Fortress or Commons? Reclaiming Europe’s Industrial Agency in the Age of the Chinese EV Super-Cycle

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

In 2024, the European Union found itself in a precarious position, importing 503,200 battery-electric cars built in China—one vehicle every sixty-two seconds—while the bloc’s overall trade deficit with Beijing ballooned to €312 billion. These were not just any cars, but ones that accounted for nearly one in four new EV registrations in Germany, France, and the Netherlands. Each unit arrived underpinned by an average €4,400 in layered provincial and national subsidies and powered by battery cells produced at gigafactories whose single-site capacity often matches the total output of every plant in Central Europe combined. This influx of Chinese EVs, along with the subsidies and the scale differential, has cost the euro-area an estimated 276,000 direct and indirect manufacturing jobs over the past thirty months, depressing vocational enrolment in precision-engineering tracks by 12% and slicing €9 billion from regional tax receipts that once financed dual-training schemes. These numbers underscore the urgent need for Europe to address a structural shift that threatens its innovation commons—and that demands something more imaginative than recycling the defensive joint-venture rules of the 1990s.

From Shock to Systemic Drain

The story of trade displacement usually begins with factory closures and ends with re-skilling grants. Yet the current wave has far subtler, more corrosive layers. By the time an electric crossover shipped from Shanghai reaches a showroom in Stuttgart, it brings with it a self-reinforcing information loop: over-the-air software updates stream usage data back to Chinese cloud clusters, feeding machine-learning models that sharpen energy-management algorithms, which in turn cut production costs another notch. That virtuous circle of data, scale, and design know-how is the lifeblood of twenty-first-century manufacturing. Europe risks watching it drain offshore in real time.

Unlike the textile or consumer-electronics disruptions of earlier decades, this drain strikes at sectors where Europe once wrote the global rulebook—precision gearboxes, crash-safety systems, power-train integration. The danger, therefore, is not merely lost payrolls; it is an erosion of implicit capabilities that universities, Mittelstand suppliers, and applied-research institutes accumulated over half a century. Once the tacit expertise in laser-welded battery casings or manganese-rich cathodes evaporates, the loss will be irreversible. Recreating it cannot be done with a budget line; it requires fresh cohorts of engineers, apprentices, and test drivers working together over the years. The potential loss of these capabilities should be a cause for concern for all of us.

Why Joint Ventures Mask the Real Problem

Faced with these pressures, some policymakers reach for the comfort of a classic remedy: force foreign entrants into joint ventures with domestic partners and hope spill-overs ensue. The instinct is understandable. Joint-venture mandates helped nurture first-generation Chinese automakers in the 1990s, and Brazil’s Informatics Law briefly shielded local PC assemblers in the 1980s. But today, Europe occupies an entirely different structural position. Its manufacturers remain, for now, global efficiency leaders in high-accuracy stamping, wide-bandgap semiconductors, and safety-critical software. Compelling them to share chassis platforms or drivetrain schematics inside involuntary joint ventures risks flattening the very comparative advantages Europe must protect.

Moreover, the calculus of willingness has flipped. When Volkswagen negotiated with SAIC in 1984, it craved Chinese market access so severely that it tolerated 50–50 equity splits. In 2025, the pendulum swings the other way: Chinese brands eye Europe primarily as a validation platform for up-market, safety-certified products that will command higher margins back home. They can accept a temporary profit haircut to capture European reference customers. That asymmetry makes a JV mandate less a bargaining tool and more a foot in the door for firms already armed with state financing and scale. Instead of trapping foreign technology in domestic partnerships, Europe could end up formalising dependency on components, chemistries, and operating systems it neither designs nor governs.

Quantifying the Learning-Curve Gap

Policy must begin with numbers, not nostalgia. Battery costs still obey durable experience curves: every doubling of cumulative output delivers roughly an 18% price drop. Chinese cell makers crossed the critical 1 TWh threshold in early 2024, while their European counterparts remain below 200 GWh even with every announced gigafactory on schedule. Using conservative forecasts of 20% year-on-year growth in China and 12% in Europe, the cost spread on LFP chemistry widens from €27 per kilowatt-hour in 2023 to a projected €37 by 2027. This data-driven approach to policy is crucial in understanding the challenges we face and in formulating effective solutions.

