Japan’s SoftBank Plans Robot and AI Industrial Complex in Arizona, U.S., 'Key Issue Is Securing Funding'

Input

Modified

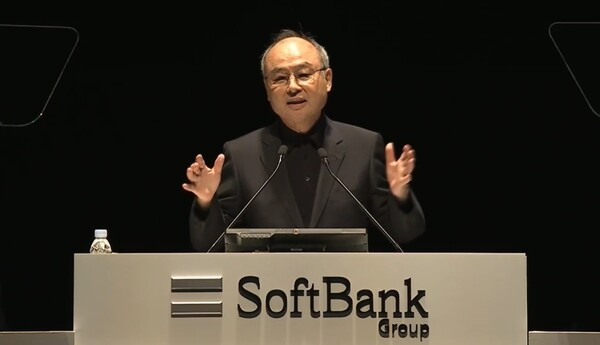

Masayoshi Son’s High-Stakes Gamble: Reshaping U.S. Manufacturing with 'Dark Factories' Plans to Build Semiconductor Production Base in Partnership with TSMC Success Hinges on Securing Strategic Partners and Funding

In a bold and unprecedented move, Masayoshi Son, the founder and chairman of Japan’s SoftBank Group, is setting his sights on transforming the American manufacturing landscape. Son’s latest endeavor, the Crystal Land Project, is an ambitious plan to develop a USD 1 trillion AI and robotics industrial complex in Arizona. This proposed mega-zone not only dwarfs SoftBank’s previous technological ventures but also signals a high-stakes gamble by Son to reimagine the future of industry.

At the core of this initiative lies a sweeping vision: to move beyond merely building smart factories and instead create a fully automated manufacturing ecosystem powered by artificial intelligence. This vision aligns with Son’s broader strategy to secure SoftBank’s position amid intensifying global competition, particularly between the U.S. and China, and to adapt to the shifting political landscape in America. However, as monumental as the plan is in scope, its success hinges on one critical factor, financing.

From Dark Factories to Humanoid Robots: A New Industrial Blueprint

The Crystal Land Project goes far beyond the conventional notion of a manufacturing hub. Inspired by the massive tech-centric industrial cities like China’s Shenzhen, Son envisions building an integrated AI-powered production ecosystem in the United States. At its heart will be a new generation of factories, “dark factories,” named for their complete lack of lighting due to the absence of human workers.

These fully unmanned facilities will operate around the clock, driven entirely by artificial intelligence that can predict demand and design production lines accordingly. Rather than requiring human oversight, the facilities will use advanced humanoid robots, equipped with vision and decision-making capabilities. According to Nikkei, the core AI chips powering these operations will be sourced from NVIDIA, while robotic technology will be supplied by Agile Robotics, a German company specializing in humanoid automation, and notably backed by SoftBank’s Vision Fund.

SoftBank is also exploring the revival of partnerships with Foxconn (Hon Hai Precision Industry), the Taiwanese manufacturing giant that previously handled production for SoftBank’s humanoid robot, Pepper. Foxconn’s proven track record in scalable manufacturing makes it a strategic candidate for realizing Son’s AI-driven production model. The broader vision is to minimize human intervention across the production of diverse goods, from smartphones and automobiles to home appliances, such as air conditioners, by embedding AI at every step of the assembly process.

This radical rethinking of manufacturing responds directly to labor shortages and rising wage pressures worldwide. With dark factories and intelligent robots at its core, Crystal Land is meant to demonstrate how AI can optimize and future-proof manufacturing systems on a national and global scale.

Strategic Partnerships and Diplomatic Leverage in a Shifting Geopolitical Landscape

Realizing such a colossal project demands more than technology, it requires robust geopolitical and industrial alliances. To that end, Masayoshi Son is proactively seeking collaboration with leading global technology firms, including Taiwan Semiconductor Manufacturing Company (TSMC), which currently produces NVIDIA’s state-of-the-art AI chips. While details remain unclear, Son is reportedly pushing for a strategic partnership that could make use of TSMC’s existing footprint in Arizona, where the chipmaker has already invested over USD 165 billion and launched mass production at its first U.S. plant.

Son has also approached Samsung Electronics and other major players in the semiconductor and robotics industries, gauging their interest in joining this AI industrial renaissance. There is speculation that companies from the SoftBank Vision Fund portfolio, many of which are on the cutting edge of AI and automation, may also be invited to join the project, further strengthening its technological depth and international reach.

Simultaneously, SoftBank has opened discussions with both federal and state officials in the U.S., seeking government support in the form of tax incentives, infrastructure aid, and policy backing. Bloomberg reports that SoftBank has already held talks with U.S. Secretary of Commerce Howard Lutnick, signaling high-level engagement with Washington.

These diplomatic overtures are not just economic, they are strategic. In the face of former President Trump’s protectionist trade policies, which have pressured global firms to commit to “Made in America” production, SoftBank’s Crystal Land Project serves multiple functions: It provides a U.S.-based manufacturing option for international firms, allows Japanese and Asian companies to sidestep trade penalties, and positions Japan as a technological ally in revitalizing American industry. By offering a cutting-edge, AI-powered manufacturing solution on American soil, SoftBank aims to transform potential regulatory pressure into a mutual opportunity.

A USD 1 Trillion Gamble: Financial Realities and Middle Eastern Lifelines

At a staggering USD 1 trillion, the Crystal Land Project is twice the scale of SoftBank’s USD 500 billion Stargate Project, which focuses on building AI data center infrastructure in the U.S. in partnership with OpenAI, Oracle, and MGX. But while Stargate lays the groundwork, Crystal Land is about execution. bringing AI to life in real-world production environments.

The magnitude of this financial commitment, however, casts a long shadow. Despite holding USD 25 billion in cash, SoftBank’s debt load has ballooned to USD 126 billion, leaving little room for error. Moreover, with up to USD 30 billion slated for investment in OpenAI this year alone, Son’s dual-project strategy is expected to strain SoftBank’s liquidity like never before. Financing these initiatives simultaneously would require massive asset sales, aggressive fundraising, or new borrowing mechanisms.

To navigate this challenge, SoftBank is courting capital from the Middle East, a region rapidly emerging as a global financial powerhouse in tech investment. Industry insiders point to Abu Dhabi-based MGX and Saudi Arabia’s Public Investment Fund (PIF) as promising backers. Both have the financial muscle and strategic interest in AI, enabling them to play pivotal roles.

Their interest isn’t speculative. During President Trump’s recent diplomatic visit to the Middle East, UAE President Mohammed bin Zayed Al Nahyan announced plans to invest USD 1.4 trillion in the U.S. over the next decade, targeting key sectors such as technology, AI, and energy. Meanwhile, Saudi Arabia has launched HUMAIN, a new national AI company aimed at securing its position across the entire AI value chain. With clear ambitions to become a central hub in the global AI ecosystem, both countries could see Crystal Land as a natural extension of their long-term strategies.

SoftBank’s efforts to align with Middle Eastern sovereign wealth could be the key to unlocking the immense capital needed to bring Crystal Land to life. If successful, it would represent not only the birth of a revolutionary industrial complex but also the convergence of Asian innovation, Middle Eastern capital, and American geopolitical opportunity.