Retiring "Recession-Proof": Urgent Call for a New Approach to Industry Resilience

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

In the euro area's inflation surge, nearly half of the increase in domestic prices over 2021–2023 can be traced to higher unit profits, not just wages or imported energy. That is the European Central Bank's finding, echoed by IMF analysis that companies, in many sectors, raised prices more than their costs rose. If profits helped power the price spiral, then the comforting label "recession-proof" tells us almost nothing about how an industry behaves when the shock is inflationary rather than a simple demand downturn. Put bluntly: if pricing power fattened margins during inflation, the same pricing power can shatter long-held assumptions about which categories hold up when the macro picture sours. Alcohol and tobacco? Their volumes are slipping in key markets as prices rise. Luxury goods? Some flagships are discounting and cutting staff to protect traffic and cash. In an era of overlapping inflation, supply, and demand shocks, defensiveness isn't a single trait; it's a shock-specific configuration of cost exposure, pass-through, elasticity, and policy risk.

From "Recession-Proof" to "Shock-Specific Resilience": A Pivotal Shift in Industry Strategy

For decades, the shorthand made sense: some categories consistently resisted demand recessions because consumers substituted down less or treated them as habitual. That story collapses when the shock is not a demand collapse but an inflation jolt or a supply choke. In inflation shocks, the relevant question is not "Do people keep buying?" but "How much price can firms pass through before volumes crack, and what happens to margins when input costs move faster than list prices?" When the shock is a supply disruption—think Red Sea reroutings or commodity spikes—the test becomes "How concentrated are inputs, how quickly can we re-engineer packs, and how exposed are we to freight and lead times?" Add regulatory overlays—excise taxes, anti-profiteering scrutiny, labeling on shrinkflation—and the same category can look sturdy in one shock and brittle in another. "Recession-proof" was a single-axis label for a multi-axis world. We need a taxonomy that classifies defensiveness by shock, not by folklore.

What the Data Say: Demand Dips, Supply Squeezes, and Profit-Push Inflation

The beverage alcohol market offers a clean test. Globally, total beverage alcohol volumes fell –1% in 2024, with declines across the US, China, India, and Europe; in the US, January-July 2024 volumes dropped roughly –3% to –4% across beer, wine, and spirits, even as ready-to-drink formats eked out gains. The culprit wasn't a classic recession—it was pricing, household budget strain, and shifting preferences. By 2025, analysts still describe the environment as a "reset," not a rebound. In parallel, early clinical evidence suggests GLP-1 drugs (e.g., semaglutide) reduce alcohol intake among some users—an exogenous headwind to volumes that dulls the old "people drink through downturns" cliché. Tobacco looks sturdier but not impervious. Meta-analyses keep landing around –0.4 elasticity in high-income markets: a 10% real price rise cuts consumption about 4%, leaving substantial revenue but eroding packs sold and pushing some buyers to illicit channels or alternative nicotine. In short, in inflation shocks, even "defensive" categories leak volume faster than the myth suggests.

Luxury underscores the shock-specific point. When demand cools and rates bite, premium discretionary is exposed. After a euphoric rebound, the global luxury market contracted around 2% in 2024; by mid-2025, bellwethers split: Hermès stayed buoyant, while others posted softer sales and margin pressure. One emblematic story: Burberry swung to a loss in fiscal 2025 and announced plans to cut ~1,700 jobs, a stark retreat from the pricing-power narrative that had defined the sector's post-pandemic run. Kering reported double-digit sales declines at Gucci; LVMH talked up "resilience" while growth slowed and fashion/leather goods faced tougher comps. Demand shocks punish luxury swiftly; inflation shocks, by contrast, can temporarily flatter margins via price increases—until discounting and mix shifts reassert themselves. The lesson is not that luxury is doomed; it is that defensiveness is situational, and the situation has changed.

