Government Orders ‘Self-Restructuring’ in Petrochemical Sector Facing Collective Collapse—All Stick, No Carrot

Input

Modified

Restructuring Left to Corporate Autonomy Government: “Submit Consolidation Plans” Industry: “A Stopgap That Shifts Burden to Companies”

The government has drawn its sword in a bid to rescue the domestic petrochemical industry, now on the brink of collapse. The core initiative is to reduce naphtha cracking capacity (NCC) by up to 25% in order to counteract the competitiveness lost amid a supply glut from China, while simultaneously paving the way for a transition toward high value-added specialty products. Yet critics argue that no long-anticipated “big deal” has emerged, with authorities focusing solely on demanding painful restructuring from companies. By emphasizing punitive measures without incentives, the government is accused of pushing the industry once again into a destructive price war.

Policy: Self-Help First, Government Support Later

On the 20th, Deputy Prime Minister and Minister of Economy and Finance Koo Yoon-cheol announced at the Industrial Competitiveness Enhancement Ministers’ Meeting (SanKyungJang) held at the Seoul Government Complex that “a business restructuring agreement involving ten major petrochemical companies has been signed” and that “each firm will submit detailed restructuring plans by the end of the year.” This was the first such meeting convened under the Lee Jae-myung administration, with petrochemicals topping the agenda among distressed sectors.

Koo stressed that “only cutting excess capacity and fundamentally enhancing competitiveness can ensure survival,” setting a target to reduce NCC output by up to 3.7 million tons, equivalent to 18–25% of the nation’s total naphtha production of 14.7 million tons. He admonished industry players, saying, “Despite clear warnings of global oversupply, companies, intoxicated by past booms, expanded capacity while neglecting high-value transformation. Now they must embark on restructuring with a do-or-die determination.”

That same day, the Ministry of Trade, Industry and Energy held a “Petrochemical Industry Restructuring Accord” at the Korea Chamber of Commerce and Industry in Seoul, formalizing three key directions: △capacity reduction and transition toward specialty products △financial soundness △minimization of impact on regional economies and employment. The plan calls for simultaneous restructuring across the three major petrochemical clusters—Yeosu, Daesan, and Ulsan—and promises timely provision of financial, tax, and regulatory support if companies’ self-help measures are deemed credible.

Authorities underscored that only companies voluntarily participating in the restructuring will receive tailored assistance, while those opting out of capacity cuts or plant adjustments will be excluded. “Companies and controlling shareholders must submit genuine, self-sacrificial plans,” Koo said, warning, “Firms seeking to free-ride will face firm consequences.” The government intends to convene SanKyungJang meetings regularly to monitor restructuring progress and closely track companies’ financials and self-help efforts.

Government Demands “Restructuring Without Job Cuts”—But Offers No Tangible Support

While this marks the formal launch of petrochemical restructuring, industry players criticize the administration for once again postponing concrete measures until year-end, effectively resetting the clock to last December when it first unveiled “Petrochemical Industry Competitiveness Enhancement Measures.” Despite promising incentives back then, little has materialized, and critics argue the golden window for restructuring is slipping away.

Moreover, a consulting report commissioned by the Korea Chemical Industry Association and submitted to the ministry last March remains shelved without concrete follow-up. Other than hosting a forum at the National Assembly earlier this month on “Industrial Restructuring through Petrochemical Reform,” no substantive steps have been taken. Rumors abound that the report has been “sealed,” its contents suppressed, or that discrepancies exist between government and industry submissions. Even the limited information revealed publicly was seen as reiterating previously known ideas without fresh substance.

The latest initiative is further clouded by controversy, as it effectively demands restructuring while minimizing workforce reductions. Plant consolidation and restructuring inevitably entail job cuts, but a progressive administration emphasizing “labor-friendliness” finds such measures politically costly. The petrochemical industry employs roughly 400,000 across the value chain—213,000 in rubber and plastics, 170,000 in other chemical manufacturing, 12,000 in chemical fiber production, and 11,000 in petroleum refining. NCC restructuring, therefore, risks detonating a second economic shock across the chemical ecosystem and regional economies. The country has already lived through a similar episode in shipbuilding, where job cuts were unavoidable but, through consolidation and a pivot to high-value vessels, the sector eventually rebounded, entering a second growth phase through collaboration with the United States.

Restructuring Rests with Private Companies—Strong Incentives Needed

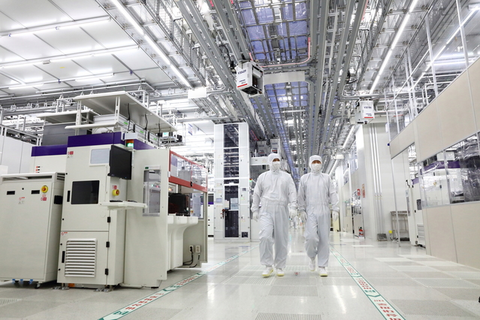

The malaise in the domestic petrochemical industry is plain: capacity has surged, but demand has stagnated. Since the 2020s, not only China but also Middle Eastern producers have engaged in aggressive capacity expansion, driving profitability into freefall. Despite years of warning signals, firms lulled by inertia and past prosperity failed to act, and with demand weakening further, the sector has slid into a prolonged downturn. Average utilization rates at major petrochemical facilities have plunged below 60%, and Yeochun NCC—a joint venture that once generated more than $700 million in operating profit—has teetered on the brink of insolvency.

Yet while the government views inter-company plant consolidation (vertical integration) as the most realistic reform path, it has left capacity-reduction methods and timelines to companies’ discretion, reaffirming that there will be no government-orchestrated “big deal.” Industry voices argue this merely shifts responsibility onto companies without offering concrete alternatives. “Every firm’s interests are different, and information-sharing among them risks antitrust penalties,” said one industry official. “With cash flow dried up amid deep recession, the government’s insistence on self-restructuring without clear guidelines amounts to an empty declaration.” Yeosu, the country’s largest petrochemical cluster, is particularly tangled, housing giants such as Lotte Chemical and LG Chem. Meanwhile, Yeochun NCC, co-managed by Hanwha and DL, has repeatedly faced delayed decision-making and shareholder disputes during downturns.

Industry representatives insist the government must at least establish restructuring guidelines through consultation with multiple companies. They call for regulatory exemptions, such as waivers on collusion rules, and direct subsidies as restructuring incentives. Some suggest invoking Article 40, Clause 2 of the Fair Trade Act, which allows relaxation of merger review standards for restructuring aimed at overcoming recessions—a provision untouched in the past 36 years. Experts likewise stress that firms bold enough to cut away failing assets deserve decisive financial support and regulatory relief. They add that the hazardous nature of heavy chemical industries demands ongoing regulatory adjustments, and that employment measures stemming from restructuring should be reasonably negotiated with both industry and labor stakeholders.