Dongfeng-Changan merger aligns with Beijing’s long-term industrial policy goals by boosting the worldwide competitiveness of Chinese brands, particularly in the NEV (New Energy Vehicle) industry.