Europe’s Lion at the Crossroads: Tech Power in an Age of Resource Leverage

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Ninety percent. That is a conservative estimate of China’s control over the world’s battery-grade graphite anode material—the unglamorous, irreplaceable heart of every lithium-ion battery that powers an EV, a data center UPS, or the robots on a factory floor. In 2023, Beijing began requiring export permits for a range of high-purity graphite products; within months, shipments saw-sawed, and downstream planners in Europe scrambled to map substitutions that do not exist at scale. Pair that with a second figure: in 2023, electricity prices for Europe’s energy-intensive industries were almost double those paid by competitors in the United States and China. These are not stray statistics; they are hard edges of a new political economy where technology prowess depends on control of materials and affordable energy. Europe stands, again, between giants. And unless it sharpens its strategy now, the next five years will be a knife-edge—and ten years from now, the edge may be gone.

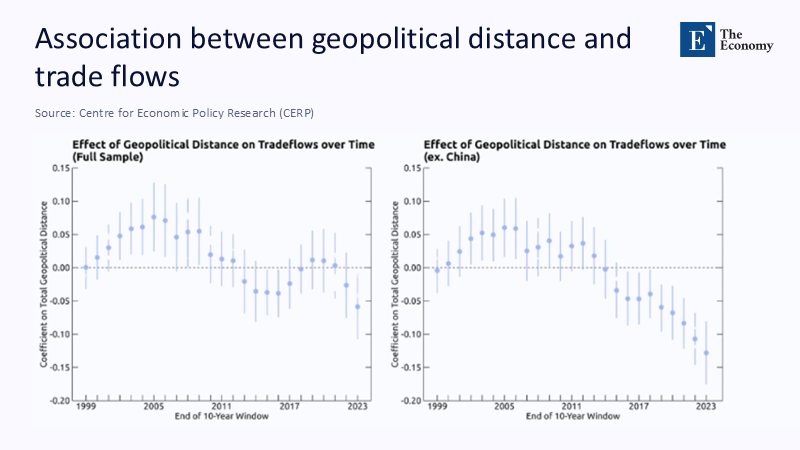

From Trade Friction to Systemic Risk

Europe’s competitive problem is no longer just “trade”: it is system risk created by the coupling of China’s technological ascent with dominance in critical inputs. Over two decades, Chinese policy methodically built scale in clean-tech hardware—solar, batteries, electric drivetrains—while consolidating processing and refining of minerals that underpin both the green and digital transitions. The result is a dual exposure: Europe is directly outcompeted in product markets (EVs, batteries, solar modules), while remaining reliant on Chinese processing for components and materials that run through the same value chains. That is a qualitatively new vulnerability, because China can toggle between price and policy power: flood markets when share is the goal, and tighten export spigots when leverage is needed. In the 1940s, a British prime minister liked to say the lion knew the way between the bear and the elephant; in the 2020s, Europe must remember the lesson, because the “bear” now has a partner and the “elephant” is not always aligned with continental priorities.

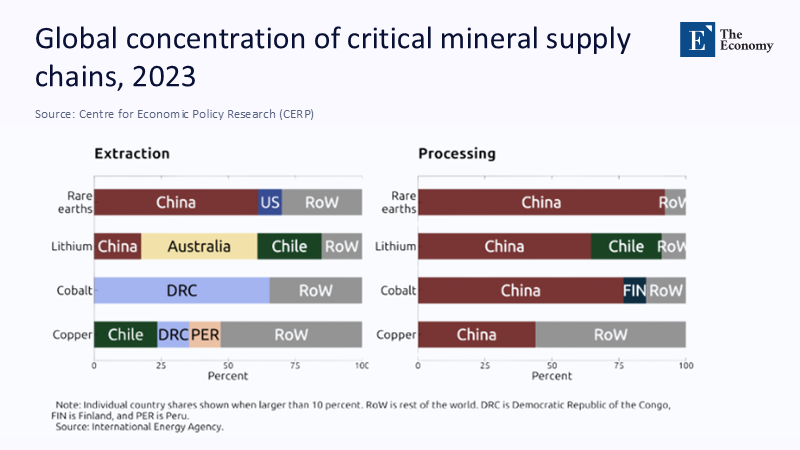

The Resource Chokepoints Europe Didn’t See Coming

Consider the new dependency math. China accounts for overwhelming shares of refining and processing in minerals Europe cannot do without: around 80–90% for rare earths, the vast majority of battery-grade graphite, and dominant positions in cobalt and lithium refining. Chinese controls on gallium and germanium (key inputs for chips, sensors, and photonics) took effect in August 2023; graphite permits followed that October. These moves were not complete bans—they were reminders that permits can become policy. Inside Europe, the Critical Raw Materials Act sets 2030 benchmarks: at least 10% of annual consumption extracted, 40% processed, 25% recycled domestically, and no more than 65% of any strategic material sourced from a single third country. Those are the correct targets, but the gap from today’s base is large; Eurostat data show, for example, China is the largest origin of EU imports of natural graphite by a wide margin. Dependency is still the default setting.

