U.S. Unveils Port Fee Strategy Targeting China—Domestic Industry Warns of Backfire

Input

Modified

Trump Signs Executive Order to Impose Port Entry Fees on Chinese Vessels Concerns Grow Over Impact on U.S. Shipping and Export Sectors Industry Voices: “This Will Be More Disruptive Than the Tariff War”

The United States is solidifying its “port entry fee” policy aimed at curbing China’s dominance in global maritime trade. With President Donald Trump signing an executive order to authorize the measure, the U.S. Trade Representative (USTR) now has a formal mandate to begin implementation. However, mounting concern is emerging from within the American shipping and trade industries. Stakeholders warn that instead of weakening China, the policy may unleash unintended consequences—delivering a backlash that harms U.S. shipbuilding, maritime logistics, and broader trade markets.

U.S. Port Fee Policy: A New Front in the Trade War

The Biden-era U.S. Trade Representative (USTR), under a revived Trump initiative, is formalizing a port fee policy aimed at weakening China’s dominance in global shipping and shipbuilding. Following President Trump’s signing of an executive order on April 9, the USTR is now empowered to craft a pricing framework targeting Chinese vessels and operators, as part of a broader national strategy to revitalize America’s shipbuilding sector and reduce reliance on Chinese maritime power.

The proposed plan introduces steep port entry fees on Chinese-owned or Chinese-built ships docking at U.S. ports—up to $1 million per entry or $1,000 per ton of vessel capacity. Additional penalties apply based on the share of Chinese-built ships in a fleet, with fees rising significantly if the fleet contains over 50% China-origin vessels.

Jitters in U.S. Industry: “A Blow to Our Own Economy”

U.S. industry leaders warn that this policy could backfire, harming American trade more than it pressures China. Jonathan Gold, VP of the National Retail Federation, stated, “Port fees pose a bigger threat than tariffs due to their far-reaching supply chain implications,” highlighting potential pullouts from Chinese shippers and devastating effects on smaller ports like Oakland, Charleston, and Philadelphia.

The World Shipping Council (WSC) estimates that if implemented, 90–98% of global ships—most of which are Chinese-built or owned—would incur the fees, sharply raising costs across the logistics ecosystem. The American Apparel & Footwear Association warned of a 12% drop in U.S. exports and a 0.25% hit to GDP.

Peter Friedmann of the Agriculture Transportation Coalition emphasized that such a policy would severely limit U.S. agricultural exports, stating, “This will crush our ability to sell food abroad.”

WSC President Joe Kramek added that it could double export shipping costs, with added fees of $600–$800 per container, disproportionately hurting American farmers. “This is not a lever to change China’s policies—it’s a blunt instrument that increases costs for U.S. producers and consumers alike,” he said.

China’s Maritime and Shipbuilding Might Grows Unchecked

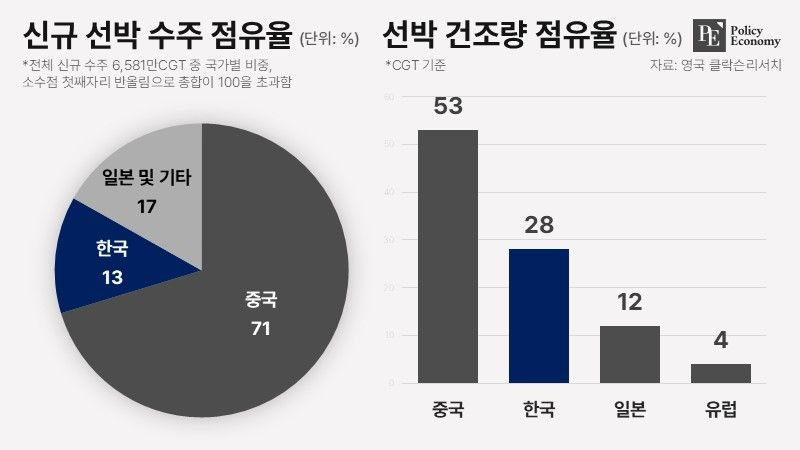

China currently dominates global shipbuilding, commanding 71% of global new ship orders in 2024, according to Clarksons Research. It also controls or operates terminals in ports across 96 countries, with 25 of the world’s top 100 ports located in mainland China. Approximately 61% of global container traffic passes through ports affiliated with China.

This dominance has raised alarms in U.S. strategic circles, leading to the current initiative as an effort to curb China’s long-term maritime influence and protect American trade infrastructure.

While the port fee policy is rooted in a desire to counter China’s growing economic and strategic influence at sea, critics argue it risks becoming another own-goal in the tariff war playbook. With no clear evidence that such fees will compel China to alter course, U.S. exporters, particularly in agriculture and manufacturing, may end up absorbing the brunt of the economic fallout.