"AgTech as the Vanguard of Future Agriculture" AI Farm Robots Slash U.S. Field Labor Hours by 70%

Input

Modified

United States Sees Rapid Expansion of AI- and Robotics-Based Smart Farming Adoption of Robots Mitigates Labor Shortages Market Projected to Reach $188 Billion by 2036

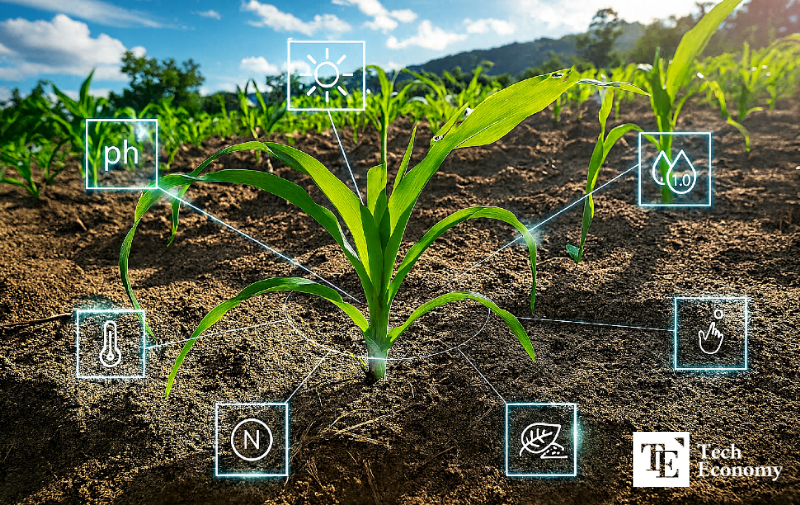

U.S. agriculture is undergoing rapid transformation on the back of artificial intelligence (AI) and robotics. While the sector has long relied on mechanization, the advent of autonomous tractors, precision-farming technologies, and robotic harvesters—collectively known as “AgTech”—is reshaping farming into a far more advanced and disruptive industry.

AI Farm Robots Delivering Breakthrough Efficiency

On August 25 (local time), the Epoch Times reported that AI robots are emerging as a new solution for an industry historically dependent on foreign labor. Roman Rylko, Chief Technology Officer of the agricultural robotics developer Pynest, stated, “Our autonomous weed-removal robot can cover 50 acres (about 200,000㎡) in just eight hours.” He added, “This used to require ten workers working two full days. Farmers have cut seasonal manual weeding hours by roughly 70%.”

Citing recent trials, Rylko noted, “The AI robot eliminated 1.6 million weeds in a single day—equivalent to the work of twelve laborers—and reduced per-acre costs by 32%.” He emphasized consistency as the most impressive feature: “Unlike seasonal laborers, robots don’t call in sick, even during peak weed season.”

Joe McGee, CEO of Harvest CROO Robotics, which partners with strawberry grower Wish Farms, underscored the value in specialty crops: “Strawberries, one of the most labor-intensive crops, must be harvested every three days. Our AI harvester accomplishes the work of 25 people in just 16 hours.” Roughly the size of a shipping container, the machine uses cameras to navigate rows, robotic arms to pluck ripe strawberries, weigh them, and pack them directly.

McGee highlighted AI’s advantage in quality control: “Human error rates in harvesting average around 10%, but AI reduces that to zero. Seasonal workers are motivated by volume-based earnings, which doesn’t always align with retail-grade quality. If produce fails to sell, farmers incur heavy losses.” According to the USDA, 3% of produce is discarded during packaging due to quality downgrades, and another 18% is lost before reaching retail. “Our AI harvester inspects and weighs fruit immediately after picking, ensuring only market-ready strawberries are packed, minimizing waste for farmers,” McGee explained.

AgTech Era Draws Influx of High-Skilled Talent

This leap in farming is not confined to technological advancement; it is fundamentally reshaping the labor pool. Long regarded as a “low-skill” sector, U.S. agriculture is now drawing a surge of high-skilled professionals. Software engineers, data scientists, and roboticists are increasingly joining agricultural start-ups and large-scale agribusinesses, accelerating innovation across the sector.

The global agricultural robotics market is on a steep growth trajectory. According to Research Nester, the market, valued at $13.44 billion in 2023, is projected to reach $188 billion by 2036, expanding at a compound annual growth rate (CAGR) of 22.5%. Fortune Business Insights provides a similar outlook, forecasting growth from $7.33 billion in 2024 to $26.33 billion by 2032 at a CAGR of 18.3%.

The United States leads the field, commanding 38.55% of the global market in 2024. Bolstered by government support and cutting-edge innovation from major equipment manufacturers, the U.S. has emerged as the hub of AgTech development. Silicon Valley, in particular, has become a focal point, with even newcomers entering agriculture equipped with advanced technical skill sets. With infrastructure already predicated on technological sophistication, labor inflows naturally skew toward tech talent—an essential factor underpinning America’s global dominance in AgTech. By contrast, while Europe and Asia increasingly recognize the imperative of agricultural automation, they lag in both talent concentration and capital intensity.

Driving a Transformation in Large-Scale U.S. Farm Operations

The most widely adopted AgTech innovations in the United States today can be grouped into three categories: the development and deployment of autonomous tractors and machinery; the application of precision farming and drones; and AI-driven greenhouse and harvesting automation. John Deere has unveiled the 9PX autonomous tractor equipped with AI-based camera technology, while AGCO, after developing an “autonomous grain cart” solution, has succeeded in enabling tractors to move automatically during harvest. Kubota has introduced robotic crop transporters and AI-powered autonomous sprayer systems.

Hylio has developed high-speed autonomous spraying drones, Carbon Robotics has implemented AI-driven systems for weed removal and soil analysis, and Burro has combined LiDAR with machine learning to deliver collaborative robots that automate on-farm logistics. Organifarms has succeeded in developing autonomous greenhouse harvesters capable of non-contact precision picking of premium-quality fruit.

Bloomfield Robotics, meanwhile, has advanced AI-enabled data analytics platforms for crop growth monitoring and agricultural automation. These technologies are viewed as critical not only for alleviating labor shortages but also for creating efficient operating models that enable farms to adapt to climate change.

The deployment of AI agricultural robots thus extends beyond merely filling labor gaps; it is redefining the very structure of the agricultural workforce. The traditional model reliant on low-wage seasonal labor is steadily receding, replaced by a paradigm in which robots and software constitute the baseline labor force. Experts argue that this shift enhances the stability of agricultural productivity while reducing sources of labor conflict. Issues such as dependence on undocumented migrant labor or wage negotiations are expected to diminish progressively as technological substitution accelerates.