China Rapidly Catching Up to the U.S. in the Bio Sector

Input

Modified

Global biotech licensing deals: from 0% to 30% China surpasses the U.S. in number of oncology clinical trials U.S. responds with accelerated new drug approvals within a month

With regulatory easing and shorter review times as its main weapons, China is aggressively targeting the global biotech market. Its strategy goes beyond merely catching up with the United States—it aims to seize dominance through institutional innovation. Industry experts predict that this bold move by China could have a significant impact on the global new drug development ecosystem. Some even forecast that, much like the global artificial intelligence (AI) industry, the biotechnology sector may also become bifurcated between the U.S. and China.

China Adopts FDA-Style Reforms, Cuts Clinical Trial Review to 30 Days

As of June 20, according to the biotech industry, China’s National Medical Products Administration (NMPA) announced on June 16 a plan to shorten the waiting period for new drug clinical trial reviews from the current 60 days to 30 days. The change applies to key pharmaceuticals with clear clinical value backed by government support, including cancer and rare disease treatments under two projects overseen by the NMPA’s Center for Drug Evaluation (CDE). The NMPA will collect public opinions until July 16 before formally implementing the policy.

This move is interpreted as an effort to accelerate clinical trials by adopting a review model similar to that of the U.S. Food and Drug Administration (FDA). According to biotech journal Fierce Biotech, China, like the FDA, uses an "indented review" system—where clinical trials automatically proceed unless objections are raised by regulators within a set timeframe. With the new rule, China’s clinical review period will now align with that of the FDA.

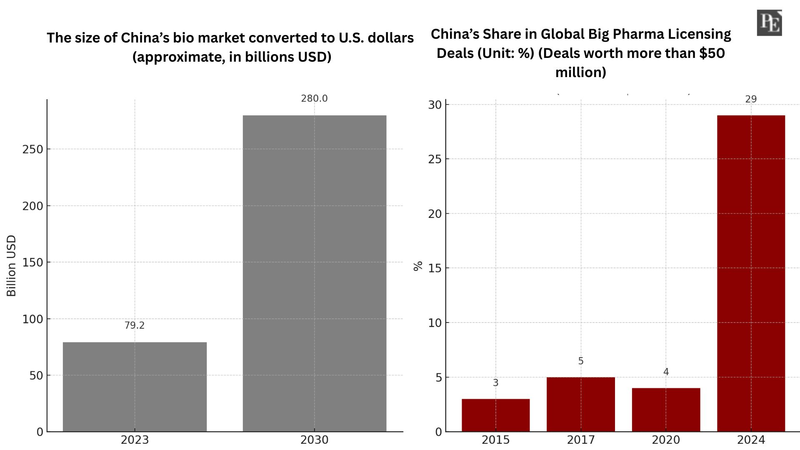

According to Grand View Research, China’s bio market is expected to grow from USD 74.53 billion in 2023 to USD 265.2 billion by 2030. In fact, China’s share of new drug technology exports to global pharmaceutical firms has risen from 0% a decade ago to 30% last year. China has already surpassed the U.S. and Europe in the scale of anticancer drug development. The global pharmaceutical industry expects China’s deregulation of clinical trials to positively influence future investments and licensing deals with big pharma.

It has been less than a decade since China began aligning its new drug development regulations with international standards. Multinational clinical trials were only permitted starting in 2015, and China joined the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) in 2017. The clinical trial review period, once lasting six months to a year, was cut to 60 days in 2018. With this latest policy, review periods for important new drugs are now down to 30 days.

These reforms have already produced tangible results. According to market research firm DealForma, about 29% of global big pharma licensing deals worth over USD 50 million involved technologies developed by Chinese biotech companies—up from just 3% in 2015. Chinese firms have shown particular strength in oncology. As of last year, 54% of China’s technology licensing deals were related to anticancer drugs. China’s share of global oncology clinical trials jumped from 2% in 2009 to 39% last year—surpassing the U.S. (32%) and Europe (20%).

China’s Biotech Ambitions

China’s rapid ascent in the biopharmaceutical industry is also evident in the highly competitive antibody-drug conjugates (ADC) market, which is gaining global attention. According to GlobalData, as of April, 5 out of the top 10 global companies with the highest number of ADC drug candidates in development were Chinese biotechs.

Major global pharmaceutical companies (big pharma) are increasingly licensing ADC candidates from Chinese firms, pushing up the value of such deals. In December last year, Bristol Myers Squibb (BMS) signed a licensing agreement with Chinese biotech SysImmune for a bispecific ADC candidate, in a deal worth USD 8.4 billion—of which USD 800 million was non-refundable upfront. This marks the largest-ever deal in the ADC field for a single pipeline.

China’s biotech rise has been fueled by robust government support. Since 2010, China designated biotechnology among eight “strategic emerging industries,” offering tax benefits and easing regulations like simplifying clinical trial processes. From 2015, policies such as “Made in China 2025” and “Healthy China 2030” have guided national-level biotech development strategies, while detailed policies have helped strengthen company capabilities.

U.S. Strengthens Countermeasures with Biosecurity Law and National Priority Voucher Program

Based on these developments, China is significantly narrowing the gap with the U.S. pharmaceutical industry. While the United States continues to push legislation like the Biosecurity Law to restrict transactions with Chinese biotech firms, it is also stepping up efforts to counter China's accelerating pace. Just one day after China announced its plan to shorten clinical trial review periods, the U.S. FDA unveiled the 'Competitive National Priority Voucher (CNPV)' program on the 17th. This initiative dramatically shortens the New Drug Application (NDA) review period from the usual 10–12 months to just 1–2 months for companies with manufacturing facilities in the U.S. or deemed politically friendly. FDA experts will conduct focused one-day meetings to evaluate applications—offering pharmaceutical companies a powerful incentive.

In April, a U.S. Senate committee also called for measures to prevent China from acquiring American citizens’ biometric data. Lawmakers warned that if China were to analyze U.S. bio data and develop drugs especially effective for Americans, the U.S. bio-sovereignty could be jeopardized—similar to how the world depended on vaccine-producing countries during the COVID-19 pandemic. The committee cautioned, “China has prioritized biotech as a strategic sector for the past 20 years and is rapidly gaining the upper hand. Without swift countermeasures, the U.S. may fall behind and never recover.”

The reason the U.S.—the world’s largest pharmaceutical power—is so wary of Chinese biotech firms becomes evident when looking at their recent achievements. Chinese genomic analysis company BGI acquired U.S.-based Complete Genomics (CGI) in 2012, entering the American market and disrupting the genomic analysis equipment sector long dominated by firms like Illumina and Thermo Fisher.

China is also rolling out "super-me-too" drugs—new medications created by modifying the chemical structure of existing ones—alongside highly sought-after global drug candidates. With strong government support, streamlined clinical trials, and access to large patient populations, China has significantly reduced drug development times and enhanced its competitiveness. Some experts in the global pharmaceutical sector even say, “Within the next 10 years, a significant portion of blockbuster drugs will originate from Chinese laboratories.”

Moreover, China now dominates the active pharmaceutical ingredient (API) market—an essential component in final drug formulations. APIs are crucial because they determine a medicine’s efficacy. China leads the world in the API market for antibiotics, and it also holds a substantial share of the API intermediate market (the semi-processed form of APIs). According to bio-industry analysts, 70% of API intermediates used in Europe come from China. This year, China’s API market revenue is projected to reach USD 15.97 billion, with an estimated compound annual growth rate (CAGR) of 7.86% through 2030.