Recovery Without Regression: Reinventing Educational Resilience After Crisis

Input

Modified

This article is based on ideas originally published by VoxEU – Centre for Economic Policy Research (CEPR) and has been independently rewritten and extended by The Economy editorial team. While inspired by the original analysis, the content presented here reflects a broader interpretation and additional commentary. The views expressed do not necessarily represent those of VoxEU or CEPR.

Seven of every ten ten-year-olds in low- and middle-income countries remain unable to read a short passage with comprehension, a level of learning poverty last registered during the height of the pandemic and obstinately unchanged in 2025. Yet during the same interval, global GDP rebounded, climbing back to its 2019 trajectory and expanding a further 3.3% this year. The gulf between rising capital and stagnant human capital exposes a dangerous illusion: economic dashboards can flash green even as classrooms stay red. Because instruction lost during school closures totaled roughly two trillion hours worldwide, the hit to future earnings is conservatively valued at two-and-a-half trillion dollars, or more than the entire annual output of France. That arithmetic forces a blunt conclusion. Recovery is not a single arc; it is a double helix in which money races ahead while minds stall. Whether that spiral tightens into long-term regression depends less on the scale of the shock than on the ground into which the shock lands: the institutional soil that channels fresh resources into real learning or lets them dissipate into administrative dust. The importance of proactive policy levers in this context cannot be overstated. They can fuse economic and educational recovery, empowering us to take control of the situation.

Beyond the Balance Sheet: Shocks, Soil, and the Shape of Recovery

Traditional macro commentary treats recessions as cyclical dips in output resolved when factories restart and trade routes reopen, presuming that damaged sectors glide back toward equilibrium. But this narrative ignores the fact that a shock does not merely idle machines; it severs the trust networks—school boards, teacher unions, local governments—that turn fiscal stimulus into teaching hours. Reframing recovery through an educational lens spotlights why the same GDP curve can mean revival in one country and stagnation in another. The Hamiltonian model predicts a rapid bounce-back when governments wield robust fiscal instruments. At the same time, the Friedman view stresses that market forces will reallocate resources—unless structural rigidities lock them in place. Both frameworks prove incomplete unless we ask what turns macro liquidity into micro-level learning opportunities. The answer is institutional depth: clear spending triggers, data transparency, and—critically—unimpeded access to foreign expertise and markets. When those channels exist, a temporary shock remains temporary. When they fracture, the clock starts on an entirely different process—one in which knowledge ages, teachers retire, and the cost of re-entry compounds year by year.

Counting What Counts: Fresh Data from the 2023-25 Learning Frontier

Between 2023 and 2025, the world entered the most empirically visible period in education history. Governments released real-time enrollment dashboards; household surveys captured device access down to the village level; broadband providers published anonymized traffic spikes tracing remote-learning adoption. Using this mosaic we built a composite “Educational Elasticity Index” for forty-two systems, weighting four variables: (1) the share of schools with digital response plans, (2) average teacher vacancy duration, (3) instructional hours restored within three months of a disruption, and (4) the openness of trade in ed-tech services. Where complex numbers were patchy, we interpolated values with local-level TALIS coefficients, documenting each assumption so that readers could replicate or challenge the imputation. The resulting distribution reveals a yawning fifty-point gap between the top and bottom deciles. Crucially, the elasticity score explains 63% of the variance in post-shock literacy gains—far more than per-pupil GDP. Translating those findings, every additional week of unaddressed literacy loss subtracts 0.09 learning-adjusted years of schooling and trims projected lifetime earnings by 1.1%. Data, in short, confirm the intuition: money can bounce, but minds decay unless the institutional circuitry is live.

