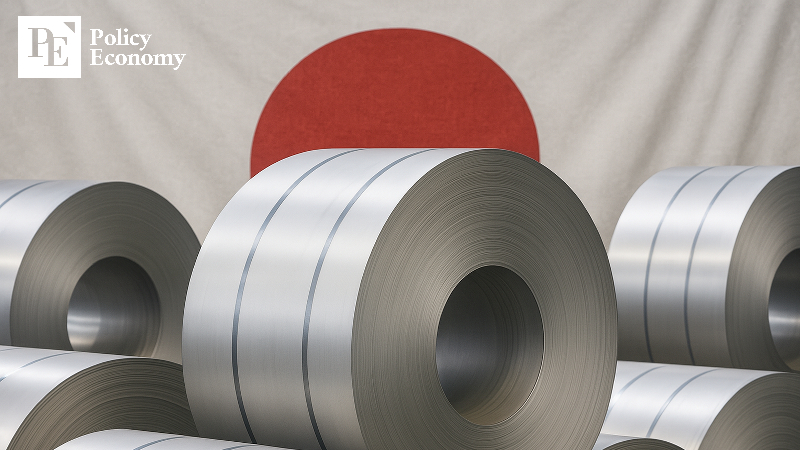

Japan Initiates Anti-Dumping Probe into South Korean and Chinese Galvanized Steel Sheets amid Domestic Industry Complaints

Input

Modified

Intensifying Race to Protect Domestic Steel “Japan Launches Anti-Dumping Probe into South Korea, China” Four Firms Including Nippon Steel and Kobe Steel File Complaint

Competition to safeguard domestic steel industries is intensifying, with Japan moving to launch a formal anti-dumping investigation into hot-rolled galvanized steel sheets imported from China and South Korea. Japanese steelmakers have reported that an influx of low-priced imports has eroded prices and profitability, underscoring the need for tariff measures. Industry observers in Seoul note that Tokyo’s announcement comes immediately after the Korean government issued a preliminary determination to impose anti-dumping duties on Japanese hot-rolled steel plates—raising speculation that the move amounts to a retaliatory response.

Nippon Steel “South Korea Also Exporting Surplus Products”

According to Bloomberg and other sources on the 12th (local time), Japan’s Ministry of Economy, Trade and Industry and Ministry of Finance jointly announced the launch of an anti-dumping investigation into imports of hot-rolled galvanized steel sheets, plates, and strip products from China and South Korea. The measure follows an April petition by four domestic steel producers, including industry leaders Nippon Steel and Kobe Steel, claiming that an influx of low-priced foreign steel has depressed domestic prices and caused operational losses.

The ministries last month also initiated an anti-dumping investigation into nickel-based stainless cold-rolled steel strips and plates from China and Taiwan. If it is determined that these imports are sold in Japan at prices lower than in the exporting countries’ home markets, thereby damaging domestic industry, anti-dumping duties equivalent to the price gap will be imposed.

China, the world’s largest steel producer, has ramped up exports as domestic demand plunged in the wake of its property market downturn. With U.S. tariffs constraining access to the American market, Beijing has sought to diversify its export destinations. Following the lead of the United States, Japan is moving to closely scrutinize potential dumping in order to protect its steel sector. The investigation is expected to conclude within a year, with duties imposed if warranted.

According to the Japan Iron and Steel Federation, Japan’s imports of general steel products in 2024 rose for the fourth consecutive year, exceeding 5 million tons for the first time since 1997. Nippon Steel contends that South Korea, which also imports steel from China, has been re-exporting excess volumes in a “chain reaction” pattern. Japanese authorities stated they would solicit stakeholder feedback and allow the submission of evidence before reaching a final determination, emphasizing that the positions of Chinese and Korean producers would also be considered.

Japan Engaged in Years of Discounted Sales to Korea

South Korea’s steel industry views the investigation as a countermeasure to last month’s decision by Seoul to impose anti-dumping duties on Japanese alloy steel hot-rolled plates. According to the Ministry of Trade, Industry and Energy’s Trade Commission, from January to December 2023, Japan’s domestic hot-rolled steel plate prices (based on data from Japan’s Nikkan Kogyo Shimbun, converted to monthly dollar averages) averaged $208 higher than the prices at which South Korea imported them (based on Korea Iron & Steel Association figures). In other words, Japanese steelmakers exported to Korea at prices averaging 25.4% below their domestic market levels.

In January 2023, Japan’s domestic hot-rolled steel plate price stood at $998 per ton, while Korea imported the same product at $551 per ton—a $447 per ton, or 44.8%, discount. Although export prices typically trail domestic prices by one to two months, such a gap was viewed as abnormally large.

Trade Ministry Imposes Provisional Anti-Dumping Duties of Up to 33.57% on Japanese Hot-Rolled Steel

While the price gap narrowed in 2024 as Japanese steel prices fell, the difference between domestic and Korea-bound export prices remained over $160 per ton on average. Industry sources noted that Japanese steelmakers, faced with sluggish domestic demand, actively targeted the Korean market—where trade barriers were minimal. When calls for anti-dumping measures grew louder in early 2023, Japanese export offers to Korea briefly rose in the first quarter of 2024, only to revert to discounted levels thereafter.

For instance, in January 2024, Japan’s domestic hot-rolled steel plate price was $770 per ton, compared with an import price to Korea of $596—a $174 per ton (22.6%) gap. In February, the gap was $133 (17.8%), followed by $123 (17%) in March, and $100 (13.8%) in April. By the second half of 2024, the gap widened again, despite Japanese industry pledges—made through bilateral private-sector consultations—to maintain fair pricing. Dumping resumed at discounts exceeding 20%.

South Korean steelmakers filed a request for an anti-dumping investigation earlier this year. The Trade Commission promptly initiated proceedings, and on July 24 convened to deliberate and resolve the matter. It issued a preliminary determination that dumping had occurred and caused material injury to domestic industry in both hot-rolled steel plates and single-mode optical fiber. To prevent further harm during the final investigation, the Commission recommended to the Ministry of Economy and Finance the imposition of provisional anti-dumping duties of 28.16%–33.57% on hot-rolled steel plates and 43.35% on optical fiber. Under Korea’s trade remedy system, the Trade Commission conducts the investigation and makes recommendations, while the Finance Ministry implements the duties.