Backlash of State-Led Growth: China’s Solar Industry Faces a Wave of Bankruptcies

Input

Modified

Massive subsidies and chronic overcapacity fuel a vicious cycle China’s state-led industrial policy hits structural limits Experts warn: “The era of explosive growth is over”

China’s solar industry is teetering on the brink of collapse, hit hard by punitive U.S. tariffs and a severe domestic supply glut. The crisis stems from a growth model heavily reliant on government subsidies, with little regard for technological preparedness. Once a self-proclaimed global leader in green transition, China now finds itself burdened with the consequences of worldwide overproduction—a burden increasingly manifesting in a domino effect of bankruptcies across the sector.

One-Third in the Red, Over 50 Firms Bankrupt

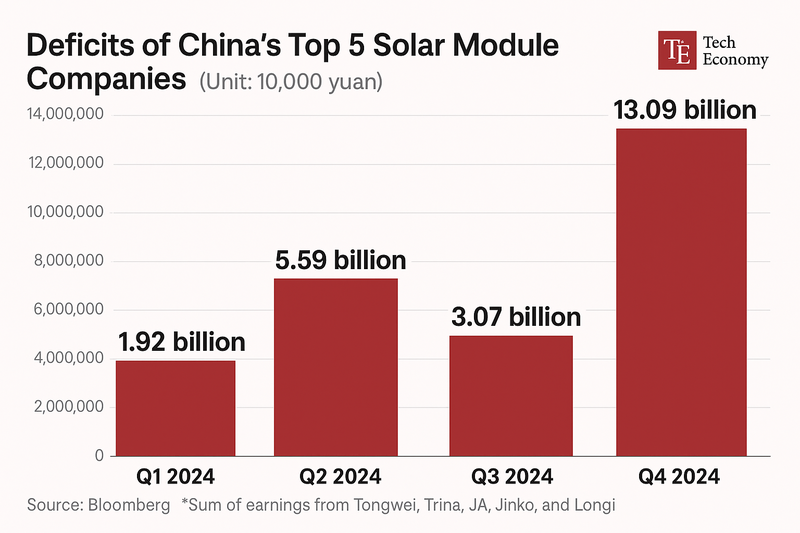

According to the China Photovoltaic Industry Association (CPIA), prices across all segments of the solar panel supply chain have plunged 60–80% from their 2023 peak. Among 121 listed Chinese solar manufacturers, 39 recorded net losses. China’s seven largest module producers together reported combined losses of 27 billion yuan (approximately $3.7 billion) in 2023—their first aggregate loss since comparable data became available in 2017. The downturn continued into Q1 2024, with five leading firms (LONGi, Trina, JA, Jinko, Tongwei) posting combined losses of 8.38 billion yuan (approximately $1.15 billion).

Stock values have plummeted as well. JinkoSolar, the world’s largest solar panel maker, saw its New York-listed shares fall nearly 30% this year, now more than 60% below their 2022 peak. Peers like JA, Tongwei, Trina, LONGi, and GCL have experienced even steeper declines—up to 80% since 2022. More firms are opting for bankruptcy. Market research group SolarBe reports that more than 50 Chinese companies within the solar supply chain have filed for bankruptcy in 2024 alone.

The industry's struggles were on full display at this month’s SNEC PV Power Expo in Shanghai, the sector’s largest trade show. The event shrank noticeably in scale, and CEOs of industry giants LONGi and Tongwei—who delivered keynote speeches last year—did not attend. Yang Liyu, General Manager of GCL Energy Clean Technology, remarked, “There are growing doubts about how deep and prolonged this downturn will be. It hasn’t eased, and it’s already proving deeper and longer than expected.”

Overcapacity Fueled by Beijing’s Electrification Ambitions

Industry experts increasingly argue that China's solar industry has been driven into a profitability crisis by unsustainable overproduction. The nation’s state-led growth strategy—centered on massive subsidies and bulk procurement at fixed prices, regardless of demand—has arguably become a self-defeating model.

According to energy consultancy Wood Mackenzie, China poured an estimated $50 billion in subsidies into its solar sector between 2011 and 2023. These policies helped the country dominate 80% of the global solar supply chain, from raw materials to finished products, and achieve world-class photovoltaic efficiency levels.

Yet the consequences of unchecked overproduction have proven severe. Annual production has consistently exceeded global demand, and by 2023, the gap had nearly doubled. The resulting price crash dealt a heavy blow to profitability: module prices dropped from $0.22 per watt in 2020 to just $0.09 by the end of 2023—a 60% decline. As a result, China’s five leading solar module makers reported combined losses of 13.09 billion yuan (approximately $1.8 billion) by late 2023. In a March industry conference, LONGi Solar Chairman Zhong Baosen admitted that China’s solar industry had entered a “danger zone.”

Seven Out of Ten Panels Are Chinese: Erosion of Korean Solar Market

The impact of China’s overcapacity isn’t limited to its domestic market. Chinese solar firms have been flooding global markets with below-cost exports—so-called “deflationary exports”—undercutting competitors and distorting industrial ecosystems worldwide.

South Korea is among the hardest hit. According to the Ministry of Trade, Industry and Energy, the market share of Chinese solar cells in Korea jumped from 33.5% in 2019 to 74.2% in 2023. During the same period, domestic Korean solar cell share fell from 50.2% to 25.1%. In many cases, even locally assembled modules rely on Chinese cells, leading to criticism that they are merely “domestic in name only.”

The Export-Import Bank of Korea noted in its “H2 2024 Solar Industry Outlook” that Chinese products now dominate the Korean market to such an extent that building solar power plants without them has become nearly impossible.

Industry insiders point to the absence of tariffs on Chinese solar cells as a key factor behind this overreliance. Under the Korea-China Free Trade Agreement signed during the Moon Jae-in administration, Chinese solar exports are exempt from duties. As a result, there is little incentive for developers to use more expensive domestic components when Chinese alternatives are both cheaper and penalty-free.

Meanwhile, the United States has taken drastic action. In May, Washington imposed record-breaking tariffs of up to 3,521% on solar products rerouted through four Southeast Asian countries—alleged backdoors for Chinese exports. The European Union is also preparing similar measures. South Korean industry observers warn that once the U.S. and EU markets are sealed off, China’s discounted solar exports will likely flood Korea even more aggressively.