Canada Moves to Mend Ties with China, Seeks Market Diversification Beyond Trump’s Pressure

Input

Modified

Canadian Prime Minister: “Engaged in constructive negotiations with China” Potential follow-up talks including meeting with Xi Jinping Considering repeal of EV tariffs amid damage to domestic industries

Canada, which has been locked in a trade dispute with China since last year, recently held trade talks aimed at repairing relations. The Canadian side announced that the two prime ministers had engaged in constructive discussions on sectors currently subject to high tariffs—including electric vehicles, steel, and agricultural products—and agreed to pursue deeper follow-up negotiations. The meeting is seen as part of Canada’s efforts to move beyond its U.S.-centric export structure and broaden its market base. In recent months, Canada has signed trade agreements with Southeast Asian and South American nations to actively expand its global market reach.

Talks on Steel, EVs, and Canola

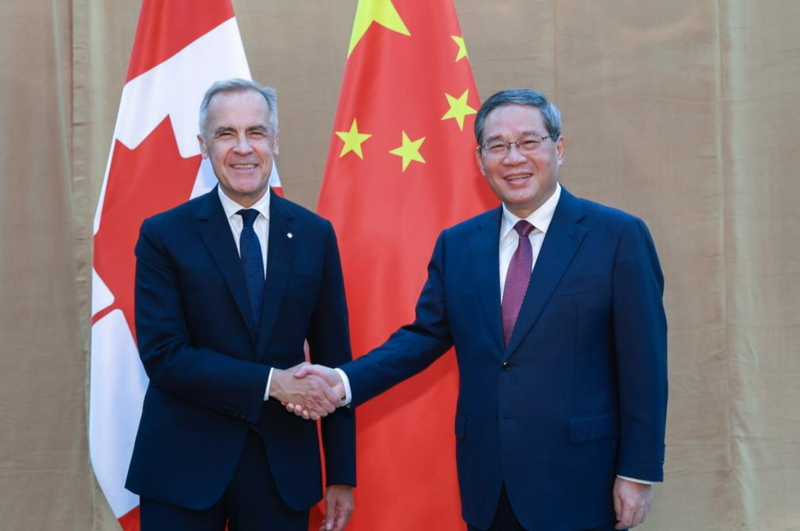

According to Reuters on September 24 (local time), Prime Minister Carney met Premier Li in New York on the sidelines of the United Nations General Assembly. Canada stated that the two leaders had a “constructive meeting” and expressed optimism that “as both sides seek ways to move beyond tariff disputes, dialogue will grow increasingly close over time.” Foreign media reported that a meeting between Carney and Chinese President Xi Jinping, along with further high-level exchanges, is likely in the near future.

In October of last year, Canada imposed tariffs on Chinese-made EVs, steel, and aluminum. Beijing retaliated by levying steep tariffs on Canadian agricultural products, leading to months of heightened tensions. However, since U.S. President Donald Trump’s inauguration, both countries have made efforts to normalize ties. In June, Premier Li told Carney that “there are no deep-rooted conflicts of interest between our two nations.” Following the recent talks, Carney stated that the two leaders had “openly discussed tariff policies on steel, EVs, canola, and other agricultural and seafood products,” giving a positive assessment.

Tariff Repeal Could Revive Agricultural Exports

Experts believe that amid intensifying protectionism from the Trump administration, Canada and China are edging toward pragmatic trade normalization. Even prior to the meeting, Ottawa had been considering scrapping or easing its 100% tariff on Chinese EVs as part of efforts to support its farming sector. In a recent interview with Canadian broadcaster CTV, Agriculture Minister Heath MacDonald said, “The government is reviewing tariffs on Chinese EVs,” stressing that “protecting farmers is the top priority.”

China is Canada’s second-largest agricultural export market after the United States. Last year, Canadian canola exports to China totaled $3.7 billion. But Beijing’s retaliatory measures in April dealt a direct blow to Canada’s farm and fisheries industries. China currently applies a 100% tariff on Canadian canola, seeds, and peas, as well as a 25% tariff on pork and seafood products. Following the announcement, Canadian canola futures plunged 7% in a single day, while fisheries along the Atlantic coast faced sharp declines in demand.

If Canada removes tariffs on Chinese EVs and Beijing reciprocates by lifting duties on Canadian farm and seafood exports, Ottawa could see its agricultural trade return to normal. At the same time, the influx of low-cost Chinese EVs could revitalize Canada’s stagnant EV market. EV subsidies have been reduced or withdrawn in key provinces such as Quebec, causing EV sales in Canada to plummet 39.2% year-on-year in the second quarter, with the share of EVs in new car sales dropping from 18.3% to 8.6%. Plug-in hybrid sales also declined by 2.2% during the same period.

Market Expansion Through Indonesian Trade Pact

Canada’s push to diversify beyond the U.S. extends well past China. On September 24, the same day Carney met Premier Li, Canada signed a Comprehensive Economic Partnership Agreement (CEPA) with Indonesia, accelerating its efforts to reduce U.S. dependence. Notably, this marks Canada’s first trade agreement with an Indo-Pacific nation. International Trade Minister Maninder Sidhu said, “The agreement will take effect within a year after ratification by both governments,” adding that “bilateral trade volume will double within six years.”

The agreement will allow Canada to export 95% of its goods to Indonesia tariff-free within 8 to 12 months. Key export sectors include agriculture, energy, telecommunications, and defense and aerospace. With Indonesia expressing interest in small modular reactors (SMRs), a next-generation nuclear technology, prospects for Canadian nuclear exports have also opened up. Although bilateral trade stood at just $5 billion last year, Indonesia is already Canada’s largest export market in Southeast Asia. Ottawa hopes to leverage this agreement to further expand across the region.

Canada is also in talks with the Philippines and plans to broaden negotiations to Malaysia, South Korea, and Japan. At the same time, it is pursuing a free trade agreement with Mercosur, the South American bloc comprising Brazil, Argentina, Uruguay, and Paraguay, which is now expanding into energy trade. For instance, Canada began exporting liquefied natural gas (LNG) to Asia for the first time in July. These moves underscore Ottawa’s strategy to move away from a U.S.-dominated trade model and solidify its economic footprint across Asia and South America.

Comment