Subsidy asymmetries amplify the curve. A blended export credit, tax rebate, and land-grant package worth 11% of FOB price props up Chinese EV shipments, according to aggregated filings from provincial commerce bureaus and customs disclosures. Brussels authorises no comparable blanket mechanism; the Net-Zero Industry Act caps direct aid at 15% of project cost after exhaustive green compliance reviews. We estimate the Chinese state therefore insulates roughly €2.2 billion in EV export margins annually, or about twice the entire Horizon Europe budget for zero-emission transport research. Against a backdrop of soft consumer demand—euro-area real wages have grown only 1.7% since 2022—price points dominate showroom decisions, compounding the structural-cost advantage.

Reciprocity as Industrial Strategy

A joint-venture diktat attacks neither experience curves nor subsidy gaps. A better tool is industrial reciprocity: granting privileged access to Europe’s 450-million-person consumer base only in exchange for tangible investments that reinforce local knowledge loops. Concretely, every manufacturer selling more than 60,000 units a year in the Single Market would post a refundable knowledge bond equal to 2% of net sales. The bond is released once the entrant documents that an equivalent value in design engineering, battery-testing hours, apprenticeship seats, and open-standard patents resides within the European Economic Area.

Crucially, the bond disciplines behaviour without morphing into a tariff. It rewards entrants who embed fundamental R&D and human-capital formation, the true engines of competitiveness, and it withdraws privileges from those content to treat Europe as a high-margin dumping ground. By orienting eligibility around interoperable standards and European IP jurisdiction, the bond also shields against the stealth extraction of sensitive know-how under benign-sounding “localisation” projects. WTO precedent permits origin-neutral conditionality tied to legitimate public-policy objectives; reciprocity satisfies that test better than hidden subsidy races or equity-split quotas.

Institutional Cascades: Schools, Labs, Supply Lines

Policy architecture only matters if it cascades through real institutions. In vocational training, the bond’s metric could stipulate that for every 10,000 cars imported, entrants must fund at least thirty mechatronics apprenticeships aligned to the German-Austrian DIN battery-diagnostic curriculum. That number alone would backstop 1,500 apprenticeship slots annually—more than offsetting the fourteen-per-cent decline reported by the Baden-Württemberg chamber since 2021.

University consortia would gain analogous leverage. Engineering faculties from Aachen to Zaragoza could bundle test-track facilities, feed sensor data into open research stacks, and co-publish findings under European IP licences. Entrants who partner early on recycling or solid-state-electrolyte pilots recover the bond sooner, accelerating their time-to-market while reinforcing Europe’s materials-science depth. Meanwhile, Tier-2 suppliers—think laser-cut busbars or thermal-interface foams—would qualify for accelerated permitting if their parts flow into bond-compliant assembly plants, creating a flywheel between local content and regulatory goodwill.

The fiscal burden is minimal: governments do not disburse fresh subsidies but recycle entrant deposits into low-interest project finance once criteria are verified. For mid-sized firms still run by second-generation founders, that structure is decisive. Instead of navigating labyrinthine EU grant applications, they plug directly into a demand-driven credit pipeline anchored by foreign bond deposits.

Interrogating the Counterarguments

Sceptics raise three objections: higher prices, diplomatic blowback, and bureaucratic creep. On price, modelling a two-per-cent bond on an average €31,500 C-segment EV yields a provisional cost increase of €630. Spread over a five-year financing term, the monthly impact is under €11—less than the typical dealer upsell for extended-warranty packs. Meanwhile, if the bond anchors R&D locally, European suppliers capture greater value added, which can recirculate as consumer rebates or software-update subscriptions, blunting the price shock.