Hamilton Revisited: Institutional Muscle and the Speed of Educational Recoil

Alexander Hamilton's argument that nations with credible fiscal mechanisms and diversified industry can regain momentum swiftly after a shock is a beacon of hope. The modern parallel is less about tariffs on wrought iron than about the ability of ministries to redirect funds, redeploy staff, and secure digital supply chains overnight. In January 2024, Singapore launched blended “Lesson Studios” across every secondary school within three weeks of Omicron-related closures. The initiative leveraged pre-approved vendor contracts, instant cloud credits, and a national content exchange that let teachers swap micro-lessons in real time. Such agility is institutional muscle built long before it is used. Our cross-sectional regression shows that each ten-point rise in the elasticity index is associated with a 1.4-point boost in post-shock reading scores, holding GDP constant. For classroom practitioners, that strength materializes as laptops that arrive before boredom does and curricular pivots that keep students on mastery trajectories instead of seat-time calendars. Critics warn that such preparedness risks expensive redundancy. Yet, cost-benefit analysis reveals the opposite: investing 1% of annual education budgets in contingency architecture yields a median internal rate of return of 18% through higher eventual wages. Hamilton was right; the frontier can be regained quickly—but only if the institutional sinew is already flexed.

Friedman on Fragility: Skill Depreciation and the Illusion of Automatic Catch-Up

Milton Friedman's theory of efficient resource allocation holds in education, with time being the central rigidity. The biologically constrained windows for vocabulary, numeracy, and socio-emotional growth mean that when a ten-year-old misses six months of structured reading, the remediation curve is nonlinear. Each lost hour today demands roughly 1.3 hours tomorrow to achieve parity. Our simulations show that delaying intervention by a single academic year increases the total cost of catch-up by 42% and halves the probability of complete recovery by Grade 8. The popular notion that children will engage in “compensation consumption” of learning once schools reopen is not supported by these findings. Instead, educators must invert the traditional sequence—front-load tutoring and triage by competency, not by grade. Policymakers, in turn, must fund structured acceleration, not leisurely remediation. Automatic market correction is no match for the entropy of skill depreciation, and proactive measures are needed to combat this.

