U.S. September Rate Cut Seen as Near-Certain Amid Easing Inflation, Calls for ‘Big Cut’ Intensify

Input

Modified

U.S. July CPI rose 2.7%, below expectations Futures market prices in 96% probability of 25bp cut Treasury Secretary Bessent presses for 50bp “big cut”

The July U.S. inflation print, coming in within the expected range, has all but cemented expectations for a September federal funds rate cut. While core inflation—which hit its highest level since February—still reflects an uncertain tariff impact, the futures market has now priced in a 100% probability of a cut. This has emboldened the Trump administration’s pressure campaign on the Federal Reserve to ease policy, reversing the balance of power in the tug-of-war between the White House and the Fed in the wake of July’s employment and inflation data.

Bessent: ‘Fed Should Consider 50bp Cut’

On August 13 (local time), U.S. Treasury Secretary Scott Bessent told Bloomberg TV’s Surveillance that the Fed could “enter a rate-cutting cycle starting with a 50-basis-point reduction at the September meeting,” adding, “By any model, the federal funds rate should be 150–175 basis points lower than it is now.” If implemented, such a “big cut” would be the first since September last year. He further noted, “The Fed could have cut rates in June or July, but at the time, the revised employment data was not available.” His remarks referred to recently released revisions showing that May and June payroll gains were weaker than initially reported, following the Fed’s July 30 decision to keep the policy rate steady at 4.25–4.50%.

It is unusual for a Treasury Secretary to comment so explicitly on the Fed’s prospective policy path; until now, Bessent had confined his remarks to past policy decisions. In an interview with Fox Business the day before, he had already stated, “The real question we must grapple with now is whether to cut rates by 50 basis points next month.” That statement came just one day after he called for a half-point cut at the September FOMC meeting, followed on the 13th by a demand for cumulative reductions of 150–175 basis points.

Inflation Rises Just 0.3%, Tariff Impact Limited

Bessent’s remarks came directly after the release of U.S. Consumer Price Index (CPI) data. On August 12, the Bureau of Labor Statistics (BLS) reported that CPI rose 2.7% year-on-year in July, 0.1 percentage point below the consensus estimate of 2.8%, and matching the June increase. Core CPI—which excludes volatile food and energy prices—rose 3.1% over the same period, slightly above expectations of 3.0%.

July’s inflation moderation was largely driven by energy costs, which fell 1.1% from the prior month. This helped keep price increases for food (0.0%), shelter (+0.2%), apparel (+0.1%), and household goods (+0.7%) contained. Stephen Juneau, economist at Bank of America, noted, “Consumers are likely feeling relief as price pressures on the most common and essential purchases ease.”

Analysts said the impact of tariffs on inflation remains unclear. In June, prices for tariffed consumer staples such as appliances (+1.9%), toys (+1.8%), footwear (+0.7%), and apparel (+0.4%) had posted sharp monthly gains. However, in July, those same categories saw either reduced price growth or outright declines—appliances (-0.9%), toys (+0.3%), footwear (+1.4%), and apparel (+0.1%)—prompting Bloomberg to conclude that “the picture remains murky.”

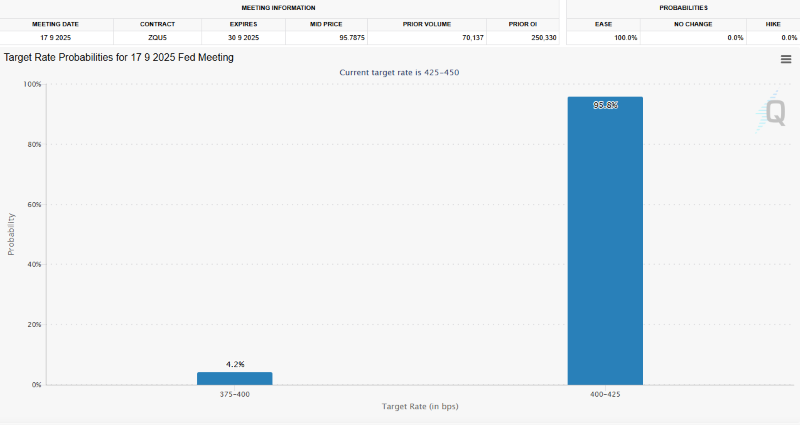

CME FedWatch: 95.8% Probability of 25bp Cut

With consumer inflation stabilizing after overshooting forecasts in June, market expectations for a rate cut at the September 16–17 FOMC meeting have surged. While tariff policy remains a risk factor, the sharply revised-down job gains in May and June have strengthened calls for economic stimulus. Combined with a stable inflation profile, the case for easing has grown. The Fed last cut rates by 50 basis points in September 2024, initiating its first easing cycle in four and a half years, but has held the policy rate steady since December.

According to the CME FedWatch Tool, federal funds futures markets have priced in a zero probability of a September hold, effectively assigning a 100% chance to a cut. The dominant scenario now is a 25-basis-point reduction, with the probability reaching 95.8% as of 1:00 p.m. KST on August 14—up from 93.9% the previous day. The persistent public pressure from Trump administration officials on the Fed has reinforced these expectations.

Among major global investment banks, Citigroup, Goldman Sachs, HSBC, Nomura Securities, and UBS forecast that the current 4.50% upper bound of the target range will be lowered to 4.25% in September. Notably, Goldman Sachs, in an August 13 report, projected that the Fed will deliver three consecutive 25-basis-point cuts in September, October, and December, followed by two more early in 2026—bringing the federal funds rate down from the current 4.25–4.50% to 3.00–3.25%. This represents an expansion in both the expected pace and magnitude of easing compared with prior forecasts.