Technology Without Materials Is Strategy Without Ammunition

Europe still builds world-class technologies—EUV lithography at ASML, power semiconductors at Infineon and ST, industrial automation, and avionics. But tech without materials is like strategy without ammunition. China’s producers now dominate EV battery markets (CATL near 35–38% share; BYD ~17% in 2024), and Chinese firms are embedding that dominance inside the EU through manufacturing footprints in Hungary and Spain. Europe’s counter is still forming: the EU’s Net-Zero Industry Act sets a 2030 benchmark for 40% local manufacturing of strategic net-zero technologies, while the EU Chips Act aims at 20% of global semiconductor production by 2030 from a starting point of roughly 10%. Meanwhile, export controls—Dutch licensing for advanced DUV tools and tightened U.S. rules—limit some Chinese access up the stack, but they do not loosen Europe’s grip on the materials it lacks. When China can set terms on inputs and scale in final goods, mere factory announcements will not close the gap.

What the Data Says: A Transparent Estimate of Europe’s Five- and Ten-Year Exposure

How exposed is Europe over the next five to ten years? Start with three anchors. First, energy-intensive industry power prices: in 2023, EU levels were nearly 2× U.S./China; Bruegel estimates EU industrial electricity prices around 2.5× U.S. averages in 2024. Second, critical-mineral processing concentration: the IEA finds the share held by the top three refining nations has grown to 86%, with China the dominant refiner for cobalt, graphite, and rare earths. Third, market scale: global EV battery demand grew roughly 27% in 2024, with Chinese firms increasing their share. A back-of-the-envelope: assume European clean-tech manufacturers face a sustained 30–50% input-cost penalty from electricity alone relative to US/China peers through 2027, and that 50–70% of their upstream bill of materials in batteries/EVs remains directly or indirectly China-conditioned. Even with NZIA’s 40% target, this yields a five-year scenario in which Europe’s domestic battery/module makers compete only in premium niches while integration risk persists; at ten years, unless processing benchmarks are met, the leverage shifts further upstream, and the competitiveness gap hardens.

Methodology note: The exposure estimate combines published price differentials (IEA, Bruegel), IEA concentration metrics, and battery market growth data (SNE/industry trackers), applying conservative mid-points for input-cost and supply-concentration elasticities. Where exact pass-through is unknown, we assume 0.3–0.5 for electricity to manufactured cost and 0.5–0.7 for upstream material dependency to finished-goods risk, consistent with observed sensitivity in energy-intensive manufacturing.

Implications for Classrooms, Campuses, and Cabinets

If this is the industrial geometry, what should educators and administrators do differently next semester, not next decade? First, treat materials literacy as core digital literacy. Engineering programs should co-teach power electronics, electrochemistry, and supply-chain geopolitics; policy schools should add modules on export controls and critical-minerals cartography. Second, build pre-competitive “resource-to-runtime” labs anchored in universities that pair materials processing pilots (recycling permanent magnets; anode/cathode precursors) with software toolchains (materials informatics, digital twins for refining). Third, demand signaling: ministries should tie grants to forward purchase agreements for recycled or EU-processed inputs that meet the Critical Raw Materials Act thresholds, shifting projects from paper to purchase orders. Fourth, fix the energy denominator: a school can’t out-innovate a 2× power-price handicap, but campuses can model demand-flex arrangements and on-site generation that spill into surrounding industrial parks. This is pedagogy with procurement, not curriculum alone.

