Samsung Display Files Additional Lawsuit Against China’s BOE — “Firm Response to Patent Infringement”

Input

Modified

"Against Chinese Display Company BOE and Seven Affiliates" "Trade Secret Infringement Lawsuit Filed in U.S. Court" "Allegations of Core Patent Infringement and Misappropriation of Technology and Talent"

The battle over OLED technology is intensifying. Samsung Display has escalated its legal offensive against BOE, China’s largest display manufacturer, accusing the rising rival of repeatedly infringing on its patented display technologies. While the courtroom clash has been simmering for years, a fresh lawsuit filed in Texas reveals Samsung's intention to strike back harder, reinforcing its zero-tolerance stance against what it sees as systematic technology misappropriation. The move not only deepens an already complex legal feud but signals potential ripples across the global supply chain, with major players like Apple caught in the middle.

Escalation in the Patent War: Samsung Targets BOE Again

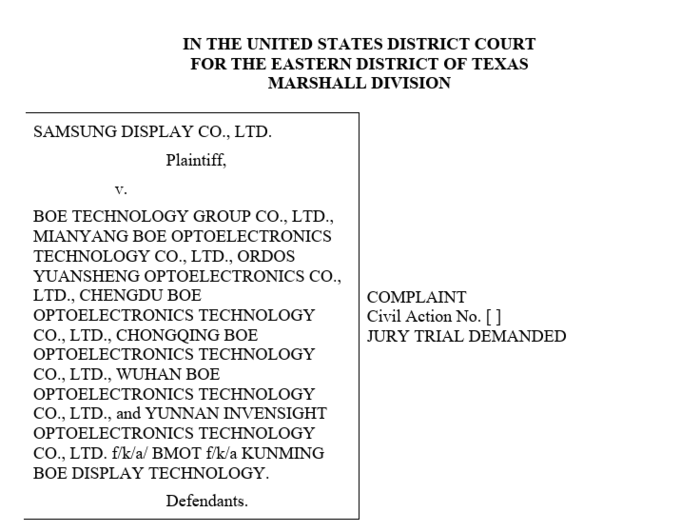

On April 21, Samsung Display filed a new complaint with the U.S. District Court for the Eastern District of Texas, targeting BOE and seven of its affiliates. The South Korean display giant alleges that the companies unlawfully used its patented OLED technologies in popular smartphones, including the Nubia Z60 Ultra and Red Magic 9S Pro. These models, released in December 2023 and July 2023 respectively, feature 6.8-inch OLED screens supplied by BOE—panels Samsung claims were built using its proprietary technology.

Specifically, Samsung accuses BOE of infringing on four U.S. patents—US11574990, US11574991, US10439015, and US10013088—related to thin-film transistor (TFT) structures and thin-film encapsulation (TFE) cell structures, both critical in OLED production. In a statement, Samsung emphasized the need to pursue “damages and other remedies” in response to the “unlawful infringement” by BOE.

Legal Momentum: U.S. ITC Ruling Boosts Samsung’s Position

This latest suit adds to a series of ongoing legal disputes between the two firms. Samsung Display is currently pursuing three major intellectual property cases against BOE in the U.S. The saga began in December 2022, when Samsung filed a patent infringement claim with the U.S. International Trade Commission (ITC). In June 2023, it followed up with a separate suit in Texas related to iPhone OLED diamond pixel structures. Further action came in November 2023 and March 2025, when trade secret infringement cases were filed with both the ITC and the Texas court.

Last month, Samsung scored a critical victory when the ITC ruled in its favor, confirming that BOE, along with U.S. parts distributors Injured Gadget and Wholesale Gadget Parts, had violated three to four of Samsung’s patents. Although the commission declined to impose an import or sales ban on BOE products—citing limited domestic industry impact—the ruling validates Samsung’s claims after over two years of litigation.

In light of this momentum, Samsung’s newest lawsuit is seen as part of a strategic campaign to hold BOE fully accountable. The company is reportedly seeking compensatory and punitive damages, including pre- and post-judgment interest and up to triple damages.

Ripple Effects on the Global Supply Chain: Spotlight on Apple

The intensifying legal confrontation between Samsung and BOE carries serious implications for the global display supply chain. As BOE aggressively scales its presence in the OLED market, both companies have become key suppliers to Apple, one of the largest consumers of OLED panels. Apple relies on a multi-vendor procurement strategy, balancing supply between Samsung and BOE to meet its vast demand and mitigate potential disruptions.

This strategy provides Apple with a cushion should one supplier face setbacks, but the legal escalation raises concerns over broader industry vulnerabilities. Analysts warn that the case may test the resilience of global supply chains and accelerate efforts toward diversification and supply chain fortification.

However, immediate disruptions appear unlikely. Most OLED panels for 2025 smartphone production have already been manufactured and delivered. Apple, which typically begins mass production of new iPhones around July, is believed to have already secured the required components for its iPhone 17 series.