Trump Hints at Involvement in Attack on Iran – Aiming for Regime Change?

Input

Modified

Trump Issues 'Ultimatum' to Iran Threatens “Unconditional Surrender,” Hints at Eliminating Khamenei Considers Striking Iran’s Nuclear Facilities Using U.S. Forces

The Trump administration has signaled that it may consider a future operation to remove Iran’s Supreme Leader, urging Iran to accept “unconditional surrender.” Although President Donald Trump initially appeared to pursue diplomatic solutions such as nuclear negotiations with Iran, following Israel’s airstrikes on Iranian targets, the U.S. has shown a sharp shift toward military involvement. This has led military analysts to speculate that Washington may now be aiming not only to support Israel's offensive against Iran but also to destroy Iran’s nuclear facilities and potentially pursue regime change.

Trump Pressures Iran: “Unconditional Surrender”

On June 17 (local time), CNN reported, citing multiple U.S. government officials, that “President Trump is becoming increasingly open to using U.S. military assets to strike Iran’s nuclear site in Fordow” and is “growing less interested in a diplomatic resolution.” Upon returning early from the G7 Summit in Canada, Trump held an 80-minute meeting in the White House Situation Room with his national security team. Reportedly discussed were joint U.S.-Israel strikes on underground Iranian nuclear sites or direct strikes using B-2 stealth bombers and bunker-buster bombs (GBU-57).

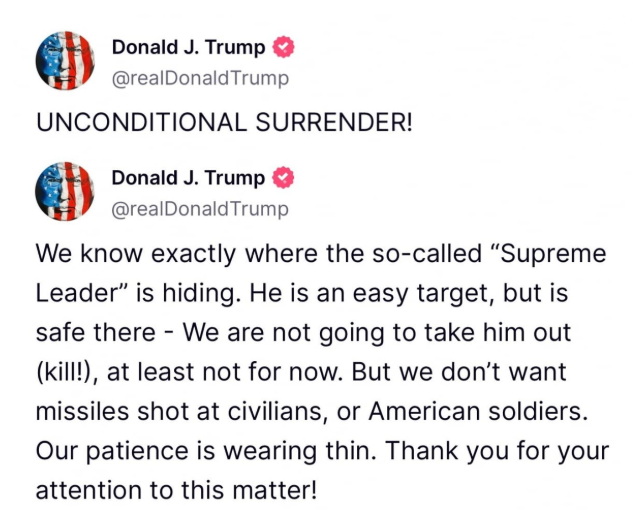

Speaking to reporters after his return, Trump said, “I no longer want to negotiate with Iran,” adding, “I want a real end, not just a ceasefire.” He later posted on Truth Social, “We know the location where Iran’s Supreme Leader Ali Khamenei is hiding. He is safe for now, but not forever,” followed by a demand: “UNCONDITIONAL SURRENDER!”

Though Trump had emphasized diplomacy, U.S. media noted a growing shift toward hardline measures since Israel’s surprise strike on Iranian nuclear facilities on June 12. Israel has requested the U.S. supply bunker-buster bombs and provide direct military support. In response, the U.S. has deployed over 30 aerial refueling tankers to the Middle East to support Israeli fighter jets. Trump also declared on Truth Social, “We now have full and total control over Iranian airspace,” a statement seen as hinting that the U.S. is aiding Israel’s air superiority over Iran.

Mideast in Turmoil – Oil Prices Volatile

As the prospect of U.S. involvement in the Israel-Iran conflict grows, markets are bracing for potential oil supply disruptions. The worst-case scenario would involve a cornered Iran attacking energy infrastructure in Saudi Arabia or blocking the Strait of Hormuz. This could trigger a sharp rise in global oil prices, worsening already uncertain inflation prospects and complicating the U.S. Federal Reserve’s interest rate policy—potentially leading to a recession.

However, Wall Street views this scenario as unlikely. Nicholas Colas, founder of DataTrek Research, noted, “A recession caused by a spike in oil prices would require a significant increase in crude prices.” According to DataTrek’s analysis from 1987 to 2019, recessions were typically triggered when West Texas Intermediate (WTI) prices doubled from their lows. Based on this, Colas estimated that WTI would need to reach USD 120 per barrel to cause a recession—far above the USD 76.54 closing price of Brent crude on June 17. He added that “such a surge in oil prices would require prolonged military action.”

Historically, markets have withstood major geopolitical shocks. Deutsche Bank analyzed 32 geopolitical events since 1939 that triggered stock market sell-offs and found that the S&P 500 typically fell about 6% over three weeks, then fully rebounded within the next three weeks. On average, it took 16 trading days to hit the bottom and 17 to recover. For instance, after the 1962 Cuban Missile Crisis, considered the closest the world came to nuclear Armageddon, the S&P 500 recouped its losses within nine days.

Is Regime Change the Goal?

Regime change in Iran is now a major focus. Experts say Israel’s airstrikes are no longer just about nuclear dismantling but may be aimed at toppling the Iranian regime. On June 15, Israeli Prime Minister Benjamin Netanyahu told Fox News that regime change “could certainly happen” given how weak the Iranian regime is. Netanyahu has long appealed to the Iranian people, emphasizing the regime’s economic failures and moral corruption. Following the first airstrike on June 12, he urged Iranians to “rise up and make your voices heard,” inciting domestic unrest.

If the U.S. military—with its overwhelming power—joins Israel in attacking Iran’s nuclear sites or advancing regime change, the Middle East could head down one of two paths: a new regional order or an escalation of conflict. If Iran, for the sake of regime survival, chooses to abandon its nuclear program and adopt a conciliatory stance, Trump and Netanyahu could potentially reshape the region’s security landscape. This could also pave the way for ending the Gaza war and normalizing relations between Israel and Saudi Arabia, allowing for a broader diplomatic realignment.

However, if Iran—the leading Shia power—chooses resistance over surrender and the conflict with Israel drags on, the Trump administration, which began with a promise to avoid foreign entanglements, may find itself deeply entangled in Middle Eastern chaos. In that case, Trump’s plans to refocus U.S. national security policy on containing its top strategic rival, China, could face major setbacks early in his new term.