U.S. Senate Rejects Stablecoin Bill, Citing 'Trump’s Conflict of Interest in Cryptocurrency'

Input

Changed

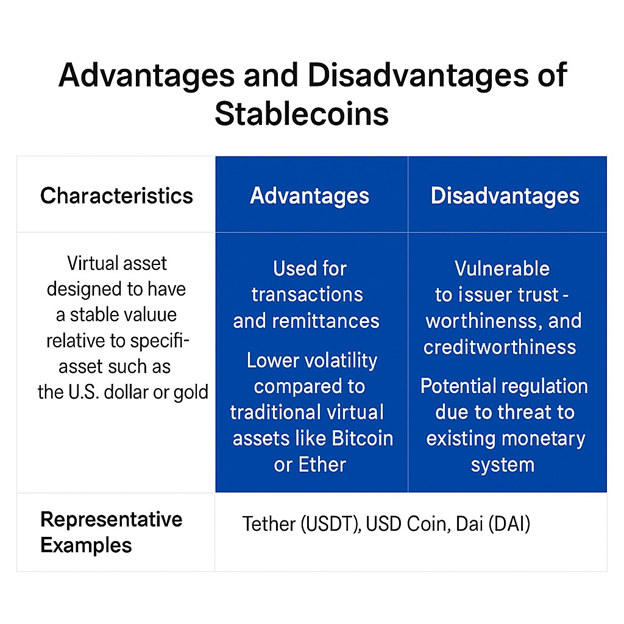

Growing Use of Stablecoins Raises Concerns Over Undermining Financial System Stability Though useful as a means of payment, stablecoins are vulnerable to market shocks and questions persist over the credibility of issuing institutions. Unlike typical virtual assets, there is a growing need for stronger regulatory oversight.

As global financial systems tighten their grip on digital assets, the future of stablecoins — cryptocurrencies designed to maintain a steady value — is growing increasingly complex. In the United States, controversy surrounding former President Donald Trump’s personal ventures into crypto has added fuel to the fire. What could have been a decisive moment for federal oversight of stablecoins instead turned into a political deadlock, revealing deeper concerns about ethics, regulation, and the direction of digital finance.

Political Fallout Over Trump’s Crypto Ties Sinks GENIUS Act

On May 12, the U.S. Senate failed to pass the much-anticipated GENIUS Act, a bill intended to establish federal regulations for stablecoins. Although the bill incorporated Democratic demands — including stronger anti-money laundering (AML) provisions — opposition from within the party ultimately blocked its passage. Nine Democratic Senators retracted their support, citing the need for tougher actions on AML enforcement, oversight of foreign issuers, and protection of national security.

What shifted their stance? The growing discomfort over President Trump’s direct involvement in cryptocurrency ventures. Delaware Senator Lisa Blunt Rochester openly questioned Trump’s financial entanglements, while Senator Jeff Merkley warned that allowing people to buy cryptocurrencies controlled by the President to gain influence amounted to “a deeply corrupt system.” Merkley added that such dynamics not only posed a threat to national security but also damaged public trust in government.

Trump had launched a meme coin called “OfficialTrump” ($TRUMP) just before taking office in January. More recently, he sparked backlash by announcing that major holders of this coin would be invited to a White House dinner. Critics, including Senator Richard Blumenthal, slammed this move as a clear example of quid pro quo. Representative Elissa Slotkin, who authored the Cryptocurrency Corruption Prevention Act, emphasized the urgency of preventing presidents from profiting through self-issued digital coins.

Further complicating matters, Trump’s family-run crypto firm, World Liberty Financial (WLFI), is reportedly planning a $2 billion investment in Binance with Abu Dhabi-based MGX. According to Chainalysis, the creators of the OfficialTrump coin have already collected over $320 million in transaction fees — adding even more weight to concerns over ethical boundaries and unchecked personal enrichment through crypto.

Dark Stablecoins Rise as Regulatory Pressures Mount

While political controversy brews in Washington, a different storm is gathering on the global front. As governments around the world move to implement tighter rules on stablecoins, experts predict a growing demand for “dark stablecoins” — privacy-focused alternatives that resist government oversight.

CryptoQuant CEO Ki Young Ju explained that government-issued stablecoins will soon face regulations akin to traditional banks, including automated tax collection through smart contracts, wallet freezes, and strict documentation requirements. In response, users who rely on stablecoins for large-scale international remittances may seek less regulated alternatives. These "dark" or private stablecoins — potentially based on algorithmic models rather than asset-backed reserves — offer a path to circumvent surveillance and maintain transactional autonomy.

Ju pointed to decentralized stablecoins that use data oracles like Chainlink to mirror regulated assets such as USDC, as well as stablecoins issued by countries that avoid financial censorship. He also floated a scenario in which Tether (USDT) refuses to comply with U.S. regulations under a Trump administration, stating that this could further entrench its role as a dark stablecoin. “USDT has often been regarded as a censorship-resistant stablecoin,” Ju remarked. “If Tether opts out of U.S. compliance, it could thrive in a future internet economy that is increasingly monitored.”

Central Banks Respond with New Regulatory Blueprints

The global regulatory response has already begun. The European Union has enacted the Markets in Crypto-Assets Regulation (MiCA), requiring greater transparency from crypto service providers and placing stablecoin issuers under strict scrutiny. As a result, European users are increasingly shifting toward newly compliant stablecoins rather than riskier options like Tether.

South Korea is also accelerating its regulatory efforts. With national elections approaching and phase-two virtual asset legislation gaining momentum, the Bank of Korea (BOK) is asserting itself more forcefully. In its 2024 Payment and Settlement Report, the central bank stressed that stablecoins — unlike other virtual assets — are now widely circulated as payment tools. If used as substitutes for legal tender, they could undermine monetary policy, financial stability, and payment systems. Hence, the BOK argues that a dedicated regulatory framework is urgently needed.

On May 12, the BOK called for the legal authority to approve stablecoin issuers, emphasizing the risk that widespread adoption of won-pegged stablecoins could decrease demand for the Korean won and severely disrupt monetary policy. It further insisted that central banks must intervene at the approval stage to minimize these potential threats.

Looking ahead, the BOK envisions a comprehensive digital finance ecosystem encompassing central bank digital currency (CBDC), deposit tokens, and stablecoins — all integrated under its policy framework. “We must build a stable and sustainable digital payment ecosystem from the ground up,” the BOK concluded, reinforcing its commitment to safeguarding national monetary systems in the age of decentralized finance.