Trump Begins Move to Replace Fed Chair

Input

Modified

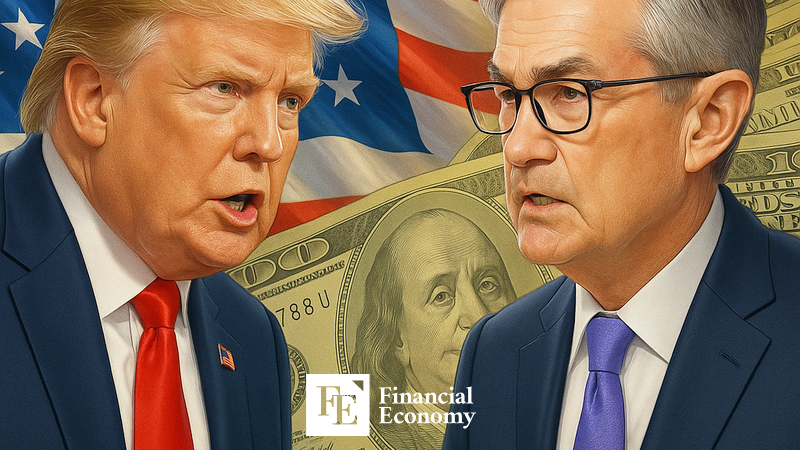

Trump Hints at Possible Early Replacement of Fed Chair Prolonged Clashes Over Several Years Deepen the Rift Former Fed Governor Kevin Warsh Among Potential Successors

U.S. President Donald Trump has once again hinted at the possibility of removing Federal Reserve (Fed) Chair Jerome Powell before his term ends. After Powell refused to bow to Trump’s pressure to cut interest rates and instead maintained a freeze, Trump has signaled his intention to replace him with a new chair ahead of schedule. Markets are now closely watching who might succeed Powell.

Will Powell Ultimately Be Dismissed?

According to an AP report on the 25th (local time), Trump spoke at a press conference following the NATO summit held in The Hague, Netherlands. When asked about plans to replace Powell, Trump said, “He’s terrible” and added, “Fortunately, he will be leaving soon.” He also revealed that he has already narrowed down the pool of candidates, saying, “I will choose the next Fed chair from 3 or 4 people.” Normally, the U.S. administration announces a new Fed chair nominee about 3 to 6 months before the end of the incumbent’s term, but Trump’s deep dissatisfaction with Powell’s monetary policy suggests he is considering an early replacement. Powell’s current term runs until May 2026.

Trump and Powell have clashed repeatedly over interest rate policy, failing to bridge their differences for years. Even during his first presidential campaign, Trump persistently demanded rate cuts from Powell. After taking office, Trump openly attacked him with phrases like “idiot” and “too slow Powell,” applying continuous pressure for rate cuts. During the press conference, Trump again called Powell “very stupid and political,” continuing his blunt criticism. Despite these attacks, the Fed has maintained its rate freeze stance without wavering since the start of Trump’s second term.

Trump Feels Betrayed by Powell

What stands out is that Powell was Trump’s own nominee during his first term (2017–2021). Trump had frequently expressed frustration with Powell’s predecessor, Janet Yellen, during her term from 2014 to 2018. In November 2015, during a book launch event for Crippled America Trump criticized Yellen as being “too political.” This effectively amounted to a direct challenge to the Fed’s independence and political neutrality.

In 2017, Trump nominated Powell, then a Fed governor, as the next chair. Given that most past Fed chairs continued serving even after a change in administration, Trump’s decision was seen as bold. For example, Alan Greenspan, appointed by Ronald Reagan, served under Presidents George H. W. Bush, Bill Clinton, and George W. Bush for a total of 19 years. His successor, Ben Bernanke, originally nominated by Bush, was reappointed and served during the Obama administration for eight years.

Yet, upon taking office, Trump immediately removed Yellen from the chair position. This led to concerns in the market that Trump had selected Powell to back his economic policies. However, contrary to Trump’s expectations, Powell proved unwilling to align with the administration’s wishes. In his first year as chair, Powell raised the federal funds rate four times for a total increase of 1 percentage point. Trump publicly criticized this, saying the Fed had “gone crazy” and calling Powell “clueless.” Even in July last year, while campaigning as a presidential candidate, Trump insisted that lowering rates was something that “should not be done,” yet Powell went ahead with a sharp 0.5 percentage point rate cut that September.

For years, their clashes continued. Initially, Trump had maintained that he would not replace Powell before the end of his term. In an interview published last December, when asked if he intended to dismiss Powell, Trump replied, “I have no such intention.” He added, “If I told him to resign, he would probably do it, but if I asked him not to, he probably wouldn’t.” However, since the start of Trump’s second administration, their conflict has noticeably intensified. Trump has now reversed course and is actively pushing for Powell’s removal.

Who Are the Potential Successors?

The leading candidate currently being mentioned as the next Federal Reserve Chair is Kevin Warsh, a former Fed governor who served during the George W. Bush administration. Warsh met with President Trump earlier this year, and last fall, he was interviewed for the position of Treasury Secretary. However, concerns are emerging within Trump’s camp that Warsh could be seen as a rebellious figure inside the Fed. This is largely because of his hawkish stance, favoring inflation control over employment growth.

Another name drawing market attention is U.S. Treasury Secretary Scott Bessent. A former prominent investment expert on Wall Street, Bessent has played a key role in major issues during Trump’s second term, including U.S.-China trade negotiations and tariff policy. In the process, he has strengthened his position within the administration and is reported to have gained Trump’s strong trust. Bessent also prevailed in a power struggle with Elon Musk, CEO of Tesla, who was once considered Trump’s "first buddy." When the two clashed over the acting commissioner appointment for the IRS, Trump ultimately sided with Bessent.

Kevin Hassett, Chair of the White House National Economic Council (NEC), is also being considered. Hassett, like Trump, holds a critical view of the Fed’s current monetary policy. In an interview with Fox News last month, he said, "We respect the Fed’s independence, but we don’t always agree with Chair Jerome Powell or their policies." He added, "We’re disappointed by their flawed economic modeling on tariffs," delivering a strong rebuke.

Other names mentioned as possible successors include Fed Governor Christopher Waller, former World Bank President David Malpass, former U.S. representative to the European Bank for Reconstruction and Development Judy Shelton, and, again, David Malpass, emphasizing his presence on the list.