Trump’s High-Stakes Retirement Experiment: Bitcoin Now Allowed in 401(k) Plans

Input

Modified

High-Risk, Volatile, Uncertain Assets Cleared for Investment

Losses Shifted to Individual Investors

Fears Mount Over Financial Market Instability

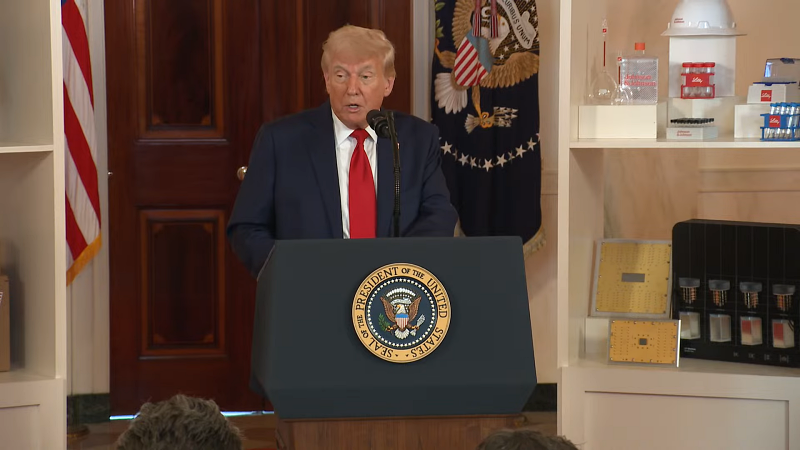

President Donald Trump has signed an executive order allowing retirement funds to invest in cryptocurrencies, sending shockwaves through global financial markets. By expanding the scope of permitted investments for major retirement plans such as IRAs and 401(k)s, the move has drawn strong criticism for increasing structural risks by channeling retirement savings into high-risk assets. As many countries have already legally prohibited pension investments in crypto, this decision is being seen as a step away from the fundamental principle of stable pension fund management.

A Structural Shift, But Market Uptake Still Distant

On August 7, Trump signed an executive order permitting 401(k) plans to significantly increase allocations to alternative investments, including private equity, real estate, and digital assets such as cryptocurrencies. The directive revises investment guidelines for retirement accounts covered under the Employee Retirement Income Security Act (ERISA), enacted in 1974. Trump reportedly instructed Labor Secretary Lori Chavez-DeRemer to work with federal regulators, including the Treasury Department and the Securities and Exchange Commission (SEC), to evaluate necessary regulatory revisions.

If implemented, the order would open the $12.5 trillion U.S. retirement fund market to a wider range of alternative investment products. Market analysts expect private equity firms, real estate funds, and crypto asset managers to benefit most. Cory Klippsten, CEO of crypto financial services firm Swan Bitcoin, remarked, “It was only a matter of time before Bitcoin entered 401(k)s,” adding, “As more people recognize its long-term risk-adjusted returns, we expect to see a growing share of workers choosing Bitcoin as a hard money investment.”

Still, the actual impact on markets may take time to materialize. Regulatory agencies like the Department of Labor and the Treasury must first craft detailed rules, and intense debate is expected over the scope of permissible assets and operational standards. Given that previous restrictions on private equity stemmed from concerns over potential losses, cryptocurrencies—with their even higher volatility—are likely to face even greater scrutiny. As a result, despite the policy’s symbolic weight, immediate capital flows into crypto-linked retirement products are not anticipated.

Backlash Grows Amid Low Market Maturity

The Trump administration’s decision to ease retirement investment restrictions is rooted in a rapidly evolving financial landscape and the growing demand for portfolio diversification. Under existing rules, retirement accounts were largely confined to traditional assets such as stocks and bonds. However, rising inflation and interest rate volatility have exposed long-term stagnation in retirement fund returns. In May, the Department of Labor announced its intention to increase investment flexibility in IRA and 401(k) accounts, allowing participants to pursue more diverse strategies and better adapt to market shifts.

The new executive order permits not just cryptocurrencies like Bitcoin but also private equity, private debt, and other alternative assets to be included in some retirement plans. While these asset classes had previously been excluded due to concerns over stability, the reform marks a fundamental redesign of the system. Given the massive scale of IRAs and 401(k)s in the U.S. personal retirement landscape, the policy shift is expected to redirect substantial amounts of capital. According to the Investment Company Institute (ICI), the total value of 401(k) assets stood at approximately $8.9 trillion as of the end of last year.

Market reactions are mixed. Supporters argue that blending traditional and alternative assets could improve returns and offer early access to high-growth industries. They also believe the move may accelerate institutional adoption of crypto by reducing regulatory uncertainty surrounding digital assets. Optimists hope this shift could break the traditionally conservative mold of retirement fund management.

But critics are raising serious concerns. Introducing volatile asset classes into long-term retirement portfolios, which are meant to grow steadily over decades, could significantly increase the risk of losses. Cryptocurrencies, in particular, are noted for extreme price swings, limited market maturity, and unpredictable dynamics. Brian Payne, Chief Strategist at BCA Research, cautioned, “Retail investors need liquidity, but high-risk assets often come with high fees, which can erode returns over time,” adding, “This could throw retirement planning off track.”

A Global Debate Over Pension Security Begins

Most countries legally prohibit public or private pension funds from investing in crypto. Their reasoning is that excessive volatility, liquidity issues, and persistent cybersecurity risks—including hacking and fraud—make digital assets incompatible with the long-term, stable nature of pension portfolios. In one example, Brazil’s National Monetary Council (CMN) in April banned closed pension entities (EFPCs) from allocating reserves to Bitcoin or other digital currencies. The decision reflected a growing international consensus that pension assets must be managed with stability in mind.

The structural risks of cryptocurrencies go far beyond price volatility. With the exception of a few stablecoins, most lack any tangible underlying assets tied to the real economy, and their valuation mechanisms remain opaque. Moreover, crypto markets rely heavily on centralized exchanges, making them highly susceptible to systemic outages and liquidity crises. In such events, asset liquidation becomes difficult, and trading is often halted or suspended. These traits fundamentally clash with the long-term nature of retirement fund management, which operates on decades-long horizons.

Against this backdrop, the U.S. executive order signals a departure from prevailing global norms in pension governance. While the vast majority of countries uphold the principle that pensions must be managed conservatively, the U.S. is opening the door to high-risk investments in the name of investor freedom. While this may offer growth opportunities for some, it also risks undermining international confidence in the U.S. retirement system’s long-term stability.

That, in turn, is fueling fears of heightened instability in financial markets. If volatility spreads across the $12 trillion retirement pool, long-term investment strategies could be upended and investor trust shaken. With a growing share of risky assets entering these portfolios, an economic downturn or market correction could trigger massive losses—potentially calling the very sustainability of the retirement system into question. That’s why this policy shift is emerging as a central point of contention in the broader debate over global financial stability.