Tesla in Crisis: Plunging Profits, Political Backlash, and Mounting Competition from China

Input

Changed

Tesla Losing Ground in the EV Market “I Won’t Buy Tesla Because of Musk” — Public Sentiment Turns Negative Will Trump’s Tariff Policy Be the Key Factor Going Forward?

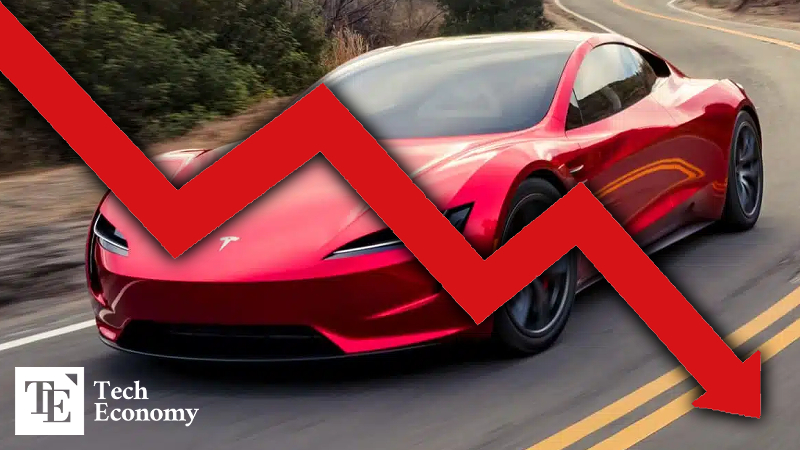

Tesla, once considered the frontrunner in the electric vehicle industry, is steadily losing its market footing. The brand’s image has taken a hit due to CEO Elon Musk’s political activities, resulting in a sharp decline in both sales and earnings. However, some analysts suggest that Tesla may have an opportunity to rebound, depending on changes in trade policy under U.S. President Donald Trump.

Tesla in Crisis as BYD Races Ahead

April 28 (local time) — CNN reports that Tesla is facing a confluence of crises—declining revenue, collapsing profits, and a tumbling stock price—suggesting the company’s troubles may be more severe than widely perceived.

According to CNN, Tesla posted a net profit of just $409 million in the first quarter of 2025, a 71% year-on-year drop. Most of this profit came not from vehicle sales, but from $595 million in regulatory credits sold to rival automakers. Industry analysts suggest that Tesla’s core automotive business may have actually posted an operational loss during the quarter.

The company’s automotive gross margin—once a benchmark of its profitability—has also collapsed. According to Morgan Stanley, Tesla’s vehicle gross margin fell from 30% in Q1 2022 to just 12.5% in Q1 2025, a level not seen since 2012, when the company sold fewer than 6,000 cars annually.

China’s BYD has now overtaken Tesla in quarterly EV sales. In Q1 2025, BYD sold approximately 416,400 electric vehicles compared to Tesla’s 336,600. For all of 2024, Tesla sold 1.78 million EVs, while BYD trailed closely with 1.76 million—a difference of just 20,000 units.

Elon Musk’s Political Foray Draws Consumer Backlash

At the heart of Tesla’s troubles is CEO Elon Musk, whose increasingly political behavior is alienating customers. Since the beginning of Trump’s second term, Musk has served as director of the Department of Government Efficiency (DOGE), tasked with leading controversial federal budget cuts. He has also inserted himself into foreign politics—appearing in videos supporting Germany’s far-right Alternative for Germany (AfD) party and publicly attacking UK Prime Minister Keir Starmer.

These moves have provoked protests at Tesla showrooms in the U.S., Canada, Germany, the UK, and Portugal. In some cases, demonstrators have vandalized facilities and torched vehicles. In the U.S., the Cybertruck has become a symbol of anti-Musk sentiment, with viral videos showing the vehicle covered in garbage or repurposed as a skateboard ramp.

A YouGov-Yahoo News poll conducted in March 2025 found that 67% of American adults would not consider owning or leasing a Tesla. Of these, 37% cited Elon Musk as a key reason.

A Glimmer of Hope: Tariff Relief

Still, not all is bleak. Some analysts point to potential tailwinds from the Trump administration’s evolving trade policy. A recent executive order signed by President Trump temporarily waives import tariffs for vehicles assembled in the United States, offering tax credits equivalent to 15% of the manufacturer’s suggested retail price (MSRP). These credits can offset future import duties on parts and components.

The exemption applies from April 3, 2025, to April 30, 2027. In the second year, the credit drops to 10% of MSRP, and it expires entirely after three years. Notably, the administration clarified that overlapping tariffs—for example, those on steel, aluminum, or imports from Canada or Mexico—will not be applied concurrently with auto tariffs, giving manufacturers like Tesla some much-needed relief.

Trump’s renewed hardline stance on China could also work in Tesla’s favor. In an interview with ABC News, the president reaffirmed his administration’s 145% tariff on Chinese imports, acknowledging that it effectively amounts to a trade embargo. “China deserves that treatment,” he said, reversing recent signals of possible détente.

Such measures could hamper Chinese automakers like BYD, which have been aggressively expanding into global markets with competitively priced EVs. If Chinese imports become prohibitively expensive, Tesla could regain ground in key markets.