Factories in the U.S., Technology from Abroad? Japan’s Battery Pride Is Crumbling

Input

Changed

China races ahead, casting a shadow over Japan’s battery industry Strategic overhaul of battery supply chains inevitable Increasing reliance on imports, with no viable domestic alternatives in Japan

Once hailed as a powerhouse in automotive technology, Japan now faces a sobering turning point: its battery industry, once a symbol of national pride, is steadily losing ground. Major automakers like Nissan and Toyota are no longer investing in domestic battery production, instead redirecting their focus abroad—particularly to the United States. With this shift, Japan appears to be stepping back from its former role as a global leader in battery innovation and stepping into a new one: that of a dependent importer in a rapidly electrifying world.

Panasonic: The Only Japanese Firm Among Global Battery Giants

The unraveling began with Nissan’s decision to cancel its planned EV battery plant in Kitakyushu on Kyushu Island. The facility, which was expected to produce lithium iron phosphate (LFP) batteries, had been scheduled to begin operations by 2028. However, amid weak profitability across the auto sector and a reassessment of investment priorities, the company withdrew from the project.

This setback dealt a significant blow not only to Nissan’s strategy but also to Japan’s national vision for a homegrown battery industry. The Ministry of Economy, Trade and Industry (METI) had aimed to expand domestic battery production capacity to 150 GWh annually by 2030, backing roughly 30 related projects with government subsidies. Nissan’s project alone was slated to receive up to 55.7 billion yen (approximately $536.5 million USD) in public support. Its cancellation has thrown into question the feasibility of Japan’s broader industrial goals.

As of now, Panasonic Energy’s joint venture with Subaru is the only major domestic project moving forward. The plant, backed by a 463 billion yen (around $4.45 billion USD) investment, is expected to open in 2027. Yet, despite its progress, industry observers agree that the project is too limited in scale to fill the gap left by Nissan’s departure.

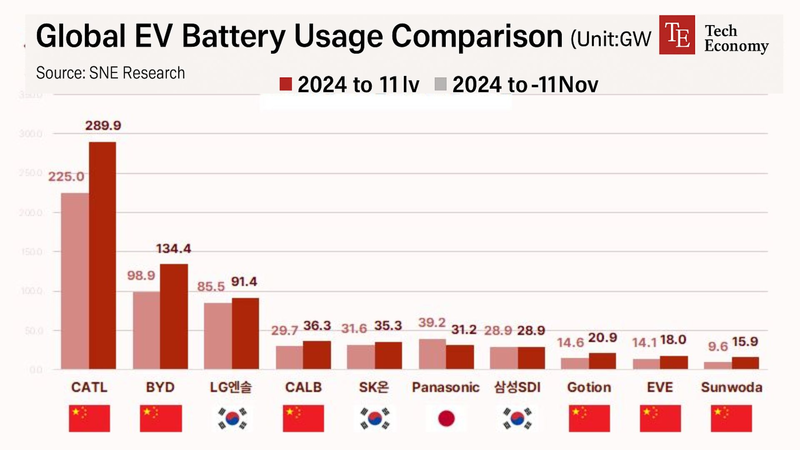

Japan’s presence in the global battery market continues to shrink. In 2024, six of the world’s top ten EV battery producers were Chinese companies, according to SNE Research. CATL retained the top position with a dominant 37.9% market share, making it the industry leader for the eighth consecutive year. In contrast, Panasonic, once a pioneer, was the only Japanese firm to make the list, trailing at sixth place.

Toyota’s Withdrawal Seen as an Effective Surrender of the Battery Industry

The situation worsened when Toyota, Japan’s largest automaker, announced the suspension of its next-generation battery plant in Fukuoka Prefecture earlier this year. The factory, to be built and operated by Toyota Battery—a dedicated production subsidiary—was expected to start operations in 2028. But slower-than-expected growth in the EV market and a flood of inexpensive Chinese batteries into the global supply chain eroded margins, leading Toyota to put the plan on indefinite hold.

The move underscored a painful reality: Japan’s battery sector is faltering in both technology and price competitiveness. Toyota may have presented its decision as a temporary adjustment, but many in the industry see it as a concession to structural weaknesses. Batteries are not merely components—they are strategic resources in the EV economy. For Japan’s largest automaker to put domestic production on hold and instead turn to foreign suppliers is widely seen as a symbolic defeat.

In place of domestic production, Toyota opted to procure approximately $1.5 billion USD worth of batteries from LG Energy Solution’s facility in Lansing, Michigan. This choice not only illustrates the declining capacity of Japan’s manufacturing base but also highlights its growing dependence on external supply chains for even the most essential components. For a country that once led the global automotive industry, the implications are profound.

Industrial Competitiveness in Decline: From Global Player to Mere Buyer

Looking forward, there is little indication that Japan will regain its footing anytime soon. Even if Toyota chooses to expand its battery production, analysts agree it is far more likely to do so in the United States rather than in Japan. The company is already constructing a major factory in North Carolina and is actively considering further expansion. Internally, executives at Toyota have acknowledged that rising EV demand may eventually require expanding the current U.S. facility or even establishing an entirely new one. As part of this planning, they are evaluating multiple regions outside Japan, indicating a clear strategic preference for foreign manufacturing.

This direction suggests a future where Toyota’s core production infrastructure is increasingly anchored in the United States, not in Japan. The company’s mid- to long-term goal is to increase the proportion of electric and hybrid vehicle sales in North America from 50% to 80% by 2030, reinforcing the notion that the U.S. is central to its growth strategy. Although the timing of additional investments will depend on how the market evolves over the next two to three years, the momentum is already shifting away from Japan.

Despite the Japanese government’s continued promotion of EVs as part of a national industrial policy, the country’s private sector is increasingly disengaging. Companies are turning outward, discouraged by high domestic operating costs, uncertain demand forecasts, and a widening technological gap. The growing consensus among industry watchers is that Japan may soon be forced to abandon its “Made in Japan” philosophy in the battery sector altogether.

What was once a symbol of industrial strength is now a cautionary tale. From Nissan’s retreat to Toyota’s pivot and Panasonic’s solitary stand, Japan’s battery industry is confronting a harsh reality: the world has moved forward, and Japan is struggling to keep pace—not as a leader, but as a buyer.