Trump Cries Foul Over Jobs Report, Fires BLS Chief—Is a September Rate Cut Now Inevitable?

Input

Modified

U.S. Job Growth Slumps to 70,000 Range Trump Claims Data Were “Manipulated,” Fires Labor Department Chief Markets Grow Increasingly Hopeful for a September Rate Cut

President Donald Trump has dismissed the head of the Bureau of Labor Statistics following the release of sharply deteriorating employment figures, claiming the data had been "manipulated." As the president accuses federal statisticians of political interference, analysts suggest this could mark the beginning of a new "policy narrative war." Meanwhile, expectations are mounting on Wall Street for a substantial rate cut—possibly a 50-basis-point “big cut”—at the Federal Reserve’s September meeting.

Trump Accuses Labor Department of “Manipulating Data to Undermine GOP”

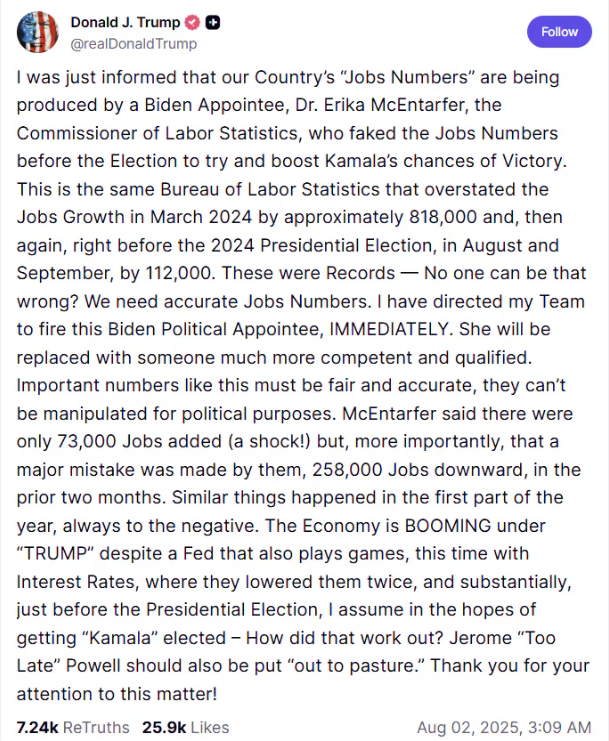

According to Reuters and CNN on August 3, the Trump administration dismissed Erika McEntaffer, director of the Bureau of Labor Statistics (BLS), on August 1. McEntaffer, a Democratic appointee, was installed under the Biden administration in 2020. President Trump took to his social media platform, Truth Social, to claim, “McEntaffer manipulated job numbers in the past to help Kamala Harris win the presidency, and she’s done it again.”

“The July jobs gain was a mere 73,000, and May and June figures were revised down by a staggering 258,000,” Trump continued, labeling it “political tampering” and “a grave error by McEntaffer.” He added, “Accurate statistics are the foundation of democracy. I instructed my team to dismiss her immediately and replace her with someone more competent and honest.”

On August 1, the Department of Labor reported that non-farm payrolls rose by just 73,000 in July, well below the Dow Jones consensus forecast of 100,000. The unemployment rate climbed 0.1 percentage points to 4.2%. More jarring was the sharp downward revision of previous months’ data: May’s job growth was slashed from 144,000 to 19,000, and June’s from 147,000 to 14,000—totaling a 258,000 reduction. The three-month average job gain now stands at just 35,000, a mere fifth of last year’s monthly average of 168,000.

Economists called the revisions “highly unusual” and indicative of a labor market cooling faster than expected. Some argued that “the Trump administration’s tariff policies are taking a toll, resulting in diminished investment and hiring.” In response, Trump lashed out, declaring that “the economy is booming under Trump, and this manipulation is a deliberate attempt to tarnish the GOP and me.” He added, “This has been happening all year, and the revisions are always downward.”

“Firing a Statistics Chief for Unfavorable Data Is Banana Republic Behavior”

The New York Times criticized the move as virtually unprecedented in the century-long history of U.S. economic statistics, calling it an abuse of power to dismiss a data official simply because the numbers were politically inconvenient. The paper cited international precedents where political meddling in data led to severe consequences: Greece falsified deficit figures for years, ultimately requiring multiple bailouts, and later prosecuted a statistics chief who tried to report accurate numbers. In early 21st-century China, local governments manipulated data to meet growth targets, forcing analysts to resort to alternative indicators to assess economic reality.

The most infamous example, however, is Argentina. Throughout the 2000s and 2010s, the country consistently understated inflation figures. In 2007, President Néstor Kirchner ousted a mathematician responsible for official CPI data and replaced her calculations with far lower inflation rates—figures the public and international creditors alike refused to believe. Eventually, bondholders and economists turned to independent sources. This erosion of trust inflated Argentina’s borrowing costs and exacerbated its debt crisis, ultimately pushing the country into default.

Experts, including former Treasury Secretary and Federal Reserve Chair Janet Yellen, voiced alarm over Trump’s decision to remove McEntaffer, who had been confirmed by the Senate. “This kind of action belongs in a banana republic, not the world’s most advanced economy,” Yellen stated, referring to nations where large-scale plantations collude with corrupt governments to suppress workers and distort governance.

Even observers who recently defended the integrity of U.S. statistical agencies are beginning to raise troubling questions. Mistrust may now spill over into other core metrics such as household income, GDP, and the Consumer Price Index. Critics warn that government statistics function as a societal mirror—and when that mirror is distorted or shattered, democratic accountability falters.

Labor Market Freeze Fuels Rate Cut Speculation

With uncertainty still looming over Trump’s tariff policies and labor market data deteriorating, analysts are increasingly betting on a rate cut in September. According to CME FedWatch, the probability of a 25-basis-point rate cut at the September FOMC meeting surged to 89% immediately after the jobs report—up from 62% a week earlier.

Inside the Fed, however, interpretations diverge. Raphael Bostic, president of the Atlanta Fed, told CNBC the data indicate “a broader softening in the labor market and economy.” But Cleveland Fed President Beth Hammack called the report “disappointing” but maintained “the labor market remains healthy.”

Some analysts now argue a more aggressive cut may be warranted. Tom Simons, an economist at a global investment bank, noted, “In a similar situation last year, the Fed implemented a 50-basis-point cut. A repeat can’t be ruled out.” Wall Street sentiment is shifting toward the view that if labor market weakness becomes more pronounced, the Fed could act—even in the face of inflationary pressure from tariff hikes.

President Trump, meanwhile, is leveraging market jitters to intensify pressure on the Fed. On August 1, he posted on Truth Social, “Stubborn fool Powell must slash rates NOW.” He continued, “If Powell refuses, then the Fed Board should take control and do what everyone knows must be done,” openly calling for Fed governors to oust Chair Jerome Powell.