Korean TVs Under Siege from China’s LED Offensive, Content Integration Strategies Take Center Stage

Input

Modified

Chinese manufacturers dominate mid- to low-end markets with aggressive growth

Cost cutting and workforce reductions lower unit production costs

Limits of low-cost countermeasures are clear, and time is running short

Chinese home appliance makers, armed with price competitiveness, are rapidly expanding their global TV market share, threatening the stronghold of Korean-made OLEDs. In response, LG Display has launched a defense centered on panel cost reductions, while Samsung Electronics and LG Electronics are exploring business-to-business expansion and content integration strategies in addition to their established premium focus. Yet, amid a reversal in shipment volumes and intensifying price pressures, the time left for Korea’s TV industry to withstand the onslaught is narrowing.

Eroding Competitiveness Beyond High-Value Products

As of October 1, industry sources report that the production cost of a 65-inch OLED panel manufactured by LG Display is on the verge of dropping below USD 500. In 2020, a panel of the same size cost close to USD 1,000, meaning prices have halved in just five years. LG Display is not stopping there; next year, it plans to revamp its display driver IC (DDI) architecture to improve power efficiency and operating stability, while reinforcing automation in inspection and modularization processes to drive further cost reductions. This strategy is seen not merely as a price cut, but as a survival move aimed at stabilizing a revenue structure now centered on OLEDs and securing global market share.

But Chinese rivals are mounting formidable competition on the strength of price. TCL, Hisense, and others are aggressively rolling out new product lines equipped with RGB LED. Though based on LCD structures, these models use RGB LEDs as backlights, significantly enhancing black levels and contrast ratios compared with traditional Mini LED TVs. However, panel costs for RGB LED TVs remain in the USD 400–600 range, with component expenses accounting for most of the total cost, limiting productivity. Because the manufacturing process requires the precise alignment of tens of thousands of micro LED chips, defect rates remain high, and module inspection costs to ensure brightness uniformity are still steep, leaving OLED with a relative edge in cost competitiveness.

Market research firm Omdia projects that OLED will retain dominance in the premium TV segment for at least another one to two years. Indeed, OLED panel shipments this year are expected to rise by about 20 percent from last year, while OLED’s share of the USD 1,500-plus premium TV market, which stood at 36.7 percent last year and 46.1 percent this year, is set to exceed 50 percent next year. Based on this outlook, securities analysts raised LG Display’s third-quarter operating profit forecast from USD 234 million to USD 347 million.

Still, cautionary signals are flashing. Chinese brands led by TCL and Hisense have already surpassed Korea in shipments, and are now leveraging economies of scale to strengthen supply chain bargaining power. As more consumers experience Chinese brands, awareness and trust grow, paving the way for long-term expansion into the premium segment. Relying solely on high-margin markets to sustain the industry has clear limitations, and overdependence on cost cuts risks weakening the core competitiveness of technology development and brand value.

Responding to Aggressive Pursuit with Labor and Operating Cost Cuts

Korean companies are closely monitoring China’s offensive. LG Electronics CEO William Cho told reporters at CES 2025 in January, “If until now we were in the stage of recognizing the threat from China, we must now move into the execution stage to respond.” In December last year, he also shared plans to outpace Chinese rivals during a company-wide “CEO F.U.N. Talk” under the theme “Reinvention for Sustainable Growth, Breaking Limits for Structural Competitiveness.”

Cho’s concerns have since materialized. LG’s MS division, which oversees the TV business, was the only major business unit to post a loss, leading to a voluntary retirement program. In August, LG Electronics offered retirement packages to employees over 50 and low performers within the MS division. This move was seen as a bid to swiftly adapt to rising business uncertainties through workforce reductions.

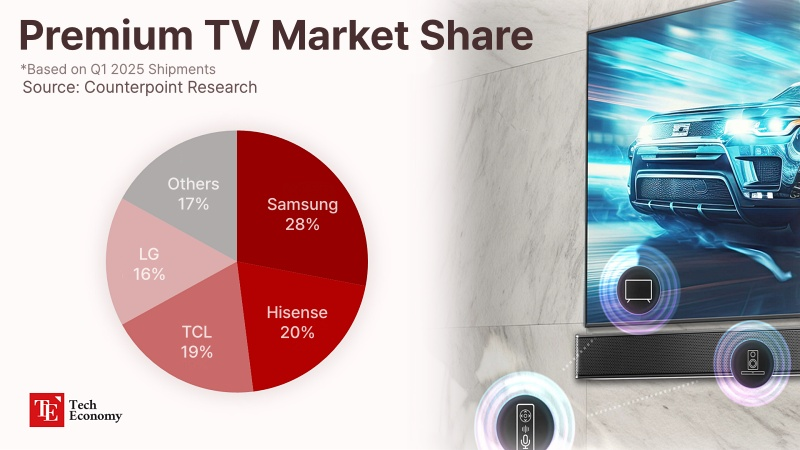

Samsung Electronics faces a similar situation. After TCL introduced Mini LED in 2019, Samsung quickly responded by launching its own version in 2021, but last year it was overtaken by TCL, Hisense, and Xiaomi. According to Counterpoint Research, in the first quarter of this year Samsung ranked fourth in sales volume and third in revenue in this segment. Consequently, Samsung’s VD division, which handles the TV business, posted second-quarter revenue of USD 5 billion, down 7 percent year-on-year and 10 percent from the previous quarter. Despite a higher proportion of premium products, intensifying global competition weighed on results.

Experts warn that responding to Chinese firms targeting niches in the premium market is the most pressing challenge for Korean players. Counterpoint noted, “Chinese brands are aggressively promoting ultra-large Mini LED LCD models that Korean brands cannot match,” adding that “consumers are increasingly showing that they see Chinese brands as making the right choice.” This reflects the growing perception among global consumers that Chinese TVs offer superior value for money.

Business-to-Business and Content Integration Strategies Gain Momentum

The industry sees the business-to-business (B2B) market as a potential escape route from the crisis. With consumer demand (B2C) slowing markedly, companies are shifting focus to commercial TV markets such as hotels. This year, LG Electronics and Samsung Electronics both unveiled new hotel TVs supporting Google Cast to target this segment. Designed for seamless smartphone-to-TV content integration in guest rooms, hotel TVs are viewed as a stable revenue source due to the potential for long-term supply contracts.

At the same time, both firms are bolstering content competitiveness to secure advertising-driven revenue models. Samsung and LG are expanding the global reach of their respective FAST (Free Ad-Supported Streaming TV) platforms, Samsung TV Plus and LG Channels. Their strategy is to generate revenue by providing free content across hundreds of millions of TVs worldwide while running advertisements.

Competition for fresh content to power these platforms is intensifying. In May, Samsung TV Plus partnered with SM Entertainment to launch the industry’s first “SMTOWN” channel, and last year it exclusively livestreamed the Everland panda cubs Huibao and Ruibao’s first birthday party, broadening user engagement with diverse formats. LG, meanwhile, has announced plans to invest USD 714 million by 2027 to secure premium content, underscoring its commitment to strengthening its FAST offerings.

Comment