Supply shocks add a different stress test. Container spot rates more than doubled from mid-December 2023 to mid-May 2024 on key East–West routes as carriers detoured around Red Sea hostilities; freight then oscillated into 2025 as capacity and trade cooled. Meanwhile, cocoa—a critical input for confectionery—hit record highs in early 2025 after poor West African harvests, before easing but remaining structurally expensive on bank forecasts—these shocks selectively hammer categories with concentrated inputs and long supply lines. Alcohol isn't immune: glass, aluminum, and agave costs rippled through 2023–2024. Some firms passed costs on; others embraced "price-pack architecture" (downsizing) to defend price points. Regulators noticed; US GAO's fresh read of BLS data finds shrinkflation contributed <0.1 percentage point to the 2019–2024 CPI rise, but consumer trust effects—and category politics—can be outsized. Again, the label that matters is not "recession-proof," but "supply-shock-proof."

Estimating Shock Defense: A Practical Matrix for Managers and Regulators

To replace vibes with evidence, we can construct a Shock-Resilience Matrix built from four measurable pillars: (1) Pass-through capacity (the share of input-cost or tax changes translated to shelf price within one quarter), (2) Demand elasticity (short-run, by income tier and channel), (3) Input concentration (Herfindahl-style measure across critical commodities and regions), and (4) Adjustment agility (median lead time to implement recipe/pack changes, including regulatory approvals). Where complex numbers are scarce, transparent proxies can suffice: for pass-through, use observed excise increases and retail scanner prices; for elasticity, draw on recent meta-estimates and market-specific deviations; for input risk, map SKUs to commodities like cocoa or agave and freight exposure. Applying this today, alcohol's pass-through looks high, but elasticity has risen as households hit affordability walls; the matrix would flag inflation-shock fragility. Tobacco shows very high pass-through and lower elasticity, hence inflation-shock resilience, tempered by illicit-trade risk as prices climb. Luxury's pass-through can be instantaneous, but elasticity is highly state-dependent; input risk is modest, yet demand shocks cut deepest. None of these scores is permanent; each changes as tastes, regulations, and technology (GLP-1s included) evolve.

Implications for Classrooms: Teaching Industries to Read the Shock

For educators, this is a curriculum rewrite opportunity rather than a footnote. Courses that still treat "defensive" sectors as static should build modules where students simulate pass-through under inflation, inventory buffers under supply disruption, and elasticity shifts under health and regulatory shocks. Case labs can assign students to reconstruct freight surges from the Drewry World Container Index and to trace commodity squeezes like cocoa from farm to barcode. Assessment should force trade-offs: is it better to shrink a pack, reformulate, or take list price, and what are the consumer trust and policy consequences of each? Readings should include the ECB and IMF analyses of profits in inflation, the BLS methodology on shrinkflation, and current market data from IWSR and Bain/Altagamma to prove how quickly category "defensiveness" migrates. The point is not to crown new evergreen winners; it is to teach students to map shocks to specific mechanisms, test assumptions with data, and iterate as conditions—and evidence—change.

Operational Playbooks: How Firms Should Reprice, Rethink, and Rebuild

Administrators and operators need a playbook that starts with a shock diagnosis. If the shock is inflationary, resist the reflex to chase price indefinitely. The empirical risk is clear: in alcohol, volumes have already slipped as prices rose, especially in the US and Europe, with trade-down and moderation undercutting premiumization. The matrix recommends a cap on price actions beyond the observed short-run elasticity threshold; above that, switch to mix and pack strategies with explicit unit-price transparency to pre-empt regulatory ire. In supply shocks, secure inputs—not just generically, but by the most concentrated nodes: a chocolate maker facing cocoa at multi-decade highs must hedge cleverly and communicate honestly, because late-cycle price hikes feed political blowback. Luxury should fight margin erosion by staging scarcity and clienteling rather than broad discounting; the Burberry episode shows how quickly a premium aura can slip once the red pen comes out. Across sectors, invest in adjustment agility—faster pack and formulation changes shorten the pain.

Answering the Skeptics: Is This Just Another Cycle?

