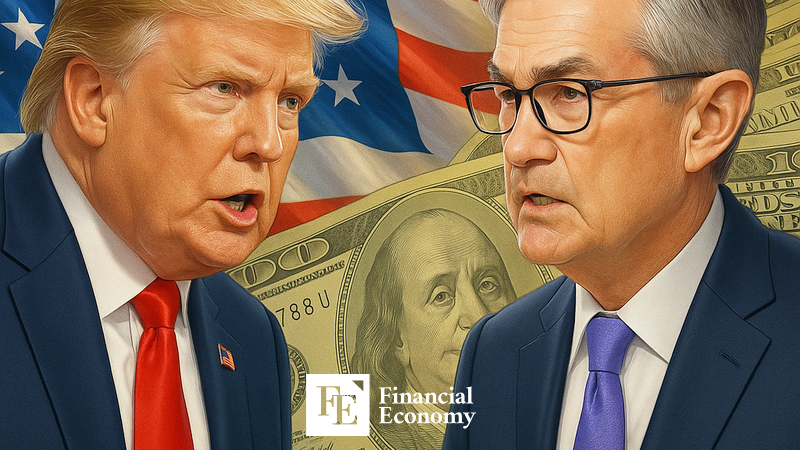

Trump Administration Presses Fed for September Rate Cut, Putting Powell’s Hawkish Stance to the Test

Input

Modified

Treasury Secretary Bessent: “Fed should deliver a big cut in September” “Cuts should have happened in June or July — delayed action” “Don’t focus solely on inflation while overlooking labor market weakness”

With the Federal Reserve deliberating whether to lower the benchmark rate in September, the Trump administration’s calls for monetary easing are intensifying. President Donald Trump has escalated pressure on Fed Chair Jerome Powell — widely viewed as a monetary hawk — urging his early resignation, while Treasury Secretary Scott Bessent has demanded a 0.5 percentage point rate cut. Citing the recent large-scale downward revisions to U.S. labor statistics by the Bureau of Labor Statistics (BLS), Bessent argued that rate reductions should have already occurred in June or July, and that the delay has been costly.

Trump: “Delayed rate cuts have dealt heavy damage to the U.S. economy”

On the 12th (local time), Bessent told Fox Business, “The Fed should remain open to the possibility of a big cut” and urged the Federal Open Market Committee (FOMC) to consider a 0.5 percentage point reduction in September. He pointed to labor market weakness as the basis for his stance. “If the real numbers had been available on time, the Fed would have cut rates in June or July,” he said, adding, “While data quality issues are a matter to be discussed later, the real question right now is whether the Fed will implement the delayed rate cut in September.”

Bessent also dismissed inflation fears tied to President Trump’s tariff policies, calling the consumer price index (CPI) figures “fantastic.” That same morning, President Trump also pressured the Fed to cut rates. On his social media platform Truth Social, he wrote, “Chair Powell’s delay in cutting rates has inflicted serious harm on the U.S. economy” and declared, “We need to lower rates now.” He further stated that he was “considering a major lawsuit against Powell” in connection with renovation work at Fed headquarters, a move seen as an attempt to force Powell’s early departure.

The FOMC meeting at which the Fed will decide on a rate cut is scheduled for September 16–17. If Stephen Myron, the White House National Economic Council Director recently nominated as a Fed governor, is confirmed by the U.S. Senate, the likelihood of a September cut is expected to rise. Bessent expressed optimism about Myron’s appointment, saying, “I hope Chairman Myron is swiftly confirmed by the Senate. He is prudent, methodical, and holds strong views on the Fed, making him a valuable voice on matters such as rate cuts.”

July nonfarm payroll growth falls short of expectations

Criticism of the Fed’s rate policy is not confined to the Trump administration. Within the Fed, Vice Chair Michelle Bowman has argued for three rate cuts over the remaining FOMC meetings this year, citing limited risks of both labor market deterioration and rising inflation. On August 11, the Wall Street Journal also warned, “The U.S. economy faces a more urgent problem than inflation” and criticized the Fed for “heading in the wrong direction entirely.” The paper accused the central bank of being fixated on inflation while ignoring more pressing issues such as labor market weakness and a housing market collapse.

The recent revisions to labor statistics by the BLS have fueled the debate. Updated figures for May and June show job gains for the two months were slashed from 291,000 to just 33,000 — a downward adjustment of 258,000. This is the largest such revision since records began in 1979, excluding the immediate aftermath of the COVID-19 pandemic in 2020. July’s labor data was also weak: nonfarm payrolls grew by just 73,000, well below the market forecast of 110,000.

Alongside labor market softening, the most acute risk facing the U.S. economy is the housing market downturn. With mortgage rates nearing 7%, the market has cooled sharply. Home sales remain sluggish: new single-family home sales in June edged up 0.6% from the prior month to an annualized rate of 627,000 units. While slightly higher than May’s 623,000, the figure fell short of the market’s expectation of 650,000. The inventory of unsold homes climbed to 511,000 — the highest since 2007 — and it is estimated it would take 9.8 months to clear the current supply.

July inflation rises 2.78%, pace accelerates from previous month

Compounding the challenges, inflation is showing signs of renewed momentum. On the 12th, the Department of Labor reported that July CPI rose 2.78% year-on-year, slightly faster than June’s 2.7% increase. Core CPI, excluding volatile food and energy prices, climbed 3.1% from a year earlier and was up 0.3% from the prior month. This inflation report reflects conditions roughly two months after President Trump announced reciprocal tariffs on April 2, dubbed “America’s Liberation Day,” and markets view it as evidence that tariff effects are now being fully priced in.

As the last inflation reading before the September FOMC meeting, July’s CPI points to the potential for further price pressures. This is expected to intensify the internal Fed debate over rate cuts. JPMorgan noted, “The impact of tariffs is driving broad-based price increases, and sectors such as hotels, airlines, and healthcare are also seeing gains — confirming summer price hikes that Chair Powell and other policymakers had warned about. CPI, PPI, retail sales, and jobless claims all continue to support the hawkish case.”

Still, some in the financial sector warn against focusing solely on inflation, stressing that once a recession takes hold, recovery to a normal growth path can take a prolonged period. Hitting the Fed’s inflation target precisely is seen as virtually impossible, with a growing consensus that price growth within a 1–3% range is acceptable. Some analysts also predict that the Trump administration’s fiscal austerity could offset part of the tariff-driven price increases. By curbing household spending while shifting more of the tax burden to foreign producers through tariffs, the policy could ultimately aid in stabilizing prices.