U.S. Auto Industry Outraged Over Trade Deal with UK: ‘Concerns Over Decline in Industrial Competitiveness’

Input

Modified

U.S.-UK Tariff Reductions and Eliminations on Key Goods Decline in Price Competitiveness of U.S.-Made Vehicles Automotive Industry Faces Emerging New Trade Order

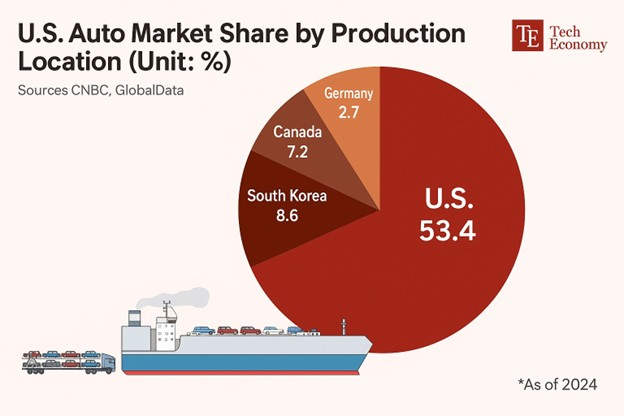

A newly signed trade agreement between the United States and the United Kingdom—heralded by leaders as a diplomatic milestone—is stirring intense backlash from within the American automotive sector. The landmark deal, which reduces tariffs on up to 100,000 UK-manufactured vehicles annually, is being criticized by U.S. carmakers who fear it will erode their competitive edge and flood the domestic market with foreign-made vehicles that contain little to no American parts.

While President Trump and UK Prime Minister Keir Starmer touted the pact as a “historic breakthrough,” the response from U.S. industry stakeholders tells a different story—one of disillusionment, economic anxiety, and frustration over the apparent prioritization of geopolitical symbolism over sector-specific protections. Yet as discontent brews in Detroit and across the American manufacturing heartland, automakers in Europe, South Korea, and Japan see the deal as an opening, prompting calls for new negotiations with Washington. The aftershocks of this agreement may well reshape global trade strategies far beyond the Atlantic.

Symbolism Over Substance: Industry Voices Alarm

The agreement, signed in early May, slashes tariffs on UK-made vehicles exported to the U.S. from a previous rate of 25%—27.5% when including Most Favored Nation status—to just 10%. This applies to up to 100,000 vehicles annually, which is roughly equivalent to the volume of UK car exports to the U.S. each year. On the surface, the pact appears to unlock new commercial opportunities for the UK’s auto sector. However, American auto leaders see it as a threat.

The American Automotive Policy Council (AAPC), representing major U.S. car manufacturers such as Ford, GM, and Stellantis (formerly Fiat Chrysler), issued a sharp rebuke. “British-made vehicles that incorporate almost no U.S. components can now be imported more cheaply than vehicles made in Mexico or Canada—despite those being composed of up to 50% U.S. parts under the USMCA,” AAPC warned. The result, they argue, is an uneven playing field that undercuts domestic manufacturers, suppliers, and workers.

The deal also extends beyond automobiles. Both countries agreed to revisit the 25% tariffs imposed on steel and aluminum. While the White House offered only that an “alternative arrangement” would be negotiated under Section 232 of the Trade Expansion Act, the UK swiftly announced that those duties would be lifted in the near future—bolstering hopes in London but triggering further frustration among U.S. industrialists.

Critics have taken aim at the Trump administration’s approach, accusing it of overlooking industry-specific interests for the sake of political symbolism. The White House appears to have prioritized the diplomatic narrative of a U.S.-UK alliance—emphasizing economic and national security integration—while leaving trade imbalances and industrial competitiveness to be dealt with after the fact. This posture has only heightened anxieties among U.S. manufacturers already burdened by inflation, supply chain instability, and volatile demand.

Still, President Trump praised the deal as a blueprint for economic and geopolitical cooperation. “This agreement includes a plan for the UK to join the U.S. economic and security framework—this is a first,” he stated. Emphasizing the link between national security and industrial policy, Trump framed the deal as part of a broader strategy to secure key sectors such as steel, technology, and automotive manufacturing through coordinated trade, export control, and supply chain policies.

Trump’s Selective Strategy: A Familiar Playbook

The nature of the deal itself reflects a distinct Trumpian approach to trade—what observers call a “selective opening” strategy. Rather than pursuing a comprehensive overhaul of bilateral trade barriers, the agreement targets specific sectors for relief. In this case, automobiles served as the UK's bargaining chip, while the U.S. likely leveraged the deal to gain future access in agricultural goods or high-tech components.

This model aligns with the administration’s broader “America First” framework. The U.S. offers narrowly tailored tariff reductions in areas critical to partner nations, allowing each side to declare diplomatic victory while avoiding sweeping concessions that might spark domestic backlash. It’s a calculated balancing act—limited giveaways in exchange for strategic goodwill.

Such conditional and transactional trade policy appears poised to become a template for future deals. India and Japan are widely viewed as the next countries in line for similar agreements. Japan, for instance, has formally requested a review of all bilateral tariffs, including those on cars. Meanwhile, the European Union, frustrated by stalled negotiations with the U.S., is weighing punitive tariffs on as much as €95 billion (about $150 billion) in American goods if talks break down.

What distinguishes this strategy is its political utility: partner nations feel they’ve secured tangible gains, while the U.S. government avoids large-scale backlash from sectors like agriculture or manufacturing. Yet for U.S. industry players left out of the loop, it’s a frustrating dance—where their concerns are often sidelined until after the ink dries.

Global Shockwaves: Reactions from Europe, Asia, and Beyond

If the U.S. auto industry is frustrated, foreign carmakers are cautiously encouraged. The U.S.-UK trade deal has sent tremors through the global auto sector. While AAPC and other U.S. groups decried the agreement for exacerbating domestic competition, automakers in Europe, South Korea, and Japan interpreted the move as a potentially precedent-setting development. One unnamed European executive reportedly quipped, “If the UK pulled it off, why not us?”

That sentiment is gaining traction across national borders. Governments in Seoul, Tokyo, and Brussels are now being pressured by their respective automotive sectors to pursue comparable negotiations with Washington. In some cases, automakers are actively lobbying policymakers to open new trade channels or revisit stalled talks with the U.S. The logic is clear: if the UK can win selective tariff relief, others may too.

The momentum also ties into a broader context of trade uncertainty. Since returning to office, the Trump administration has aggressively weaponized tariffs, branding the auto sector a strategic priority. In April alone, the U.S. levied a sweeping 25% tariff on all imported cars—a move that caused Jaguar Land Rover to halt all U.S.-bound shipments for the month. Stellantis, whose brands span Chrysler, Peugeot, and Fiat, temporarily shuttered operations in Canada and Mexico.

By singling out the UK for tariff relief, the U.S. has essentially revealed its hand: under the right conditions, it is willing to grant preferential treatment. That revelation is now influencing the trade strategies of governments and corporations worldwide. Several auto companies reportedly believe that if such relief is granted, it could significantly improve vehicle price competitiveness and expand their footprint in the U.S. market.

In essence, one bilateral trade deal has done more than alter tariffs—it has jolted the global automotive industry into a state of reorientation. What began as a symbolic diplomatic win for the U.S. and UK has quickly become a flashpoint for broader economic realignments, with automakers scrambling to secure their place in a rapidly evolving trade order.