Resignation of Ishiba Spurs Hopes for Expansionary Fiscal Policy, but Warnings of “Long-Term Fiscal Crisis” Emerge

Input

Changed

peculation on fiscal expansion and monetary easing by successors Mounting fiscal strain from rising national debt and bond yields Concerns of prolonged fiscal burden despite cyclical recovery

The resignation of Prime Minister Shigeru Ishiba has become more than a political vacuum, emerging as a pivotal juncture that could redefine Japan’s fiscal trajectory. Market expectations are growing that the next administration will revive the aggressive expansionary stance of “Abenomics,” pushing equities to record highs and putting downward pressure on bonds. Yet analysts warn that such expansion, while fueling short-term exuberance, risks becoming toxic for the broader Japanese economy in the long run.

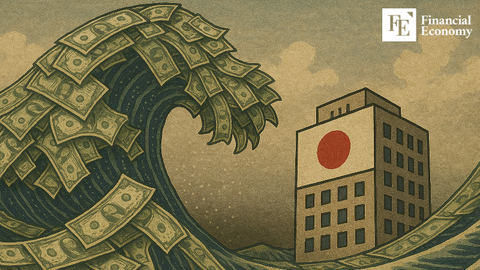

Tokyo Stock Exchange Nears Record Highs on “Second Abenomics” Expectations

According to Nikkei on the 9th, the Nikkei 225 index closed at 43,643.81 on the 8th, up 1.48% from the previous session. It briefly touched 43,838.60 in early trading, surpassing the previous record close of 43,714.31 set on August 18. The intraday peak stood at 43,876.42 on August 19. The yen depreciated as much as 0.8% against the U.S. dollar, with the exchange rate reaching 148.58. The Japanese currency also weakened to 173.91 against the euro and 200.33 against the British pound, marking its lowest level in a year.

This trend reflects market sentiment that the ruling Liberal Democratic Party (LDP), having lost its majority in both houses, is likely to push more expansionary fiscal policies to secure opposition support. Indeed, Sanae Takaichi, the leading contender to succeed Ishiba, has long been dubbed the “female Abe” for her support of Abenomics. She advocates maintaining ultra-low interest rates and expanding government spending to reinforce the recovery. Takamasa Ikeda, senior portfolio manager at GCI Asset Management, noted, “If Takaichi becomes the next prime minister, it will be positive for equities, as she is a strong proponent of greater government expenditure.”

Japan’s National Debt at Double GDP Raises Red Flags

The structural challenge lies in Japan’s already bloated fiscal position, making unlimited stimulus untenable. While Japan has historically appeared stable given that the Bank of Japan (BOJ) and domestic institutions hold the bulk of its government bonds, experts caution that excessive debt still weighs heavily on the economy. Rising yields increase borrowing costs, posing the risk of a severe fiscal crisis.

According to the Ministry of Finance, Japan’s national debt has reached $9 trillion—more than twice the size of GDP and the highest among advanced economies. Government support has stretched across a wide range of areas, from aid to farmers and small businesses to emergency pandemic relief, and more recently defense spending and consumer subsidies. Coupled with rising pension and social security costs from an aging population, fiscal burdens continue to swell.

As the BOJ unwinds its negative rate policy and scales back long-term bond purchases, concerns over fiscal sustainability are surfacing. On September 4, the 30-year government bond yield spiked to a record 3.286%, while the 40-year yield climbed nearly 90 basis points this year to 3.506%, stoking market unease. Even a modest rise in yields multiplies Japan’s debt servicing costs exponentially.

Koji Yano, former Vice Minister of Finance, warned, “Japan’s debt is already at risk of a credit downgrade. Even a slight rise in rates could have significant ripple effects across the economy.” In 2021, he famously likened the LDP’s expansionary plans to “a ship rushing toward an iceberg.”

Visible Recovery Momentum Bolsters Case for Further Rate Hikes

Japan now faces the prospect of paying nearly $122 billion in interest next year due to surging bond yields. At the same time, evidence of recovery is mounting, making additional rate hikes by the BOJ increasingly unavoidable. Revised data from the Cabinet Office showed real GDP grew 0.5% quarter-on-quarter in Q2, or 2.2% on an annualized basis—well above the preliminary estimate of 0.3% and 1.0% respectively. The upward revision was led by private consumption, which accounts for more than half of GDP, increasing 0.4% versus an earlier 0.2%. Japan also posted a current account surplus for the sixth consecutive month, with July’s balance at $25 billion.

Since ending negative interest rates in March 2024, the BOJ raised its policy rate to around 0.25% in July, and further to about 0.5% in January, before holding steady for four consecutive meetings. BOJ Governor Kazuo Ueda stated in July, “Real interest rates remain very low. We will continue to raise policy rates in line with improvements in economic and price conditions.”

The Q2 GDP uptick thus strengthens the case for another hike this year. Yet stronger growth will trigger further tightening, in turn magnifying fiscal burdens. As one analyst cautioned, “For now, expansionary policy expectations are lifting equities and weakening bonds. But over the long horizon, higher yields will tighten the government’s fiscal straitjacket and force heavier taxation. Expansionary fiscal policy, viewed in the long term, is poison to the Japanese economy.”

Comment