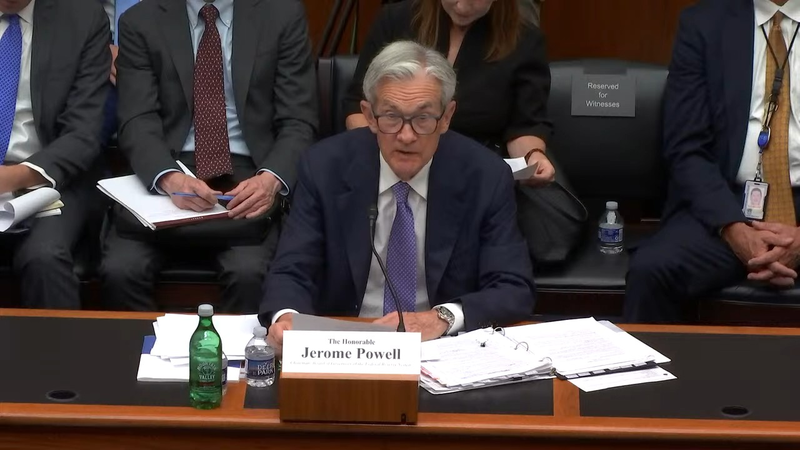

Fed Chair Powell Maintains Cautious Stance: ‘No Need to Hasten July Rate Cut"

Input

Modified

“Tariff Policy’s Impact on Inflation Must Be Closely Examined” “Still Too Early to Specify Timing for Rate Cuts” Diverging Opinions Within the Fed Over a Possible July Rate Cut

Federal Reserve Chair Jerome Powell expressed that there is no need to rush into a rate cut when asked about the possibility of a cut in July. He emphasized that it is still too early to make such a move, as the impact of the Trump administration’s tariff policies on inflation remains uncertain. Powell indicated that the Fed should monitor the situation for now. However, some Fed officials appointed by President Trump are advocating for an early rate cut, leading to growing divisions within the Fed over the direction of monetary policy.

Powell Asserts that Tariff Impact Will Become Clear After Summer

On the 24th (local time), Federal Reserve Chair Jerome Powell appeared before the U.S. House Financial Services Committee for the Semiannual Monetary Policy Report hearing. When asked about the possibility of a rate cut in July, Powell responded, “If inflationary pressures continue to ease, we could reach a point where an early rate cut is appropriate. However, with the economy still strong, I don’t want to single out a particular meeting. I believe there’s no need to rush.” Powell further explained, “The impact of tariffs on consumer prices will gradually become apparent through the June and July data,” signaling that the Fed intends to wait and assess the situation after the summer.

As for why the Fed is not following the lead of other major central banks, like the European Central Bank (ECB), which is moving quickly to cut rates, Powell said, “Most experts and the Fed expect inflation to rise back to a meaningful level this year.” His comments suggest that the Fed is reluctant to move toward rate cuts prematurely, given the potential for renewed inflationary pressures.

The ECB, in contrast, has lowered interest rates eight times between June of last year and this June, cutting a total of 2 percentage points in response to slowing economic growth and downward pressure on inflation in the Eurozone. Earlier, on the 18th, the Fed concluded its two-day Federal Open Market Committee (FOMC) meeting by keeping the federal funds rate unchanged at 4.25%–4.50%. This marked the fourth consecutive rate freeze since the start of Trump’s second term, as the Fed maintained its stance despite the President’s demands for rate cuts.

At the time, Powell explained that the Fed’s wait-and-see approach was due to “a still-solid economy and robust labor market.” However, he added, “If the labor market deteriorates to a concerning level, that would influence our decision on a potential rate cut.”

Regional Fed Presidents Back Powell’s Cautious Approach

During the hearing, several officials expressed support for Fed Chair Jerome Powell’s cautious stance. Neel Kashkari, President of the Minneapolis Federal Reserve, stated, “Recent inflation data is encouraging, but we need clearer insight into how tariffs will affect prices.” John Williams, President of the New York Fed, added, “It is appropriate to maintain current interest rates to analyze the impact of recent policy changes.”

Beth Hammack, President of the Cleveland Fed, noted that “the current rate level is likely to be maintained for some time.” At the same time, Susan Collins, President of the Boston Fed, emphasized that “a somewhat restrictive policy stance remains necessary.”

Fed Governor Michael Barr also signaled caution regarding rate cuts. Speaking at an event hosted by the Kansas City Fed in Omaha, Nebraska, Barr warned that tariffs could lead to a resurgence in inflation. He noted, “The U.S. economy is currently on solid footing,” pointing to low unemployment and easing inflation approaching the Fed’s 2% target. However, he also warned, “Short-term inflation expectations, supply chain adjustments, and secondary ripple effects could cause inflationary pressures to become entrenched.”

Barr further pointed out the risks associated with the Trump administration’s tariff policy. He cautioned, “Excessive tariff barriers could slow economic growth and drive up unemployment. These impacts may not be temporary, and there is considerable uncertainty regarding their policy effects.” He stressed, “In this environment, it’s crucial to avoid prematurely shifting policy toward rate cuts. The Fed is currently well-positioned to observe how the situation unfolds.”

Trump-Appointed Fed Officials Push for Early Rate Cuts

In contrast, officials appointed by President Trump are pushing back against Powell’s caution, calling for an early rate cut. Fed Vice Chair Michelle Bowman, speaking at a conference hosted by the Czech National Bank on the 23rd, argued, “If inflation pressures continue to ease, we should lower interest rates as early as the July policy meeting. This would align rates with a neutral stance and help maintain a healthy labor market.”

Notably, Bowman, who previously voted against a **0.5 percentage point “big cut” at the September FOMC meeting last year, favoring only a modest reduction, is now seen as making a sharp shift from a hawkish (tightening) to a dovish (easing) stance.

Christopher Waller, a Fed Governor previously considered a moderate hawk, also called for rate cuts in a CNBC interview on the 20th. He said, “We should start considering a rate cut at the next FOMC meeting. I don’t want to wait until the labor market collapses before acting.” Waller pointed to recent data showing inflation gradually slowing, adding, “With inflation moving closer to the Fed’s 2% target, it’s time to begin discussing rate cuts.”

Both Bowman and Waller premised their arguments on the belief that Trump’s tariff policy will not cause significant inflation. Bowman specifically cited the Personal Consumption Expenditures (PCE) price index, noting that it is nearing the Fed’s target. The PCE inflation rate slowed from 2.5% earlier this year to 2.1% in April, and Wall Street expects the May PCE figure, to be released on the 27th, to show a 2.3% year-over-year increase. Waller further argued, “So far, economic indicators have been strong. Even if tariffs have some impact, it will be temporary and won’t lead to persistent inflation.”