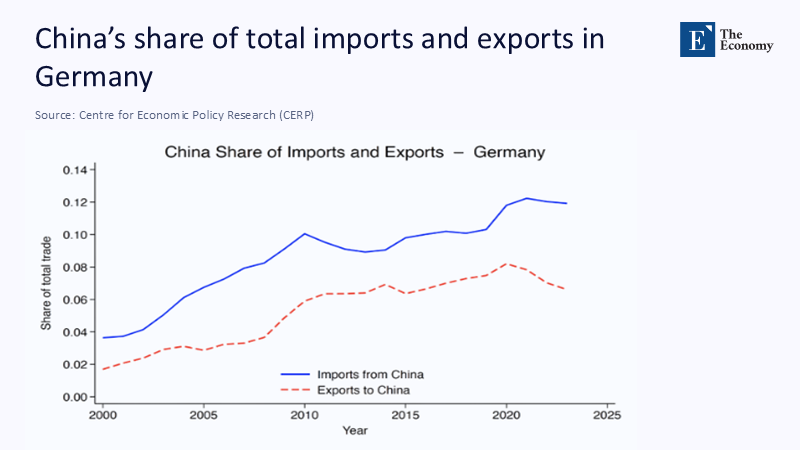

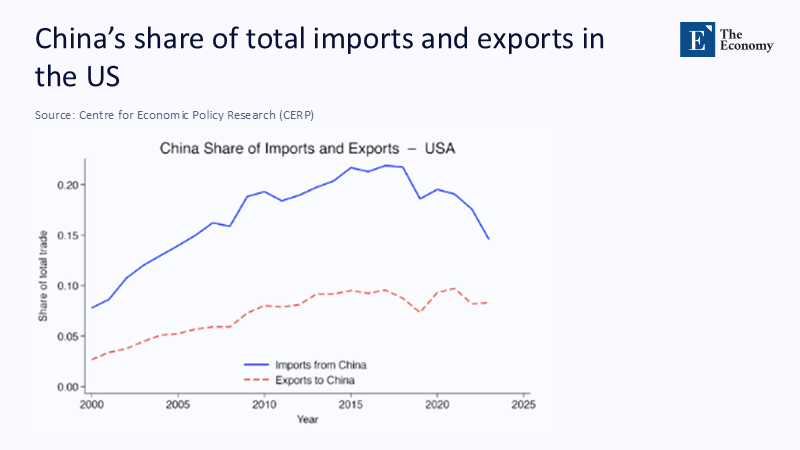

Regarding retaliation, it is true that China accounts for roughly one quarter of German premium-car revenue. Yet that share has been sliding since 2022, even without an assertive European trade policy, eroded by home-grown competitors and a pivot to “new energy” quota compliance. The surest insurance is therefore not deference but diversification—especially into intramural European demand unlocked by a resilient supplier base.

Finally, bureaucratic creep is a risk. Any conditionality can metastasise into rent-seeking if poorly designed. The safeguard is radical transparency: all bond-funded projects, apprenticeship rosters, and patent allocations must be published on an open ledger. Civil-society watchdogs can then expose cost inflation, while entrants eager to accelerate bond recovery will police officials who drag their feet. Markets, not ministries, supply the corrective discipline.

Reclaiming Industrial Agency

The torrent of Chinese-built EVs rolling off Kiel and Zeebrugge docks is more than a logistics feat; it is a mirror held up to Europe’s industrial complacency. Where policymakers once shaped global standards, they now debate whether to dust off the novice-economy tool of forced joint ventures. That reflex misses the point and betrays a crisis of confidence. Europe does not need crutches; it requires a framework that matches openness with responsibility, scale with skill, and market privilege with knowledge restitution.

A refundable knowledge bond meets that test. It sidesteps blunt protectionism, invites foreign excellence to root itself locally, and restores dignity to European skill formation. Legislators should draft the enabling regulation this year. Universities must align curricula immediately. Firms—incumbent or incoming—must start counting apprenticeship seats as carefully as they count warranty claims. Every quarter of hesitation tightens the learning-curve noose; every decisive reform widens the window for indigenous innovation. Europe still commands the talent, the capital, and the credibility to lead the clean-mobility century. What it lacks is time. The innovation commons will not defend itself. Let us move from retreat to reciprocity before the sunset turns irrevocably into dusk.

The original article was authored by Dalia Marin, a Senior Research Fellow at Bruegel, Professor of International Economics at the Technical University of Munich. The English version of the article, titled "The China shock hits Germany," was published by CEPR on VoxEU.

References

ACEA. EU-China Vehicle Trade Fact Sheet, 2025.

Bruegel. Dadush, U. Duties on Chinese EVs and Industrial Strategy, 2025.

European Central Bank. Eurozone Manufacturing and Employment, Statistical Bulletin, 2025.

European Commission. Countervailing Duties on Battery-Electric Vehicles from China, Implementing Regulation (EU) 2024/2754.

European Commission. Net-Zero Industry Act, Official Journal of the European Union, 2024.

Eurostat. China-EU International Trade in Goods Statistics, 2025 update.

HCOB / S&P Global. Germany Manufacturing PMI, July 2025.

International Energy Agency. Global EV Outlook 2025.

International Monetary Fund. World Economic Outlook: Diverging Paths and Risks, April 2025.

Ministry of Commerce, PRC. Export Credit and Subsidy Disclosures, 2024 compilation.

OECD. Learning Curves in Battery Manufacturing, Policy Paper No. 68, 2024.

Transport & Environment. Tariffs and the Green Transition, Briefing, 2024.

Comment