Trump Softens Tone on China Tariffs After Two Days; Beijing Wields Rare Earths as Leverage: “The One in a Hurry Is the U.S.”

Input

Modified

Trump’s Message of “Respect for Xi” Amid Rising Tensions China’s Rare Earth Offensive Targets America’s Achilles’ Heel Tariff Truce Under Strain as Strategic Power Struggle Reignites

Amid mounting concerns over the rekindling of the U.S.-China trade war, Trump declared that “the United States wants to help China,” just two days after announcing a “100% additional tariff” on Chinese goods in retaliation for Beijing’s decision to restrict rare earth exports. The abrupt softening in tone is seen as a calculated move by Trump to enhance his negotiating leverage through his characteristic “strike-and-retreat” tactic. But with Beijing striking directly at one of America’s most vulnerable sectors, analysts say China’s rare earth restrictions have hit Washington where it hurts most—its national security supply chain.

Trump: “We’re Trying to Help China; Everything Will Be Fine”

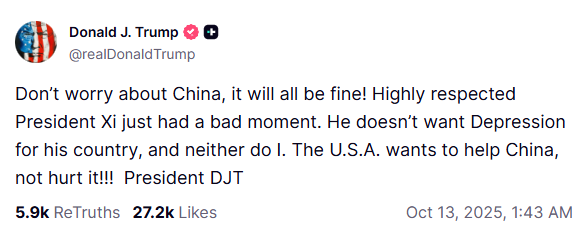

On October 12 (local time), Trump posted on his social media platform Truth Social, “He [President Xi] doesn’t want China to fall into recession. Neither do I.” He added, “Don’t worry about China. Everything will be fine,” referring to Xi as “the respected president who is just having a rough moment.” His comment was widely interpreted as an allusion to China’s rare earth export restrictions, implying that negotiations could resume once Beijing stabilizes its position.

Speaking to reporters aboard Air Force One en route to Israel, Trump further remarked, “I have a very good relationship with President Xi. He’s a very strong and very smart man—a great leader for China.” Although he hinted that a summit with Xi might not be necessary, he confirmed his attendance at the upcoming Asia-Pacific Economic Cooperation (APEC) summit, leaving the door open for a potential meeting.

Members of Trump’s administration also signaled a shift from hardline rhetoric toward the possibility of negotiation. Vice President J.D. Vance said in a Fox News interview, “Much of this depends on how China responds. If China reacts aggressively, the president has far more cards to play.” He added, “In the coming weeks, we’ll see whether China wants to start a trade war or behave rationally. I hope they choose the latter.” U.S. Trade Representative Jamison Greer echoed this sentiment, saying, “It has become clear over the past few days that China’s exercise of power will not be tolerated. The president has always been open to dialogue if the other side is interested.”

Beijing Tightens Its Grip on Rare Earths as Washington Strikes Back with 100% Tariffs

Trump’s recent statements mark a noticeable departure from his previous combative tone. On October 10, in response to China’s expanded rare earth export restrictions, he announced a 100% additional tariff on Chinese imports starting next month. Calling China’s actions “vicious and hostile,” Trump said the restrictions were “choking markets and making life difficult for almost every country, especially China.” He also stated that there was “no reason” to meet Xi at the APEC summit in Korea, suggesting Beijing had undermined the framework of the existing tariff truce.

China had first imposed a 34% retaliatory tariff in April after the United States raised duties on Chinese goods, and soon restricted exports of seven key rare earths—samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium. On October 9, the Chinese Ministry of Commerce and General Administration of Customs expanded the list to include five additional rare earth elements—holmium, erbium, thulium, europium, and ytterbium—effective November 8. Having recognized the strategic potency of rare earth controls during the earlier trade war, Beijing appears to be weaponizing them once again.

The new measures broaden the scope of restrictions to products manufactured overseas using Chinese rare earth materials or processing technologies. Even if the product contains trace amounts of Chinese rare earths or relies on Chinese refining or processing techniques, exporters must now obtain a special “dual-use item” license from Beijing. The controls also extend to non-military applications such as system semiconductors below 14 nanometers, 256-layer memory chips, and AI research equipment with potential military applications—all subject to case-by-case review.

While Trump countered with the threat of punitive tariffs, Beijing showed no signs of retreat. “Threatening us with exorbitant tariffs is not the right path to coexistence,” China’s Ministry of Commerce said in a statement on October 12. “Our stance on the tariff war has been consistent—we do not seek confrontation, but we are not afraid of it.” The spokesperson accused Washington of “seriously damaging China’s interests and the tone of economic dialogue” by adding numerous Chinese firms to its export control and Specially Designated Nationals (SDN) lists just weeks after the Madrid talks.

The New York Times noted that “China’s boldness may stem from the perception that Trump is weak,” pointing to several instances where the president had escalated tariff threats only to later withdraw. The paper also observed that, unlike during Trump’s first term, Beijing now possesses a far more advanced technological base, allowing it to confront Washington with greater confidence.

Diplomatic Tug-of-War Ahead of Summit Puts Tariff Truce at Risk

Observers interpret the intensifying rhetoric as a calculated prelude to the long-anticipated U.S.-China summit, expected to take place during the APEC conference next month—the first face-to-face meeting between the two leaders in six years. Both sides appear to be hardening their positions to strengthen their negotiating leverage ahead of the summit and the expiration of the mutual tariff suspension on November 10.

Trump has long voiced frustration over China’s weaponization of rare earths—materials critical to U.S. defense and high-tech industries. Rare earths are essential for semiconductors, F-35 fighter jets, submarines, missiles, and satellites. According to the International Energy Agency (IEA), China accounts for 92% of global rare earth refining and processing, leaving the United States almost entirely dependent on Chinese supply. Efforts to rebuild domestic production have faced obstacles due to environmental concerns, limited infrastructure, and workforce shortages, making substitution difficult.

Trump is also dissatisfied with China’s failure to meet agreed import levels of American soybeans, a politically sensitive issue ahead of next year’s midterm elections. According to the American Soybean Association, China has not purchased U.S. soybeans since May, hurting producers in key Republican strongholds such as Illinois, Iowa, Minnesota, Nebraska, and Indiana.

Yet analysts warn that the tariff ceasefire could collapse if the current standoff intensifies. Since May, the two nations had maintained a fragile truce under which Washington scaled back reciprocal tariffs and Beijing lifted restrictions on rare earth exports, extending a 90-day suspension once through negotiation. The agreement is set to expire on November 10.

Optimism had been building that the APEC summit in Gyeongju later this month could lead to a top-down breakthrough in trade talks. However, with China escalating its rare earth export controls and the United States retaliating with steep tariffs, fears are mounting that unless both sides find common ground soon, U.S.-China relations could spiral into an irreparable breakdown.

Comment