Targeting ‘Dopamine Addiction’ with Fast-Paced Storytelling, China’s ‘Micro Dramas’ Surge in the U.S.

Input

Modified

Chinese Micro-Drama Boom User base climbs 7% to 660 million Generates billions in U.S. revenues

Micro dramas, each lasting around two minutes per episode, are sustaining explosive growth in China and emerging as a key instrument of soft power. In these fast-moving narratives—where couples break up, reincarnate, and marry again in the blink of an eye—the format has precisely aligned with the time perception and emotional triggers of mobile-native audiences, reshaping content consumption patterns in the U.S. and beyond.

Most Revenues Flow from the U.S.

According to the South China Morning Post (SCMP) on the 17th, Chinese micro dramas have recently achieved meteoric growth in the U.S., disrupting established entertainment markets and commanding attention as a new cultural phenomenon. The format first appeared in China in 2018, with the National Radio and Television Administration adding it to the official review system in 2020. Since 2022, the sector has expanded at breakneck speed.

The China Netcasting Services Association (CNSA) reported that by the end of last year, the number of micro-drama users reached 662 million, up 7.3% from the first half of the year, generating $7.02 billion in revenues—surpassing the entire Chinese box office. Chinese platforms are also securing strong footholds overseas, with ReelShort overtaking TikTok as the most-downloaded app in the U.S. in November 2023.

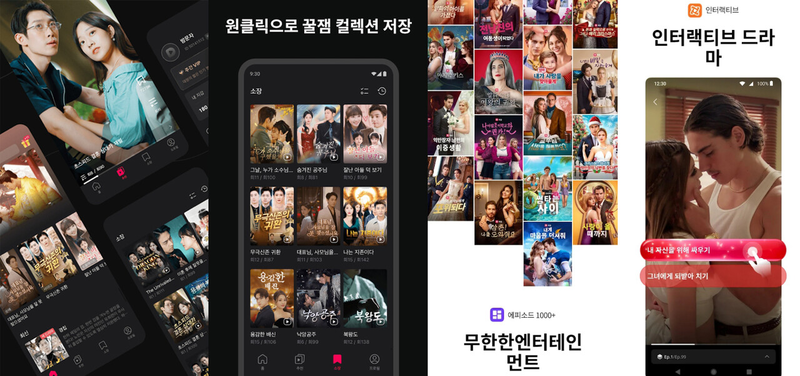

Dozens of Chinese micro-drama platforms are now competing globally, with ReelShort, DramaBox, and GoodShort emerging as frontrunners. The U.S. is the largest buyer, accounting for 49% of global revenues. ReelShort and DramaBox dominate the sector, posting $130 million and $120 million, respectively, in in-app purchase revenues in Q1 2025. One standout hit, The Double Life of My Billionaire Husband directed by Xiang Xining, racked up more than 485 million views on ReelShort in the U.S. alone.

Addictive, Short-Form Narratives of Love, Revenge, and Identity Shifts

Micro dramas are ultra-short series built on high-intensity emotions and relentless plot twists. Episodes run for just one to two minutes, typically filmed in vertical format, aligning with the mobile-first consumption habits established by TikTok and Douyin. The storylines revolve around love, betrayal, revenge, forbidden identities, sudden reversals of fortune, and rapid ascents to success.

Although the plots may appear exaggerated or formulaic, the use of “cliffhangers every minute” sustains an addictive engagement loop. “Chinese micro dramas are designed to satisfy the appetite for instant gratification,” explained Sima Shah, VP of Research & Insights at Sensor Tower, in an interview with CNBC last month. “The key is delivering emotional payoff immediately. The exaggeration, if anything, adds to the appeal.”

Viewers typically get a few free episodes before hitting a paywall, after which full viewing can cost more than $10 per series—exceeding Netflix’s monthly subscription fee. Nevertheless, audiences are willing to pay. Between 2021 and 2023, the Chinese micro-drama market grew tenfold, and it is projected to reach $14 billion by 2027.

Reshaping Content Production and Consumption

Micro dramas also benefit from highly efficient production models. While traditional TV dramas may take months or years to complete, these apps can roll out 8–10 original dramas per month, surpassing 100 annually. From concept to final cut, production takes only about two months, often relying on unknown actors at costs as low as $20,000 per series. Increasingly, artificial intelligence is being deployed to streamline both timelines and budgets.

Such advantages are drawing major Chinese corporations into the sector. Douyin, the Chinese counterpart of TikTok, now regularly showcases micro dramas, while Tencent and Baidu are stepping up investments, particularly in the U.S. market. To capture Western audiences, many micro dramas are produced in Los Angeles directly in English. While revenge sagas and tales of corporate intrigue remain staples, American viewers show strong preference for fantasy themes involving werewolves and vampires.

Hollywood is beginning to respond. Netflix has introduced a vertical mobile feed, while Disney has announced plans to invest in DramaBox through its accelerator program. “Since short-video apps like TikTok have fundamentally reshaped entertainment consumption, it’s only a matter of time before more Western studios join in,” said director Xiang. Micro dramas are also creating opportunities for independent U.S. creators, particularly as Hollywood strikes have left many without work. Xiang himself turned to micro-drama production after struggling to find employment in Hollywood.