Answering the Critics: Overcapacity, Overregulation, and the ASML Exception

Three objections recur. One: “Chinese overcapacity will lower Europe’s costs.” That misunderstands structure: overcapacity cheapens modules in the short term while deepening import dependence and eroding the EU’s ability to bargain on inputs; when policy flips to permits—as with graphite—the price advantage evaporates. Two: “Europe’s problem is regulation, not resources.” Compliance burdens are real—the AI Act introduces obligations and potential fines up to 7% of global turnover—but even a perfect regulatory regime cannot overcome imported material chokepoints and a stubborn energy-price delta. Three: “ASML proves Europe is fine.” ASML is a triumph, yet even it is enmeshed in export-control politics; Dutch licensing now covers advanced DUV shipments to China. Singular champions do not immunize ecosystems. The correct conclusion is not deregulation at all costs; it is targeted acceleration where regulation is the tool (standards, demand guarantees) and ruthless simplification where process has become the product.

Europe Between Giants: Industrial Policy for a Resource-Bound Age

Look across the chessboard. The United States is tightening access to China for advanced chips and, increasingly, AI model weights; China replies with materials leverage and domestic scale. Europe sits between, with world-class firms but brittle inputs and higher energy costs. The right European play is not a carbon copy of either giant. It is a resource-reciprocity strategy: lock in diversified offtakes with allies, couple NZIA/CRMA targets to real procurement and storage, and finance mid-stream processing—lithium, cobalt, graphite, rare earths—inside the single market and with trusted partners. It is also a demand-integrity strategy: use tariffs sparingly (as with Chinese EVs) but pair them with a performance standard tied to upstream traceability and grid-intensity, so protection rewards clean, secure inputs rather than flags. And it is a human-capital strategy: fund university-industry chairs in materials/compute co-design so the next generation can redesign around scarcity instead of being defeated by it.

Give the Lion Its Teeth

In 1945’s aftermath, Europe’s leaders navigated between superpowers with clarity born of necessity. Today’s map is different, but the need is the same. The opening number—ninety percent—was not chosen for theater; it is a flashing light on the instrument panel that tells us materials and energy now set the speed limit on European innovation. If we spend the next five years admiring our incubators while ignoring the refineries, we will enter the 2030s as price-takers in the very technologies we championed. If, instead, we fuse pedagogy with procurement, demand with domestic processing, and regulation with real-economy speed, the lion’s path through the elephant and the dragon becomes visible again. That will take contracts, kilowatts, and classrooms—not slogans. The work begins where lectures end: in the labs that turn raw ore and recycled waste into the strategic inputs Europe must own, and in the boardrooms and ministries ready to buy them at scale.

The original article was authored by Florencia Airaudo, an Economist at the Board of Governors Of The Federal Reserve System, along with six co-authors. The English version of the article, titled "Risks in the new international trade landscape," was published by CEPR on VoxEU.

References

Airaudo, F., de Soyres, F., Fisgin, E., Gaillard, A., Santacreu, A., Richards, K., & Young, H. (2025, August 4). Risks in the new international trade landscape. VoxEU/CEPR.

ASML. (2023, June 30). Statement regarding export control regulations Dutch government.

ASML. (2024, December 3). ASML expects impact of updated export restrictions to fall within outlook for 2025.

Bruegel. (2024, December 5). Decarbonising competitiveness: Four ways to reduce European energy prices.

European Commission. (2024). Critical Raw Materials Act (CRMA).

European Commission. (2024, July 3). Provisional duties on battery electric vehicles from China. Press release IP_24_3630.

European Parliament. (2025, February 19). EU AI Act: first regulation on artificial intelligence.

Eurostat. (2024). International trade in critical raw materials.

IEA (International Energy Agency). (2024). Electricity 2024. Executive summary.

IEA. (2024). Global EV Outlook 2024: Trends in electric vehicle batteries.

IEA. (2025). Global Critical Minerals Outlook 2025. Executive summary and report.

IEA. (2022). Solar PV Global Supply Chains. Executive summary.

Mayer Brown. (2023, July 27). China imposes new export controls on two minerals critical to the manufacture of semiconductors. Reuters. (2023, August 1). China gallium, germanium export curbs kick in.

Reuters. (2023, October 20). China to require export permits for some graphite products.

Reuters. (2023, October 19). Curbs choke off shipments of gallium, germanium for second month.

SEMI. (2024, January 2). Global semiconductor capacity projected to reach record high in 2024.

State of European Tech / Atomico & Invest Europe. (2024). State of European Tech 2024.

U.S. Bureau of Industry and Security (BIS). (2024, December 2). Commerce strengthens export controls to restrict China’s capability to produce advanced semiconductors.

VoxEU/CEPR. (2025). Risks in the new international trade landscape.

Historical note: Churchill framing drawn from Conrad Black, “The indispensable man,” The New Criterion (Dec. 2018).

Comment