Two criticisms recur. First, that the recent pattern is cyclical noise, and we'll revert to the old hierarchy. But the profit-push evidence from Europe, the volume softness in alcohol even outside formal recessions, and the persistent supply disruptions argue otherwise; we are in a regime where multiple shocks overlap. Second, that "shrinkflation" is a populist sideshow unworthy of strategic attention. BLS and GAO analyses indeed suggest downsizing contributed only a sliver to headline inflation since 2019, and firms need flexible price-pack architecture to manage costs. Yet treating it as trivial misses the trust and policy risk: when consumers feel nickel-and-dimed, scrutiny follows, and the political appetite for labeling or other constraints grows. The practical response is not to abandon the tool but to deploy it with candor, transparent unit pricing, and better targeting. The larger point stands: defensiveness is not about a talismanic sector label; it's about continuously re-estimating the parameters that move behavior, margins, and legitimacy.

A New Policy Lens for Regulators

For policymakers, the taxonomy clarifies three levers. First, monitor pass-through in real time. If unit profits are doing more of the work than costs, warnings and voluntary codes can nudge behavior before enforcement is considered. Second, align excise and health goals with shock conditions: where inflation is running hot, automatic indexation of alcohol and tobacco taxes should be calibrated to avoid accelerating illicit substitution while still meeting public-health objectives; elasticity evidence can guide that calibration. Third, invest in supply-chain visibility—ports, freight indices, and commodity dashboards—to catch sector-specific distress before it spills into consumer prices. International bodies are already building these lenses; domestic agencies can integrate them faster. The payoff is policy that filters noise from signal—distinguishing normal price discovery from profit-led inflation, and temporary input spikes from structural shortages—so interventions target the proper mechanism, not the wrong myth.

Retiring a Comfortable Myth

When we opened with the observation that unit profits did much of the heavy lifting in the European inflation burst, it wasn't to villainize companies; it was to insist on precision. "Recession-proof" was built for a simpler world in which demand shocks dominated the syllabus. Our world is more tangled. In 2024–2025, alcohol volumes sagged despite no formal recession in many markets; luxury saw pockets of discounting and headcount cuts; supply arteries constricted and commodities like cocoa soared, distorting margins and forcing trade-offs that no demand-side story can explain. The way forward is a taxonomy and a toolkit: shock-specific defensiveness, measured and re-measured, taught in classrooms, embedded in operating playbooks, and wired into policy dashboards. If educators prepare students to diagnose the shock before they recommend the cure, if managers cap price at the elasticity threshold and invest in adjustment agility, if regulators watch pass-through as closely as they watch wages—then we can stop speaking in talismans and start acting on mechanisms. That is how we retire a comfortable myth and build a sturdier economy.

