U.S. Employment Gains Halved, Labor Market Cooling Reinforces Rate-Cut Outlook

Input

Changed

910,000 Jobs Wiped Out in Revision Largest Downward Adjustment in 23 Years Fed Poised for Rate Cut at This Month’s FOMC

U.S. employment conditions have proven weaker than initially assessed, as government data revisions revealed more than 910,000 fewer jobs were created over the past year than previously reported. The scale of the downward adjustment, the steepest since 2002, has heightened expectations that the Federal Reserve may soon move to cut interest rates. Markets have already priced in a 25-basis-point reduction at next week’s Federal Open Market Committee (FOMC) meeting, with growing speculation of a larger 50-basis-point cut in October.

Labor Department’s Major Revision

On September 9, the Bureau of Labor Statistics (BLS) said in its preliminary benchmark revisions that payrolls from April 2024 to March 2025 were 911,000 jobs, or 0.6%, below earlier estimates. This marks the largest downward revision in 23 years. Original figures had indicated employers created about 1.8 million jobs during that period on a non-seasonally adjusted basis. The revised data suggest average monthly job gains were only half that amount.

The revisions affected nearly all sectors. Retail trade posted the sharpest cuts, followed by leisure and hospitality, professional and business services, and manufacturing. Specifically, employment in leisure and hospitality was revised down by 176,000, while professional and business services fell by 158,000.

The figures are preliminary and final revisions will be released in February. Until then, further adjustments remain possible. If confirmed, average monthly job gains would shrink from 147,000 to about 70,000. BLS compiles employment data from surveys of about 121,000 businesses, cross-checked against unemployment insurance filings, which are often delayed and subject to later corrections.

“Job Market Slowdown Already Underway”

The revisions suggest that the recent slowdown in hiring is not a sudden development but rather a continuation of a weaker trend over the past year. Although the updated data do not reflect conditions since March, they imply the labor market was already losing momentum even before President Donald Trump’s tariff policies took effect.

The scale of the adjustment has fueled political controversy. Trump last month abruptly dismissed BLS Commissioner Erica MacEntee, and he previously criticized similar revisions under former President Joe Biden as evidence of economic mismanagement. After the latest announcement, White House Press Secretary Caroline Levitt said, “Today’s report from BLS marks the largest downward revision on record and proves President Trump was right. Biden’s economy was catastrophic, and BLS was broken.” Still, Fed officials and economists had already signaled expectations for weaker job growth. Fed Chair Jerome Powell noted last month that employment levels would be “substantially revised downward.”

September and October Cuts Expected

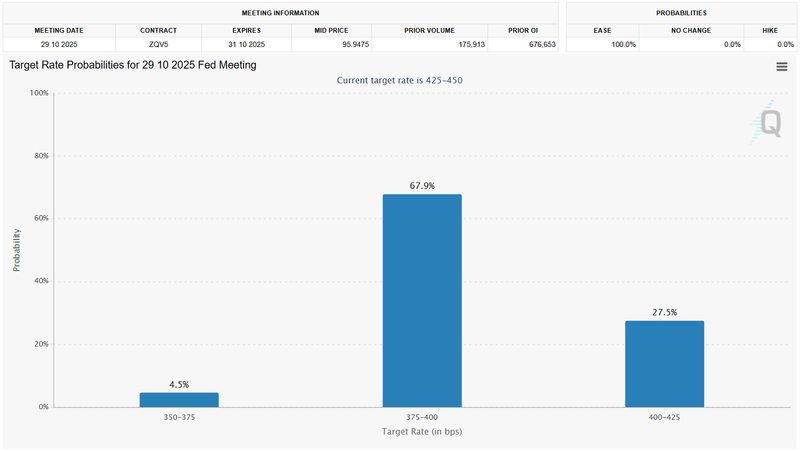

Concerns over labor-market weakness have solidified market bets on a September rate cut. According to CME FedWatch, futures markets assign a 93.7% probability to a 25-basis-point reduction at the September 16–17 meeting, with a 6.3% chance of a 50-basis-point move. Before the release of the August jobs report, the probability of a half-point cut was effectively zero, but signs of cooling employment have pushed expectations sharply higher.

Futures also price in a 67.9% likelihood of a 50-basis-point cut at the October FOMC. While markets see a strong chance of a third cut in December, expectations for a fourth reduction by January have slipped below 40%. Sal Guatieri, senior economist at BMO Capital Markets, said, “For the year through March, the labor market was much weaker than BLS initially estimated. That gives the Fed one more reason to cut rates next week.” Ian Lyngen, another BMO economist, added, “It depends on the August inflation data, but the Fed will plan on a 25-basis-point cut, and if inflation prints within forecasts, a 50-basis-point move will be on the table.”

Comment