Samsung Bets Big on HBM4, But Faces Internal Discord and Staffing Struggles

Input

Modified

Frequent Job Postings Signal HBM Push, But Slack Foundry Utilization Creates Surplus Workforce “Are We Sacrificing Long-Term Competitiveness?” Some Employees Ask

Strategic Talent Reallocation to Bolster HBM Capabilities

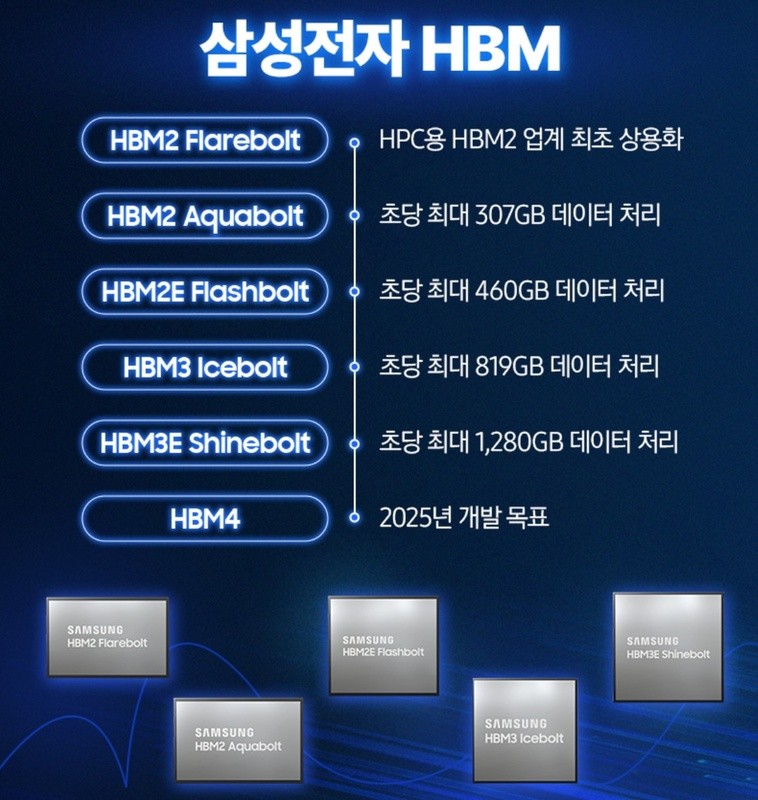

Samsung Electronics has launched an aggressive strategy to regain its memory leadership by accelerating development and production of next-generation high-bandwidth memory (HBM4). As part of this effort, the company has implemented an internal free agent (FA) program allowing employees from its struggling foundry division to voluntarily transfer to HBM-related teams.

Key business units such as the Memory Manufacturing Technology Center and Semiconductor Research Center are actively recruiting staff to bolster R&D and production for HBM4. The move is seen as a direct response to increasing pressure from rivals SK hynix and Micron, both of whom have made significant gains—particularly in supplying HBM3E to NVIDIA.

Once-Robust DRAM Growth Slows, Triggering Redeployment

Internally, the realignment has sparked debate. While Samsung portrays the redeployment as a way to flexibly utilize surplus foundry personnel, concerns have emerged about weakening focus and morale in the foundry business, which posted over KRW 2 trillion ($1.5B) in estimated losses in Q1 2025. Poor 3nm yield rates have cost Samsung key clients like Qualcomm and NVIDIA, limiting its share in high-end foundry services.

Employees worry that continuous talent shifts will further erode the foundry’s competitiveness at a critical time when TSMC is maintaining a strong lead. Some insiders report growing dissatisfaction and a sense of inequality between business units, particularly over wage disparities and uncertainty about long-term prospects.

📉 Losing Ground in DRAM After 33 Years

In another blow, Samsung has lost its DRAM market crown for the first time in 33 years. SK hynix overtook it in Q1 2025 with 36% market share versus Samsung’s 34%, buoyed by its early and aggressive rollout of HBM3 and HBM3E. Once the pioneer of the global DRAM race, Samsung’s dominance is now being tested amid a generational transition in memory technology.

Inter-Divisional Tensions May Undermine Long-Term Strength

With HBM3E efforts facing delays due to thermal and yield challenges, Samsung is skipping ahead to HBM4. The technology leverages foundry logic die integration for better customization and performance—an area where Samsung’s vertically integrated structure could outpace competitors. The company aims to begin mass production of HBM4 using its 1c-nanometer node by late 2025.

At the latest shareholders’ meeting, Vice Chairman Jeongyeon Hyun reiterated Samsung’s commitment to significantly increasing HBM supply and ensuring no repeat of HBM3E missteps. Early HBM4 samples have already been delivered to select clients for testing.

Samsung’s decision to prioritize HBM4 may offer a short-term edge in the next-gen memory race. However, critics argue that continued disruption in human capital allocation could hurt long-term foundry innovation and widen the gap with rivals like TSMC. With internal morale reportedly fragile and external competition fiercer than ever, Samsung faces a delicate balancing act between aggressive ambition and operational cohesion.