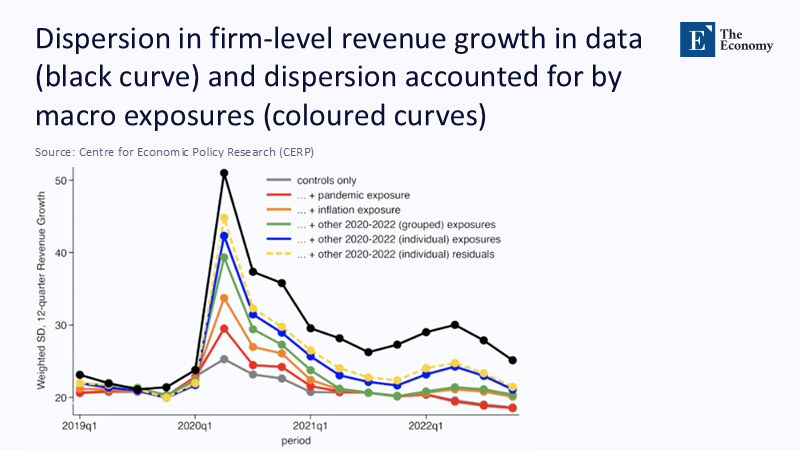

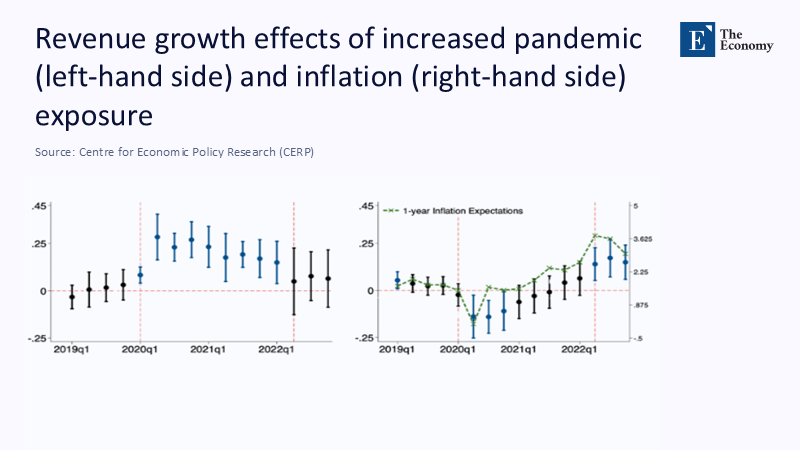

The original article was authored by Steven Davis, Thomas W., and Susan B. Ford Senior Fellow and Director of Research, Hoover Institution, along with two co-authors. The English version of the article, titled "Explaining firm-level reactions to macro shocks," was published by CEPR on VoxEU.

References

Bain & Company / Altagamma. (2024). Luxury Market Monitor 2024: Good times for a change (Press materials and slides). Milan, November 13, 2024.

Bain & Company. (2025, June 19). Luxury confronts slowdown amid economic headwinds and market disruptions (Press release).

Bureau of Labor Statistics. (2023, February 2). Getting less for the same price? Explore how the CPI measures "shrinkflation" and its impact on inflation. Beyond the Numbers.

Bureau of Labor Statistics. (2025, July). Research CPI without product size changes (R-CPI-SC).

European Central Bank. (2023). How have unit profits contributed to the recent strengthening of domestic inflation? ECB Economic Bulletin, Box 3.

GAO. (2025, July). Consumer Prices: Trends and Policy Options Related to Product Downsizing ("Shrinkflation"). GAO-25-107451.

Hendershot, C. S., et al. (2025). Once-weekly semaglutide in adults with alcohol use disorder. JAMA Psychiatry.

IMF. (2023, June 26). Europe's inflation outlook depends on how corporate profits absorb wage gains (IMF Blog).

IWSR. (2024, June 26). US beverage alcohol market set for slow recovery after "reset" year.

IWSR. (2024, September 25). Navigator data show declines continue as US awaits alcohol market recovery.

IWSR. (2025, April 3). Preliminary data: beverage alcohol endures another tough year in 2024.

Kering. (2025, July 29). First-half 2025 results (press materials).

Marsh. (2024). Red Sea crisis: Impact and how to manage cargo risk.

Reuters. (2024, October 23). Kering warns on 2024 operating profit as Gucci sales fall.

The Guardian. (2025, May 14). Burberry may cut 1,700 jobs globally to reduce costs as profits fall.

The IFS / BMC Public Health summaries. (2024). The relationship between price and demand of alcohol, tobacco, unhealthy food, and SSBs. BMC Public Health.

The IZA / Tobacco Control meta-analytic literature (selected). Guindon, G. E., et al. (2023). Socioeconomic differences in the impact of prices and taxes on tobacco use; Cho, A., et al. (2024). The effect of tobacco tax increase on price-minimizing behaviors.

UNCTAD. (2024, October 22). High freight rates strain global supply chains, threaten vulnerable economies.

World Bank / FoodNavigator / Trading Economics (cocoa). (2025). Cocoa prices hit record highs and remain elevated; production down an estimated 14% in 2023–24; spot prices around $8,000/ton in August 2025.

Drewry. (2025, July 31). World Container Index (weekly spot rates).

LVMH. (2025, July 24). Solid results in the first half of 2025 despite the prevailing environment.

Comment