Internal Rift at Yeochun NCC Amid Petrochemical Downturn: Hanwha Pushes ‘Capital Injection’ vs. DL Sees ‘Bottomless Pit’

Input

Modified

Head-on Clash Over Bailout Amid Default Crisis Hanwha: “Inject Funds to Avert Default” DL: “Diagnose Root Causes First, Consider Workout”

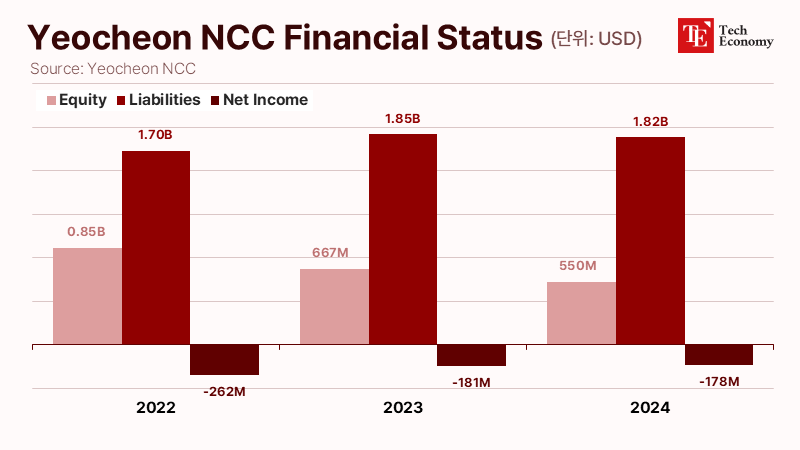

Yeochun NCC, South Korea’s third-largest ethylene producer, is teetering on the brink of default, with co-major shareholders Hanwha Group and DL Group locked in direct conflict over whether to inject additional funds. Hanwha is pressing for an immediate cash infusion to avert a debt default, while DL opposes further support, reportedly viewing the company as a “bottomless pit” and leaning toward a workout process. The standoff is seen as a stark illustration of the petrochemical industry’s deepening crisis under mounting external pressures.

Request for $2.18 Billion in Fresh Capital: Hanwha Approves, DL Delays

According to the petrochemical industry on the 11th, Boston Consulting Group (BCG), commissioned by the government and industry to advise on restructuring, reported that roughly 1.5 million tons—about 24%—of the 6.4 million-ton ethylene capacity in the Yeosu Industrial Complex should be cut. Ethylene, a key feedstock for plastics and fibers, is often called the “rice of industry.” Yeosu hosts seven plants run by Yeochun NCC (annual capacity 2.28 million tons), LG Chem (2 million tons), Lotte Chemical (1.23 million tons), and GS Caltex (900,000 tons), among others. BCG’s analysis indicates that two to three plants would need to be shut down.

BCG further concluded that full plant closures would be more effective than proportional production cuts, given labor and operating costs. The report also recommended similar scale reductions for ethylene plants in the Ulsan and Daesan industrial complexes. Industry observers see Yeochun NCC—operating three plants in Yeosu—as the most likely restructuring target. The company, which has been in the red for the past three years, halted operations at its No. 3 plant earlier this month. Unless it repays $2.25 billion by the 21st, it could face default.

Hanwha and DL each hold a 50% stake in Yeochun NCC. In March, they jointly injected $1.45 billion apiece through a capital increase, totaling $2.9 billion, but cumulative losses and a deteriorating balance sheet depleted those funds within three months. While further funding is unavoidable, the two shareholders remain at an impasse. Hanwha’s board approved an additional $1.09 billion loan to Yeochun NCC at the end of last month, stressing swift action, while DL insists on diagnosing the root causes before committing funds, and has floated the possibility of a workout program. With Yeochun NCC’s six board seats split evenly between Hanwha Solutions and DL, any capital injection requires bilateral approval; DL’s continued opposition would block Hanwha from unilaterally providing the loan.

Caught in a China–Japan–Middle East Squeeze

DL’s resistance reflects its view that South Korea’s petrochemical industry faces a near-irreversible decline. The traditional business model—processing naphtha from crude oil to produce ethylene for export—once provided stable cash flows, prompting widespread NCC expansion and cementing petrochemicals as a core national industry.

That boom ended abruptly as China emerged as a decisive factor. Once Korea’s largest export market, China achieved self-sufficiency in key products such as ethylene, polypropylene, and ethylene glycol by 2023 and has since ramped up export offensives. Its ethylene production capacity surpassed 50 million tons in 2023 and is projected to hit 72.25 million tons by 2027. Compounding matters, Russian crude, discounted due to sanctions over the war in Ukraine, has flowed into China, bolstering its cost advantage. With crude and electricity costs more than 20% lower than Korea’s, price competition has become virtually impossible.

Adding to the pressure, Middle Eastern capital, leveraging cheap crude, is expanding aggressively into petrochemicals. Saudi Aramco’s subsidiary S-Oil is investing heavily in the Shaheen Project, which bypasses conventional refining-to-NCC processes by producing base olefins such as ethylene directly from crude. This slashes ethylene prices to about one-third of NCC production costs, prompting warnings at a recent National Assembly forum that the project could trigger an industry-wide collapse.

Japan presents another formidable challenge. Tokyo moved early to restructure its petrochemical sector and secure dominance in high-value specialty products. Mitsui Chemicals, for example, plans to spin off and merge its Basic & Green Materials division around 2027, shedding oversupplied commodity lines to focus on specialties. Production capacity cuts are ongoing: after closing a PTA plant at its Iwakuni-Ohtake site in 2023, Mitsui shut its PET plant last year. The Japanese government is driving facility integration and rationalization across industrial complexes, aiming to cut ethylene capacity by 2.4 million tons and reduce total capacity to 4.3 million tons by 2030.

Asset Sales, Plant Consolidations, and the Onset of Restructuring

Under these headwinds, most Korean petrochemical firms are in severe financial distress. Lotte Chemical, which posted $1.15 billion in operating profit in 2021, swung to a $574 million loss in 2022 and deepened the deficit to $670 million last year. Analysts forecast it will follow a $95 million operating loss in Q1 this year with another $108 million loss in Q2. Hanwha Chemical’s division recorded a $69 million operating loss in Q1, while LG Chem’s petrochemicals unit lost $42 million.

Firms are responding with aggressive downsizing, shedding non-core assets to cut fixed costs. LG Chem sold its polarizer business last year for $832 million, and recently divested its water solutions unit to private equity firm Glenwood PE for $1.06 billion. It also decided to sell its aesthetics business under its life sciences division. Lotte Chemical sold its water treatment membrane plant in June, and has raised about $1.37 billion by selling stakes in overseas subsidiaries in Malaysia, Pakistan, and elsewhere.

Still unable to return to profitability, companies are moving toward plant consolidation. NCC facilities, the epicenter of the crisis, are top of the list. Lotte Chemical is negotiating to transfer its NCC plant in South Chungcheong to HD Hyundai Chemical and integrate it with HD Hyundai Oilbank; HD Hyundai Chemical posted a $212 million loss last year. LG Chem is also considering its Yeosu NCC plant as a potential divestment target.

However, despite consensus on the need for consolidation, no major deals have been finalized. Divergent views on asset valuations, future operational plans, and the uncertainty introduced by the U.S. 25% reciprocal tariff have stalled progress. Even if restructuring proceeds, combining already uncompetitive business units may yield limited results.