"An AI-Centered Financial Ecosystem Emerges" — Tool and Walter Tycoon Consortium Raises 20 Trillion Won to Establish AI-Driven Investment Firm

Input

Changed

“TWG Formed with 53 Trillion Won in Personal Wealth from Thomas Tull and Mark Walter” xAI Teams Up with TWG and Palantir to Launch AI Tools for Financial Data Accelerating Financial Innovation with Supercomputer Technology

As artificial intelligence reshapes industries worldwide, two American billionaires are forging a bold new path in finance—one where decisions are powered by data, algorithms, and adaptive systems. Thomas Tull, former CEO of Legendary Pictures, and Mark Walter, principal owner of the LA Dodgers and CEO of Guggenheim Partners, have joined forces to launch TWG Global, a holding company designed to redefine investment through AI integration.

Their vision is not simply to fund AI technologies—but to build an investment firm whose foundation is artificial intelligence itself. Backed by nearly $15 billion (approximately 21 trillion KRW) in capital, TWG aims to drive innovation across sectors including finance, defense, and sports, setting a new standard for how capital, technology, and strategy converge in the digital era.

TWG Secures Investment from UAE’s Mubadala, One of the Nation’s Top 3 Sovereign Wealth Funds

TWG Global was officially established on May 6, following the consolidation of a combined $40 billion capital pool by Tull and Walter. Just days later, TWG announced that it had nearly completed its fundraising—thanks largely to a $10 billion (approximately 14.15 trillion KRW) preferred equity investment from Mubadala Capital, a key branch of the United Arab Emirates’ top three sovereign wealth funds. As part of this deepening alliance, TWG also plans to acquire a 5% stake in Mubadala Capital, aligning itself with the UAE’s long-term strategy of economic diversification.

Mubadala’s involvement is more than financial—it is strategic. As the UAE pushes to reduce its dependence on oil, the fund is aggressively expanding into industries such as AI, semiconductors, life sciences, smart infrastructure, and healthcare. Mubadala’s expansion has been supported through arms like the Abu Dhabi Investment Council (ADIC) and MGX, a tech investment subsidiary focusing on AI and chip technologies.

In 2024, Mubadala Capital led all sovereign wealth funds globally in investment volume, allocating $29.2 billion (approximately 41.3 trillion KRW)—a 67% year-on-year increase, as reported by Global SWF. This surge far outpaced the global average increase of 7% and reinforces Mubadala’s conviction in future-oriented technologies like AI. For TWG, this support provides a powerful combination of capital, credibility, and long-term alignment with one of the world’s most aggressive strategic investors.

TWG and Palantir Form AI Joint Venture for Financial Services

With a strong financial base secured, TWG has turned to execution—starting with a strategic joint venture announced in March with Palantir Technologies, a leader in enterprise data analytics and AI infrastructure. This collaboration, still in its early stages, aims to develop AI-powered financial analytics tools targeted at banking, investment management, insurance, and other financial services.

The venture is the result of a year of quiet collaboration between TWG and Palantir, during which AI capabilities were embedded into TWG’s portfolio companies. The new initiative seeks to transition institutions from fragmented data usage to comprehensive, AI-integrated enterprise systems. Palantir, which supports government agencies including the CIA and global corporations, brings its analytical expertise and strong financial footing—as highlighted by InvestingPro—to power this transformation.

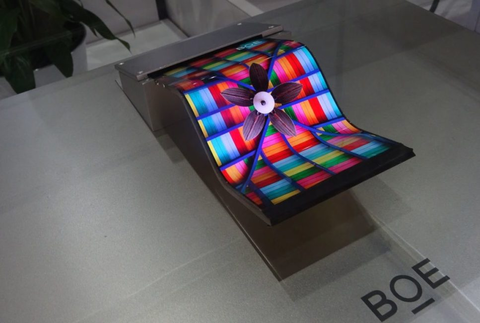

Adding to the strength of this alliance is the participation of xAI, the AI company founded by Tesla CEO Elon Musk. xAI is contributing its Grok large language models (LLMs) for rapid, large-scale data analysis and the Colossus supercomputer for real-time processing. Grok will handle functions like financial market forecasting and risk analysis, while Colossus will support live trade evaluation and predictive modeling—together creating a high-speed, intelligent infrastructure for next-generation financial services.

The synergy among these players—TWG, Palantir, and xAI—signals a major evolution. Their goal is not merely to modernize financial systems, but to embed real-time intelligence directly into operational processes, enabling institutions to respond faster, forecast more accurately, and manage risk with unprecedented agility.

TWG Leads Solution Design and Deployment

TWG’s role in this collaboration is not limited to capital or strategy—it is also taking the lead in developing and deploying customized AI solutions. Unlike generic technology rollouts, TWG works directly with executives at client companies to design systems tailored to the realities of specific industries. This bespoke approach ensures that AI is integrated into the operational heart of organizations—not bolted on as an afterthought.

This belief—that artificial intelligence must be central to business, not peripheral—is shared across TWG’s partners. According to Palantir CEO Alex Karp, the majority of financial institutions have not yet had the opportunity to fully harness AI’s capabilities. He emphasized that embedding AI into operations can help institutions achieve faster, more relevant outcomes for their customers, while also delivering far greater societal value.

This strategic vision is already catalyzing momentum. According to Reuters, the TWG-Palantir-xAI alliance is expected to accelerate AI adoption across the financial industry, serving as a model for future integration efforts. Meanwhile, xAI continues to scale its infrastructure ambitions. In March, the company joined a U.S.-based consortium supported by NVIDIA, Microsoft, MGX, and BlackRock, aiming to build and expand national AI infrastructure capabilities.

What started as a partnership between two high-profile billionaires is quickly becoming a cornerstone of the global AI-finance movement. As TWG Global continues to evolve, it stands poised to shape a new standard for intelligent capital—where speed, precision, and adaptive decision-making become essential to how value is created in the 21st century.