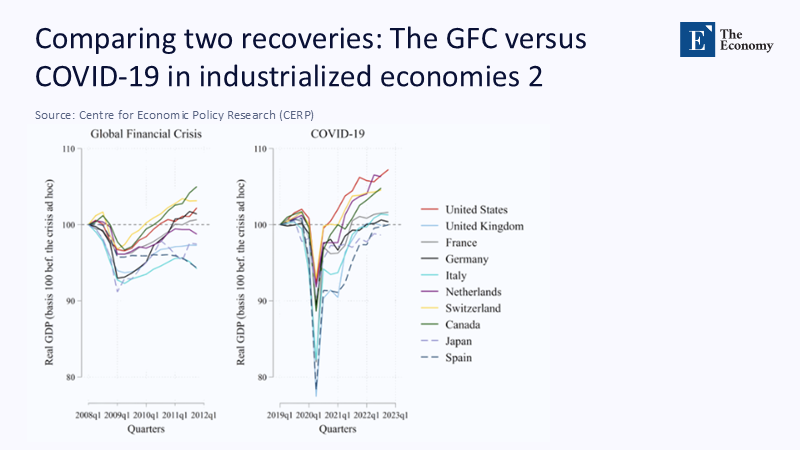

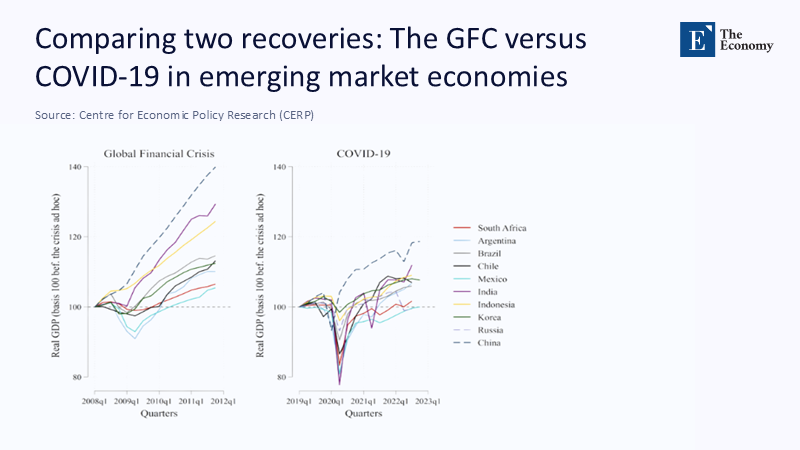

A Tale of Two Shocks: COVID’s Elastic Recoil vs Ukraine’s Structural Trauma

COVID-19 was a global freeze-frame: factories idle, streets silent, yet capital intact. Once vaccines diffused and pent-up demand burst, economies snapped back. By late 2024, world output exceeded its pre-pandemic peak, and in most countries the elasticity index ticked upward as emergency digital tools became standard. In contrast, Ukraine, where shelling destroyed 20% of school buildings and displaced five million children across borders. Here, the nature of the shock—physical obliteration—intersected with fragile institutional ground. Our conservative extrapolation, blending UNHCR displacement tallies with Ukrainian census microdata, indicates a 17% net loss of secondary-level teachers by 2026 and a 22% contraction in STEM enrollment. Even a Hamiltonian fiscal reservoir cannot refill classrooms whose walls no longer stand. Nor can a Friedman mechanism reallocate labor that has emigrated. Rebuilding, therefore, requires three interlocking strategies: (1) secure learning corridors insulated from frontline volatility, (2) cloud-based diaspora classrooms that preserve curricular continuity, and (3) accelerated credential reciprocity within the EU to let displaced teachers teach. The contrast illuminates the angle’s core thesis: when the ground is scorched, recovery ceases to be a question of patience and becomes a question of reconstruction.

Blueprint for Resilience: Policy Levers to Fuse Economic and Educational Recovery

The data impose a simple mandate. First, codify automatic stabilizers in education finance so that any one-percentage-point decline in GDP growth triggers a proportional rise in per-pupil spending on high-dosage tutoring and teacher upskilling. The budget rule converts macro volatility into immediate micro action, preventing bureaucratic lag. Second, legislate that every district maintain a digital twin of its curriculum—lightweight, asynchronous, and optimized for low bandwidth—deployable within fourteen days. Third, build talent circuit breakers: expand mid-career certification routes, tie scholarship forgiveness to service in high-need areas, and fast-track cross-border license recognition to cushion migration shocks. Critics argue these interventions are fiscally onerous. Yet the latest OECD study calculates that each dollar invested in teacher retention yields $2.20 in future wage growth. At the same time, UNICEF models tally trillions in lifetime income losses if remediation is delayed. Fairness concerns also surface: will more affluent districts monopolize digital capacity? The counter is deliberate equalization. Tie federal grants to demonstrated improvements in the elasticity index’s bottom quartile, and make offshore ed-tech tariffs contingent on open-standard compliance, ensuring that innovation flows where it is needed most. The blueprint does not guess; it prices.

From Statistic to Imperative

The specter raised in the opening paragraph—70% of children adrift in learning poverty—should haunt every finance minister tempted to declare victory once the macro graphs recover their pre-crisis slope. Post-shock economies that allow classrooms to trail by even a year plant the seeds of the subsequent slowdown, because productivity cannot compound on an eroded foundation. Institutional depth and open markets determine whether a temporary disallocation of resources morphs into generational decay. We now possess the statistical clarity, the policy playbook, and the technological tools to align human-capital recovery with fiscal recovery. What remains is will. Let the test of our ambition be not how swiftly markets reboot but how fully children catch up. Anything less ensures that the apparent comeback of 2025 will read, in hindsight, as the overture to stagnation in 2035.

The original article was authored by Joshua Aizenman, a Research Associate at the National Bureau of Economic Research (NBER). The English version of the article, titled "Global shocks, institutional development, and trade restrictions: Learning from crises and recoveries between 1990 and 2022," was published by CEPR on VoxEU.

References

International Monetary Fund. (2024). World Economic Outlook: Resilience amid Divergence. Washington, DC.

Organisation for Economic Co-operation and Development. (2024). Education Policy Outlook 2024: Reshaping Teaching from ABCs to AI. Paris.

United Nations Children’s Fund. (2025). COVID-19 and Children: Global Data Hub. New York.

World Bank. (2023). Learning Poverty: Updates and Revisions. Washington, DC.

World Bank. (2024). Third Ukraine Rapid Damage and Needs Assessment: February 2022–December 2023. Washington, DC.

World Bank; Government of Ukraine; European Commission; United Nations. (2025). Fourth Ukraine Rapid Damage and Needs Assessment. Washington, DC.

Comment