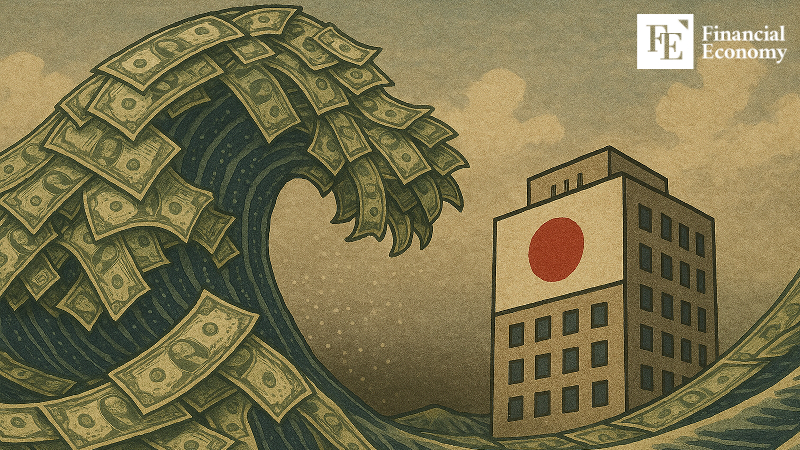

As Foreign Deals Surge, Is Japan Moving Toward a Finance-Centered Economy?

Input

Changed

Japanese Firms Sold Off to Foreign Capital One After Another SoftBank and Others Step Up Overseas Acquisitions Is Japan Abandoning Manufacturing to Follow America’s Path of “Financialization”?

A new wave is sweeping Japan’s mergers and acquisitions market. Foreign firms are increasingly targeting Japanese companies, while Japanese corporations themselves are stepping up overseas acquisitions—signaling a turning point for the country’s industrial landscape.

Japan’s M&A Barriers Come Down

According to a Bloomberg report on the 8th, foreign firms proposed 193 takeovers of Japanese companies last year—either by acquiring a majority stake or making them wholly owned subsidiaries. That figure marks the highest since records began in 1998. From January through the end of August this year, 157 such deals had already been proposed, putting the market on track to break records once again.

Analysts point to new M&A guidelines from the Japanese government as a key factor behind this surge. In August last year, the Ministry of Economy, Trade and Industry issued rules encouraging companies not to reject legitimate acquisition proposals outright, but to review them carefully. This effectively curbed the longstanding practice in Japanese industry of blocking foreign capital with vague justifications such as “incompatibility with corporate culture.” Shigeru Matsumoto, a professor at Kyoto University’s Graduate School of Management, explained, “In the past, if the target company’s management rejected an offer, that was the end of it. But governance reforms and the new guidelines have made such summary rejections virtually impossible.”

The historic weakness of the yen and Japanese firms’ inadequate takeover defenses are also fueling the trend. Ulrike Schaede, a professor at the University of California, San Diego who specializes in Japanese corporate studies, said, “The weak yen has created many undervalued deals in Japan. At the same time, two decades of corporate governance reform have stripped Japanese companies of their defensive tools. They are essentially naked, with no weapons left.”

Outbound M&A Surges

Japanese companies are also ramping up their outbound acquisitions. According to S&P Global, Japan’s outbound M&A deals totaled $50.2 billion last year—nearly double the $28.9 billion in inbound M&A involving Japanese companies. By sector, the largest outbound deals were in financial services ($24.9 billion), information technology ($6.8 billion), consumer discretionary ($5.5 billion), healthcare ($3.9 billion), and materials ($3.8 billion).

This outbound wave has continued into 2024. In February, Meiji Yasuda Life Insurance—one of Japan’s four major life insurers—announced it would acquire the U.S. operations of Legal & General for about $2.3 billion. The move is aimed at tapping into overseas insurance markets to offset Japan’s aging demographics and prolonged low interest rates, while diversifying and stabilizing revenues.

In March, SoftBank Group, the majority shareholder of U.K.-based chip designer Arm, revealed plans to acquire U.S. semiconductor firm Ampere Computing for $6.5 billion. SoftBank said in a press release that it would purchase all of Ampere’s shares through its subsidiary Silver Banz6, with the deal expected to close in late 2025 pending U.S. regulatory approval. Once completed, Ampere will become an indirect wholly owned subsidiary of SoftBank. Analysts see the acquisition as a strategic move to leverage Ampere’s large-scale data processing and AI capabilities to complement Arm’s design strengths.

The Rise of Financialization

As Japanese companies trade stakes and pursue M&A deals more actively with foreign firms, some analysts suggest Japan may be gradually moving toward becoming a “finance-centered nation,” much like the United States. The U.S. economy began to financialize rapidly after President Nixon ended the dollar’s gold convertibility in 1971. Financialization refers to a process in which the financial sector grows to dominate the overall economy, a trend typically seen in countries with advanced industrial capitalism.

The U.S., having turned away from a declining manufacturing base, leveraged the dollar’s role as the world’s reserve currency to expand its financial industry. American capital pushed into overseas markets, driving liberalization and global expansion. By the late 1990s, regulatory easing gave Wall Street structural dominance over the real economy of goods and services production, and financialization spread across nearly all sectors of the U.S. economy.

By the 2000s, profits from the financial industry had surged to two to three times those of manufacturing. Finance no longer merely supported the real economy but began to dominate it, with capital management capacity itself becoming the core measure of competitiveness. This shift also spurred American capitalists, including Microsoft founder Bill Gates, to establish family offices—private firms dedicated to managing or advising on family wealth—reflecting the growing focus on direct control over personal assets.

Comment